Current Interest Rate For Mortgage 30 Year – We independently review all recommended products and services. We may receive compensation if you click on the links provided. Learn more.

After hitting a 23-year all-time high on Wednesday, the 30-year mortgage rate rose again on Thursday, pushing the average yield into the 8% range. The average for almost every type of loan rose by double-digit percentage points, and the average reached new two-decade highs.

Current Interest Rate For Mortgage 30 Year

The most recent 30-year fixed rate is 8.10%. Rates vary widely from lender to lender, so it’s always wise to shop around for the best mortgage option and compare rates regularly, regardless of the type of loan you’re shopping for.

Solved Suppose You Obtain A 30 Year Mortgage Loan On Which

The lowest national average rates are offered by more than 200 of the nation’s largest lenders with a loan-to-value ratio (LTV) of 80%, applicants with a FICO credit score of 700-760, and mortgage scores.

The rate on new 30-year home loans rose 18 basis points on Thursday to an average of 8.10 percent. Combined with the previous three days, the 30-year average represents a four-day gain of 27 basis points. Two days ago, the price of 7.92% was the most expensive average level since the end of 2000. This sets the new benchmark as the highest in at least 23 years.

The 30-year FHA and 30-year VA rates also rose on Thursday, though they were 10 and 13 basis points, respectively.

Freddie Mac released its weekly mortgage average yesterday, showing that the 30-year rate hit a 23-year high. Freddie Mac’s average is currently at 7.31%, eight basis points higher than August’s all-time high of 7.23%.

Us 30 Year Mortgage Rate Plunges By Most In Nearly 16 Months

An average that combines prices from the previous five days and may include credits with discount points. Instead, his averages show

The 15-year mortgage rate rose 12 basis points on Thursday to an average of 7.33 percent. The previous reading of 7.21% was the highest 15-year average since 2001.

The 30-year Jumbo yield also rose 12 basis points to an all-time high. Although daily averages are not available for 2009, the current rate of 7.27% is the most expensive 30-year mortgage rate for at least 20 years.

Average rates on nearly every new type of home loan rose by double digits Thursday, with the 10-year rate the most profitable, averaging 21 basis points. The smallest increase on the day was seen for ARM 5/6 loans, which gained just 4 basis points on average.

A 3% Mortgage Rate In A 7% World? This Startup Says It Can Do That

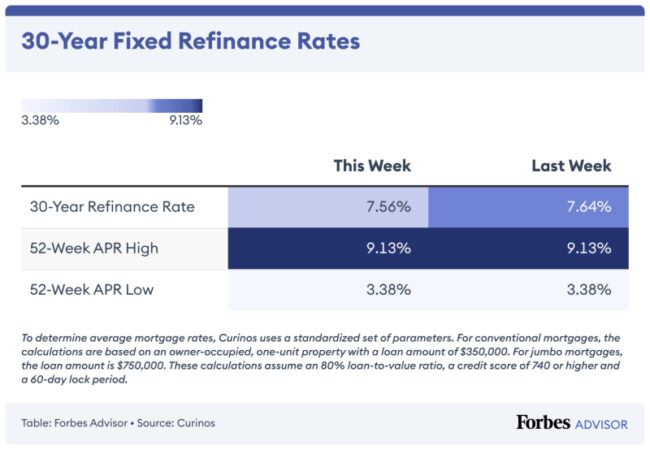

Refinance rates moved largely in line with new purchase prices on Thursday, although an average – for 30-year FHA loans – dropped a few points. The 30-year average rose the same 18 basis points as its new purchase sibling, keeping the spread between the 30-year and new purchase prices at 36 basis points. Meanwhile, the 15-year average added 14 basis points, while the 30-year average added 12 basis points.

The refi rates for 5/6 and 7/6 ARM loans were nearly identical, gaining only 3 and 4 basis points, respectively.

The prices you see here are usually not directly comparable to the teaser prices you have advertised online, as these prices have been selected as the most attractive, while these prices are average. Teaser rates may include a down payment or may be selected based on a hypothetical borrower with a very high credit score or lower than average credit. The mortgage rate you secure is based on factors like your credit score, income, and more, so it may be higher or lower than the average you see here.

The minimum mortgage rate varies by state of origin. Mortgage rates can be affected by national differences in credit rating, average mortgage loan type and loan size, in addition to the different risk management strategies of individual lenders.

Unemployment Rates, Interest Rates, Mortgage Rates & Credit Card Rates

The states with the lowest new Thursday purchase averages in 30 years were Vermont, Delaware, Mississippi, North Dakota, Rhode Island and Wisconsin, while the states with the highest averages were Ohio, Hawaii, Utah, Arizona and Texas.

Because changes in any number of these can occur simultaneously, it is generally difficult to attribute changes to a single factor.

