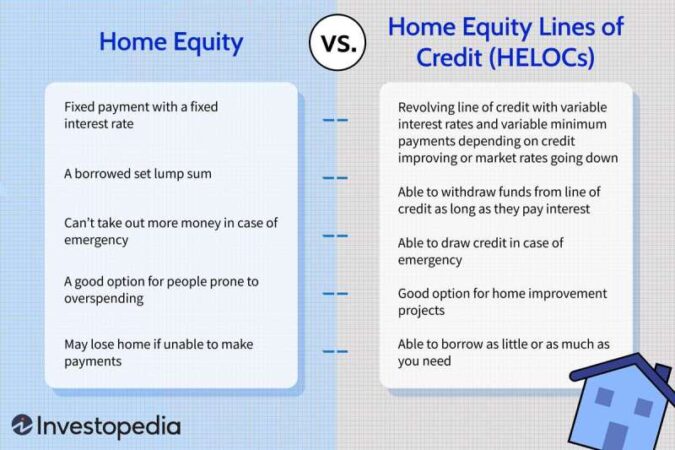

Can You Refinance A Home Equity Loan Into A Mortgage – Equity loans—Equity loans; Home loan or second mortgage: it is a type of consumer loan. Home equity loans allow homeowners to borrow money against their home. The loan amount is based on the difference between the current and market value of the homeowner’s mortgage balance. Home loans are usually fixed; traditional Home equity lines of credit (HELOCs) usually have variable rates.

In fact, a home equity loan is called a second mortgage because it is similar to a mortgage. The property of the house acts as a guarantee for the lender. The amount a homeowner can borrow will be based on a partial loan-to-value (CLTV) ratio of 80% to 90% of the home’s estimated cost. In fact, the loan amount and the interest rate paid also depend on the borrower’s credit score and payment history.

Can You Refinance A Home Equity Loan Into A Mortgage

It is illegal to discriminate against mortgage lenders. career Religion sex marital status, use of social assistance; Nationality If you believe you have been discriminated against on grounds of disability or age; There are steps you can take. One such step is to file a report with the Consumer Financial Protection Bureau or the US Department of Housing and Urban Development.

Refinance Home Loan Singapore 2023

Conventional home loans have the same repayment period as traditional mortgages. The borrower usually includes both principal and interest. Fixed payments are made. With any type of mortgage, if the loan is not repaid, the home can be sold to pay off the remaining debt.

A home equity loan can be a great way to turn your home equity into cash; Especially if that money is invested in home improvements to increase the value of your home. However, always remember that you are putting your home at risk: when real estate prices drop, you could end up owing more than your home is worth.

If you want to move, you may lose money on your home purchase or you may not be able to move. If you are taking out a loan to pay off debt, resist the temptation to pay off that debt. Consider all your options before doing anything that puts your home at risk.

“If you are considering a large home equity loan, be sure to compare rates on several different types of loans. A cash out may be a better option than a home equity loan. Depending on the amount you need, housing”.

How Much Home Equity Can (and Should) I Borrow?

Home equity loans became popular because the Tax Reform Act of 1986 provided a way for consumers to deduct the interest deduction, one of its key provisions, by eliminating the interest deduction. The law left a major obstacle: interest in servicing residential mortgages.

Despite this, the Tax Cuts and Jobs Act of 2017 freezes the deduction until 2026 for interest paid on home equity loans and HELOCs, according to the Internal Revenue Service (IRS) “the taxpayer’s taxes are used to buy, build or improve a home.” for example, Interest on loans used to consolidate debt or pay a student’s college expenses is not tax deductible.

As with a mortgage, you can ask for a good estimate, but do an honest assessment of your finances before doing so. “In order to save money, you need to have a good understanding of where you owe and the value of your home before you apply,” said Casey Fleming, branch manager of Fairway Independent Mortgage Corporation. and author

. “Especially with the appraisal [of your home], that’s a huge expense. If your appraisal is too low to support the loan, you’re out of money,” and there’s no refund for not qualifying.

