Current Interest Rate For 30 Year Mortgage Refinance – The Federal Reserve Bank of the United States indirectly controls mortgage rates in Singapore. During the 2008 financial crisis and Covid-19, they pushed interest rates to record lows, making home loans in Singapore cheaper than ever. But starting this March, the period of historically low interest rates may come to an end. Here’s what to expect and what to do about it:

Let’s tackle the first topic on many minds: Will the Russia-Ukraine war force the Fed to delay a planned rate hike?

Current Interest Rate For 30 Year Mortgage Refinance

So far, the answer is clearly no. The worst inflation in the last 40 years in the US; and some of its economists have theorized that rising commodity prices (which may be the result of war) may worsen inflation.

Quarterly Forecast: Rapidly Rising Rates & Declining Demand Driving A Housing Market Slowdown

There is no doubt that rates will rise at this point; the question is how much the increase will be: or the usual 0.25 percent. increase, or 0.5 percent may be “too high.”

Take $1.125 million for example. Loan amount in USD (maximum loan for a typical apartment priced at USD 1.5 million).

With a current interest rate of about 1.3 percent, the monthly loan payments would be about $4,394 over a 25-year term. Assuming the interest rate remains at this level throughout the period, the interest payment would be approximately $193,301.

If we were to raise the interest rate by two percent, close to the pre-Covid average in 2018, that would bring the monthly payments to about $4,768, for a total interest rate of about $305,508, if the rate remains constant.

Deciding Between Hdb Loan Vs Bank Loan? Here’s A Guide With Infographic

So, even if the sting isn’t particularly painful on a monthly basis, a higher rate will make a big difference to your overall income in the long run.

We have already written about the most obvious solution – accelerating the repayment of housing loans. However, this is not a viable or smart solution for every homeowner; and in such cases you can consider:

Currently, most bank loans are based on the SORA system; however, they may be based on one-month or three-month SORA rates (some may have longer rates, such as six or nine months, but this is rare).

The interest rate period indicates how often your mortgage payments will be revised to match the current SORA rate. So, for example, there will be a monthly repayment amount that varies at a monthly rate; the quarterly interest rate will be revised quarterly.

Year Mortgage Rates Dip

(which is not guaranteed), a longer interest period may save you more when interest rates rise. For example, a three-month rate may mean you’ll still pay February’s rate after the March increase because your loan is reviewed in April.

But it should be added that mortgage brokers say the theory doesn’t always work. For example, if a bank has a high interest rate spread over a longer period, it can wipe out all savings.

It’s best to compare expert versions; but at least a longer interest rate period makes it easier to plan your finances. This could be useful if the economy is unstable due to the war in Ukraine.

Unfortunately, there is no fixed interest rate fixed home loan in Singapore. One possible solution is to refinance between fixed-rate loans when the time and price come.

Here Are Today’s Refinance Rates, Sept. 4, 2023: Rates Ease

For example, you can take out a three-year fixed-rate loan and pay it off in 2025. Request a refinance into another three-year fixed-rate package. Interest rates may continue to increase as there is no guarantee that another fixed rate loan will be approved. cheaper, but it means you can hold the favorable rate longer and reduce overall volatility.

However, this method requires a little bit of tweaking, as refinancing often involves costs (for example, $2,500 to $3,000 in legal fees). You should be careful not to lose any savings by refinancing too often.

The first way is refinancing, which means switching to a loan package from a completely different bank. As we noted in point 2, refinancing almost always has costs; and you don’t have to pay legal fees to keep double digits every month.

Another method is to reconstruct the price. That is, changing the loan package from the same bank to another. It is much cheaper than refinancing and costs more than $800.

Mortgage Rate Lock Guide

If the mortgage interest rate is too high, it may be cheaper to refinance with the same bank at a lower interest rate than to refinance completely.

Some banks also offer ‘free revaluation’ of home loan packages. This condition allows you to change the loan price for free when the same bank offers a cheaper package.

This is subject to terms and conditions, but don’t expect the bank to be kind enough to tell you about it. Please review the terms and conditions to see what you are eligible for.

If you have not yet taken out a home loan, you may want to look for such options in the terms and conditions; There may be a break when choosing one of the two banks.

Historical Mortgage Rates: Past, Present, Future

Read this second analysis from Ian on how rising interest rates will affect property prices and how to prepare

As property taxes and mortgages rise, owners can expect lower incomes. That’s why it’s more important than ever for landlords to look for tax incentives.