Macroeconomic factors keep the mortgage market relatively weak throughout 2021. In particular, the Federal Reserve is buying billions of dollars in bonds in response to the economic pressure of the pandemic. Bond buying policy is a major factor in mortgage interest rates.

But starting in November 2021, the Fed began buying its bonds, making significant cuts each month until zero in March 2022.

How Much Do Interest Rate Hikes Cost?

Since then, the Fed has been aggressively raising the federal funds rate for decades to combat inflation. Although the federal funds rate can affect mortgage rates, it does not do so directly. In fact, the federal funds rate and mortgage rates can move in opposite directions.

However, given the historic pace and scale of the Fed’s interest rate hikes in 2022 and 2023 — raising rates by 5.25% over the past 18 months — even the indirect effect of the federal funds rate has had an impact. mortgage rate in the last two years.

The Fed will hold two more rate-setting meetings in 2023, ending on November 1 and December 13. While it’s too early to confidently predict the central bank’s next move, Fed Chairman Jerome Powell said that another rate increase is certainly possible.

The above national average is calculated based on the lowest rate offered by over 200 of the nation’s largest lenders, assuming a loan-to-value (LTV) ratio of 80% and an applicant with a FICO credit score in the range of 700-760. . range. The resulting rates represent what customers should expect when receiving actual quotes from lenders based on their qualifications, which may differ from the advertised teaser rates.

What’s The Latest On Interest Rates?

For our map of the best state rates, the lowest rate currently offered by the lender reviewed is listed in that state, assuming both LTV parameters of 80% and a credit score between 700-760 .

Require writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also cite original research from other reputable publishers where appropriate. You can learn more about the standards we follow when creating fair and unbiased content in our editorial policy. Mortgage rates rose at a record pace in March after the Federal Reserve raised interest rates for the first time since 2018 in hopes of curbing rising inflation. .

Freddie Mac data shows that in just the past four weeks, the average rate on a 30-year mortgage — the most common type of mortgage in the U.S. — is up a whopping 24 percent. Redfin Deputy Chief Economist Taylor Marr said this was the highest four-week increase in mortgage rates on record.

Homebuyers are now paying an average of 4.67% on a 30-year fixed mortgage, up from 3.22% in January. Marr said that the rapid increase in mortgage rates in the U.S. in recent months has pushed up the average monthly payment for a U.S. homebuyer. of more than $500.

Deciding Between Hdb Loan Vs Bank Loan? Here’s A Guide With Infographic

And with Wall Street predicting that the Federal Reserve will raise interest rates as many as seven times this year — raising the cost of borrowing for everything from cars to student loans — the Home buyers are likely to see more mortgage rate increases in the future.

Rising home loan costs could help cool the hot US housing market as higher rates cause some borrowers to lose mortgage eligibility due to tighter requirements. banks’ credit-to-income requirement.

“We’re hearing from our agents that some first-time buyers may be more sensitive to price increases and will be among the first to pull out. I think we’re already seeing some buyers being pushed out of today’s market.” Marr said.

Also, according to a Bankrate.com survey released Wednesday, 64 percent of homeowners say affordability is a barrier to buying a home.

Unraveling Mortgage Trends: A Deep Dive Into Today’s Rates

However, in the fourth quarter of 2021, Redfin found that a record 80% of homes were being purchased by investors who are typically cash buyers and therefore insensitive to rising interest rates. This means that even with the recent rise in mortgage rates, home prices are likely to rise in the short term.

The median home price has fallen in recent years, rising from about $215,000 at the start of the pandemic to more than $280,000 this month.

In January alone, home prices rose 19.2% for the year, the largest annual increase in prices since 2008 U.S. bubbles.

One of the main reasons for the rapid increase in housing prices is the previously low financial resources. According to a 2021 report by the National Association of Realtors, the U.S. has failed to build 5.5 to 6.8 million homes over the past two decades.

Should You Make A Bigger Down Payment In This High Mortgage Rate Environment?

Marr said single-family home inventory is near its lowest level in decades and “since March 27, active listings are down 22% year-over-year.”

Although U.S. homebuilders has recently ramped up construction to keep up with demand, Marr believes the increase in new construction inventory may not be enough to keep prices down in the near term.

“One in three single-family homes are currently new construction, but they are still being built about 31 percent below their long-term average.

Current average interest rate for 30 year mortgage, current interest rate for 30 year va mortgage, current interest rate for a 30 year mortgage, current fha interest rate 30 year mortgage, current interest rate for 30 year mortgage refinance, current interest rate for 30 year conventional mortgage, current interest rate 30 year fixed mortgage, current average 30 year mortgage interest rate, current interest rate mortgage 30 year fix, current interest rate for 30 year mortgage, current market interest rate for 30 year fixed mortgage, what is current interest rate for 30 year mortgage