What Is Refinancing A Home Loan & Why It’s Important

Before signing, especially before using a debt consolidation loan, run the numbers with your bank and make sure the loan is low. More than the combined amount of all your current debts each month. Although the home loan interest rate is low, a new loan may take longer than your current debt.

To obtain a loan Equity loan interest is tax deductible if used for construction or improvement.

Home loans pay a lump sum of money to the borrower at an agreed interest rate over a set period of time (usually five to 15 years). Payments and interest are the same throughout the life of the loan. Once the property is sold, the loan must be repaid in full.

A HELOC is a line of credit that works like a credit card, where you can draw down as needed, pay it off, and draw down again over a period of time. giving The draw period (5 to 10 years) is the draw amortization period that is no longer allowed (10 to 20 years). HELOCs typically have a variable interest rate, but some lenders offer fixed-rate HELOC options.

Home Equity Loan & Cashout Refinancing In Singapore (2023)

There are many important advantages to home equity loans, including cost, but there are also problems.

A home loan can provide an easy way to effect and can be an important tool for borrowers. If you have a stable and reliable income and you know you can repay the loan. Low interest rates and tax deductions can make home loans a smart choice.

Getting a home equity loan is relatively easy for most consumers because it is a secured loan. The lender will run a credit check and order an appraisal of your home to determine your creditworthiness and CLTV.

Although higher than the first mortgage. Interest rates on home equity loans are much lower than those on credit cards and other consumer loans. This explains why home equity loan buyers borrow against the value of their home, which is to pay off credit card balances.

Guide To Understanding Home Equity Lines (heloc) And Loans

How much to borrow A home loan is always a good option if you know exactly what it is for. You are guaranteed full payment at closing. “Home equity loans are generally better for larger, more expensive goals, such as remodeling, paying for higher education or debt consolidation,” he says. said Richard Airey, senior loan officer at Integrity Mortgage LLC. in Portland, Maine.

The main problem with home loans is the constant expense for the borrower. loan It may seem like a very easy solution for the borrower to spend and borrow more. Unfortunately, An example of this is the term lenders: refinancing is the practice of releasing additional debt that the borrower uses to pay off existing debt and make additional purchases.

Reinstatement leads to a credit environment that tends to attract borrowers to home loans that offer 125% down payments on the borrower’s home. This type of loan usually carries a high fee: the loan is not fully guaranteed because the lender provides more money than the home is worth. Also, keep in mind that interest paid on the portion of the loan that exceeds the value of the home is not tax deductible.

When applying for a home loan, you may be tempted to borrow more than you need right away because you only have one payment and don’t know if you’ll be able to get another loan in the future.

The Pros And Cons Of Refinancing

If you are considering a loan that is worth more than your home. It’s a good time for a reality check. If you owe 100% of your home equity, can’t you live on your income? If you have 25% of your debt and interest and fees are piling up, it doesn’t seem reasonable to wait any longer. It can be a slippery slope to break and close.

Each lender has its own requirements, however, in order to be approved for a home equity loan. Most lenders generally require:

Although a loan similar to housing that does not meet these requirements can be approved. Borrowers are expected to pay a higher interest rate with a fixed rate loan.

Your current loan balance and current second mortgages by searching for a quote or logging into your lender’s website; Estimate HELOCs or home equity loans. Estimate your home’s current value by comparing recent sales in your area or using a comparison site like Zillow or Redfin. Note that their estimates are not always accurate; So, adjust your budget if necessary based on the current condition of your home. Then divide the current balance of all the loans on your property by the current value of the property to get the percentage of equity you have in your home.

What Is Home Equity?

Rates are based on a loan amount of $25,000 and a loan-to-value ratio of 80%. HELOC

Refinance home equity loan, refinance mortgage home equity, can i refinance my mortgage and home equity loan together, can you refinance a home equity loan, refinance mortgage or home equity loan, refinance mortgage with home equity loan, can you refinance a home equity loan into a mortgage, refinance mortgage vs home equity loan, equity home loan mortgage refinance, refinance home equity loan into mortgage, rolling home equity loan into mortgage, can you refinance your home equity loan