Home loan repayments can be claimed as a tax deduction. For example, the monthly payment on a million dollar loan for 25 years at 1.3% is about $3,906 per month.

Of that $3,906, the interest portion is about $1,050 (the rest of the loan repayment goes toward paying off the principal). You can claim that $1,050 in property taxes.

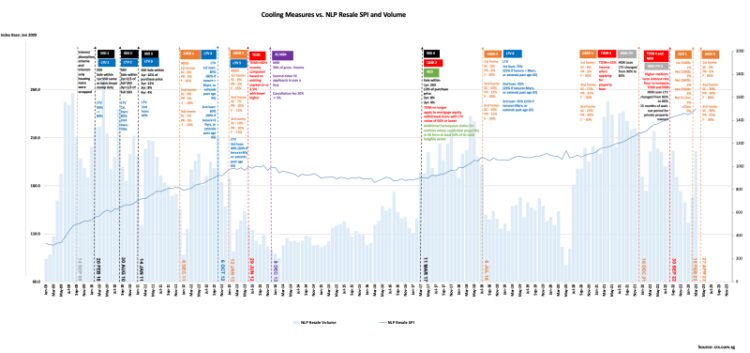

New Singapore Property Market Cooling Measures 2023, Latest Changes & Tdsr

Remember, it’s up to you as the landlord to pay attention to these details and make a claim; Don’t assume that the authorities will know and do it for you.

HDB interest rates are 0.1 per cent higher than existing CPF rates; and that hasn’t changed in nearly two decades. Unlike private bank loans, HDB loans remain the same regardless of broad economic conditions.

HDB flat buyers can use HDB loans or bank loans and feel safe investing in HDB, while rates are now on the rise. It’s also important to add that you can refinance your HDB loan into a bank loan later if you decide to pay it off; but you can also do the opposite (bank loan cannot be converted to HDB loan).

However, some mortgage brokers and home buyers disagree with this assessment. This is based on more than a decade of low interest rates for bank borrowers: during the financial crisis since 2008, bank home loans have been two per cent or below, while HDB loan rates have been at record highs. It was 2.6 percent. .

Sibor Home Loan Borrowers

While this is true, an HDB loan can offer a nice peace of mind due to its volatility. HDB is also lenient if something goes wrong and you have to stay late.

In general, mortgage rates don’t rise so quickly that lenders feel the pain immediately; at least not yet. They probably did

However, it will increase in the coming years, and we remind readers that until 2008, during the crisis, around four percent was the norm for mortgage interest rates.

Talk to your mortgage broker about your specific situation and whether it’s best for you to get started on fixed rate loans early. Email us at Stacked and we’ll put you in touch with the right people. In the meantime, you can subscribe to us for in-depth reviews of new and resale apartments and updates on the Singapore property market.

Year Fixed Mortgage Rates Explained

Ryan J. Ryan is an old-school journalist who has gone digital. He has lived in almost every type of accommodation in Singapore, from apartments to private houses. Over the past 18 years, he has been a content creator for companies large and small, founded an education business, and occasionally worked in radio. He also spends too much time and money painting little plastic soldiers.

My name is Sean and our goal is to help home buyers and sellers in Singapore make the best decision for themselves. I have a question? Email us at: hello@

Go ahead and learn what really matters. Sign up to get the latest in your inbox twice a week.

Pay 5 Creative Ways Smart Home Buyers Are Using to Get Around Mortgage Limits in 2023 Dec 13 Finance the Hidden Costs of Home Ownership: How Much Interest Only on a 10-Year Home $1 Million Could Be $300,000 in 2023 How to Get Cash Before July 25th Without Selling Your Home : 4 Creative Ways to Do It Jun 14, 2023 Finance Feb 9, 2023 Paying off an existing mortgage?

The Basics Of Refinancing Your Mortgage Loan

Comment 25 Surprisingly Successful Apartments (Since 2013) By 2023 December 12

30 year refinance mortgage rate, current 30 year interest rate, current mortgage refinance rates 30 year fixed, current interest rate for 30 year mortgage, current 30 year mortgage rate, current 30 year mortgage refinance interest rates, current 30 year mortgage rates refinance, 30 year mortgage interest rate, current interest rates refinance 30 year fixed, current interest rate for mortgage, current interest mortgage rate refinance, average interest rate for 30 year mortgage