- Can You Use Your Home As Collateral For A Loan

- Cash Out Refinance Vs. Home Equity Loan: What’s The Difference?

- Get A Loan For Your Startup Without Collateral

- What Is Home Equity And How Can You Use It?

- Is A Home Equity Loan A Good Idea? Know The Pros And Cons

- What Can Be Used As Collateral For A Personal Loan?

Can You Use Your Home As Collateral For A Loan – “Expert review” means that our financial review committee has thoroughly evaluated the article for accuracy and clarity. The review board consists of a panel of financial experts whose aim is to ensure that our content is always objective and balanced.

Edited by Troy Segal Troy Segal Arrow Rights Senior Editor, Home Lending Edited by Troy Segal Senior Editor. He edits stories about mortgage and home loan benefits as well as stories about home ownership. Twitter Connect with Troy Segal on Twitter Troy Segal Connect with Troy Segal on Email.

Can You Use Your Home As Collateral For A Loan

:max_bytes(150000):strip_icc()/WhatIsCollateral_GettyImages-1211174464-95091c69ff684f529ddd3b75b4d66f9a.jpg?strip=all)

Kenneth Chavis IV Review Kenneth Chavis Senior Wealth Advisor at Versant Capital Management Kenneth Chavis IV is a senior wealth advisor at Versant Capital Management who provides business owners, executives, investment management, sophisticated wealth strategy, financial planning and tax advice. Medical doctors and others. About our Board of Examiners Kenneth Chavis IV

How To Finance An Overseas Property

Founded in 1976, it has a long track record of helping people make smart financial choices. We’ve maintained that reputation for more than four decades by demystifying the financial decision-making process and giving people confidence in what to do next.

We follow a strict revision policy so you can be sure we put your interests first. All of our content is produced by highly trained professionals and edited by subject matter experts, ensuring that everything we post is objective, accurate and reliable.

Our mortgage reporters and editors focus on what consumers care about most – the latest rates, the best lenders, navigating the home buying process, mortgage payments and more – to help you make informed decisions as a buyer and homeowner.

We follow a strict revision policy so you can be sure we put your interests first. Our award-winning editors and reporters produce honest and accurate content to help you make sound financial decisions.

Cash Out Refinance Vs. Home Equity Loan: What’s The Difference?

We appreciate your trust. Our goal is to provide readers with accurate and unbiased information, and we have editorial standards to ensure this. Our editors and reporters carefully check editorial content to ensure the accuracy of the information you read. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

The editorial team writes for you – the reader. Our goal is to provide you with the best advice to help you make smart personal financial decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team is not compensated directly by advertisers, and our content is carefully checked for accuracy. Therefore, whether you read articles or reviews, you can be sure that you are getting reliable and trustworthy information.

You have a money question. There is an answer. Our experts have been helping you manage your money for over four decades. We continually strive to provide consumers with the expert advice and tools they need to succeed in their lifelong financial journey.

Adhere to strict editorial policies, so you can be sure our content is honest and accurate. Our award-winning editors and reporters produce honest and accurate content to help you make sound financial decisions. The content created by our editorial team is objective, factual and not influenced by our advertisers.

Get A Loan For Your Startup Without Collateral

We are transparent about how we deliver quality content, competitive pricing and useful tools to explain how we make money.

An independent, advertising publisher and comparison service. We receive compensation in exchange for placement of sponsored products and services or for clicking on certain links posted on our website. Therefore, this compensation may affect how, where and what products are displayed in the listing section, except as prohibited by law for mortgage, home equity and other home loan products. Other factors, such as our proprietary website rules and whether products are offered in your area or within your selected credit score range, may affect how and where products are displayed on this website. Although we strive to provide a comprehensive offering, this does not include information on every financial or credit product or service.

If you use a mortgage to buy a home, the lender needs to be sure you can make the payments. A strong credit score, steady income, and a good history of credit management can provide some assurance, but lenders will also rely on the collateral that secures the loan — the home you’re buying — to approve or deny it. decision making

Collateral is property that the borrower provides as collateral for a loan or loan. For a mortgage (or deed of trust, which is only used in some states), the collateral is almost always the property you’re buying with the loan.

What Is Home Equity And How Can You Use It?

The money creates a bond over the property. The loan allows the lender to seize the collateral if you do not repay the loan as per the terms of the agreement. When you pay off the loan, the lender removes the loan and no longer has a claim on the property.

Regardless of what you do as collateral or what you plan to do with the money you borrow, the definition remains the same: it’s your offer to help recover the money.

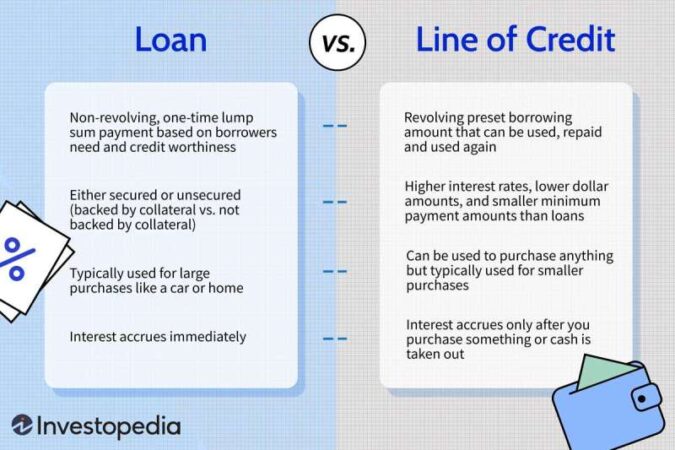

A loan backed by collateral is called a secured loan. There are also unsecured loans that do not require collateral, meaning there are no assets backing them.

When determining your loan approval, the lender will order an appraisal. If not, the lender may reject the mortgage because the collateral is worthless.

Best Secured Collateral Loans For Bad Credit (dec. 2023)

On the other hand, if you do not surrender your property and reach a foreclosure agreement with your lender, the lender may foreclose on the home and you will lose your mortgage.

There are rules about how a lender can recover losses, but it depends on whether the mortgage is a loan or a non-loan.

You’ll often hear the words “treaty” and “treaty” used in the same sentence or in similar contexts, but it’s important to understand the difference.

A mortgage is a type of loan that you can use to finance the purchase of a property. Collateral is property that provides support for a loan – any loan.

Is A Home Equity Loan A Good Idea? Know The Pros And Cons

You almost always need collateral to get a mortgage, and that collateral is almost always the property you’re buying with the loan. Think of it as a mortgage, which is a loan, and the collateral is something that is committed to – and shows how serious you are about repaying that loan.

Collateral applies to all types of secured loans, not just mortgages. Collateral does not have to be real estate. Some lenders allow borrowers to use their savings accounts or savings certificates. If you don’t pay back the borrowed money, the lender can take your cash.

Edited by Troy Segal Troy Segal Arrow Rights Senior Editor, Home Lending Edited by Troy Segal Senior Editor. He edits stories about mortgage and home loan benefits as well as stories about home ownership. Connect with Troy Segal on Twitter Connect with Troy Segal on Twitter by Email Troy Segal Senior Home Lending Editor

Review by Kenneth Chavis IV Iowa Wright Senior Wealth Advisor at Versant Capital Management Kenneth Chavis IV is a senior wealth advisor at Versant Capital Management providing business owners, executives, investment management, sophisticated wealth strategy, financial planning and tax advice. Medical doctors and others. About Our Review Board Kenneth Chavis IV Senior Wealth Advisor Versant Capital Management Here you can read some frequently asked questions and answers about this topic! If you have any other questions you would like answered, please contact our team. We direct!

What Is Home Equity?

If you are considering a personal loan, you may wonder if your home can be used as collateral. While using your home as collateral for a personal loan can get you lower interest rates and higher loan amounts, it puts your home at risk if you default on the loan.

Before using your home as collateral for a personal loan, there are a few things to consider.

If you are considering using your home as collateral for a personal loan, you must have equity in your home. Equity is the portion of your home’s value that you actually own. For example, if your home is worth $200,000 and you have a $100,000 mortgage balance, you have $100,000 in equity.

Unless you have a lot of property in your home, you cannot use it as collateral for a personal loan. And if you have a negative balance — meaning you owe more on your mortgage than your home is worth — using your home as collateral can put you at risk of foreclosure.

What Can Be Used As Collateral For A Personal Loan?

If you use your home as collateral for a personal loan, the interest rate will be lower than what you would otherwise get

Using car as collateral for personal loan, using your house as collateral for a loan, can you use land as collateral for a home loan, use car as collateral for loan, using home as collateral for loan, can you use your ira as collateral for a loan, loan with home as collateral, use home as collateral for loan, use home as collateral for a loan, can you use your car as collateral for a loan, can you use your home as collateral for a loan, loan using home as collateral