Can Student Loans Be Discharged Under Chapter 7 – This page is a compilation of the blog sections we have around this keyword: many debtors. Each header is linked to the original blog. Each link in italics is a link to a different keyword. Since our content corner already has more than 200,000 articles, readers want a feature that allows them to read/discover blogs revolving around specific keywords.

When a debtor files for bankruptcy, an automatic stay is granted, stopping creditors in their tracks. This stay is a powerful tool that can give the borrower much-needed relief from constant harassment from creditors. But how long will automation last? This is a question many borrowers ask themselves, and it’s important to know the answer when planning for the future.

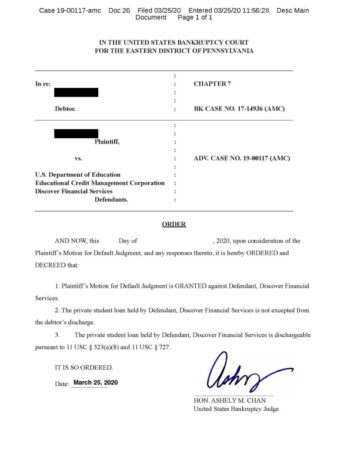

Can Student Loans Be Discharged Under Chapter 7

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png?strip=all)

1. The automatic suspension shall continue until the bankruptcy proceedings are completed or terminated. This means that creditors are prohibited from taking any action against the debtor during this period. They cannot garnish wages, seize assets, or even contact the debtor. The stay is intended to give the debtor time to develop a plan to pay off their debts or make a fresh start through bankruptcy.

What Is Chapter 13 Bankruptcy? Definition & Eligibility

2. If the debtor has already filed for bankruptcy, the duration of the automatic suspension may be shortened. For example, if the debtor has filed for bankruptcy within the past year, the stay will last only 30 days. If the debtor has filed for bankruptcy two or more times in the past year, there may not be an automatic stay.

3. The automatic stay does not apply to certain types of actions. For example, if the debtor is facing criminal prosecution, the stay does not prevent the prosecution from continuing. Also, if the debtor is at risk of eviction, the stay will only provide temporary relief. The owner can continue the eviction process after a certain period of time.

4. Creditors may ask the court to lift the automatic stay if they have good cause to do so. For example, if the borrower has property that is not covered by the exemptions and the lender wants to repossess it, they can lift the stay. Before making a decision, the court will consider the creditor’s request and the debtor’s objections.

In summary, the automatic stay is a powerful tool that can provide borrowers with much-needed relief from creditor harassment. It continues until the bankruptcy case is closed or dismissed, but there are exceptions and creditors can ask the court to lift the stay. Understanding how the automatic stay works is an important part of the bankruptcy process.

What Is The Brunner Standard For Discharging Federal Student Loans? — Reboot Your Life: Tampa Student Loan And Bankruptcy Attorney Blog — February 5, 2023

The automatic stay provision is an important tool for debtors in bankruptcy. This gives borrowers the much-needed breathing space to restructure their finances and plan their way through the crisis. The importance of automatic liens to debtors is multi-faceted and can be viewed from different angles.

1. Creditor Harassment Protection: An automatic stay ends creditor harassment, which can be a huge source of stress for borrowers. Lenders are prohibited from contacting borrowers directly by any means, including phone calls, email or letters. This protection allows the borrower to focus on restructuring their finances without the constant threat of lender harassment.

2. Time to reorganize finances: The Automatic Stay feature gives borrowers a much-needed break from their creditors, allowing them to reorganize their finances without fear of litigation or foreclosure This time can be used to create a payment plan, sell assets, negotiate with creditors or seek advice from financial advisors.

3. Foreclosure Protection: An automatic stay can prevent foreclosure proceedings against the debtor. This protection can give borrowers the time they need to get back on track with their mortgage payments or negotiate a loan modification with their lender. In some cases, borrowers can keep their homes by filing for bankruptcy and developing a plan to pay off their debts.

Chapter 7 Bankruptcy Lawyer In Miami

4. Protection against utility interruptions: Automatic Stay can prevent utility companies from interrupting services such as gas, water or electricity due to non-payment. This protection can be critical for borrowers who need these services to support their homes or businesses.

5. Time to seek legal advice: The Automatic Stay feature gives debtors time to seek legal advice from a bankruptcy attorney. This advice can be invaluable in helping debtors navigate the complex bankruptcy process and understand their rights and obligations.

The automatic stay provision is an important tool for debtors in bankruptcy. Provides much-needed relief from creditor pressure, protection from foreclosure and utility delays, and time to reorganize finances and seek legal advice. An automatic stay can be the difference between financial ruin and a fresh start for many borrowers.

The Importance of Automatic Foreclosures for Homeowner Debtors – Automatic Foreclosures: How They Protect Homeowner Debtors During Bankruptcy

Guide To Private Student Loan Bankruptcy

There are some common mistakes that businesses make when reporting fraud that can hinder the debt collection process. These mistakes can lead to late payments, legal problems, and even loan default. In this section, we will discuss some of the most common mistakes to avoid when filing a defamation report.

One of the most common mistakes businesses make when sending defamation notices is not doing so on time. Many businesses wait too long to send these notices, which can lead to payment delays and legal issues. It is important to send a payment notification as soon as possible after payment.

Another common mistake businesses make when filing defamation notices is not providing enough information. The notice of dishonor must clearly state the reason for the dishonor, the amount due, and any interest or fees due. It should also include the borrower’s contact information and instructions on how to resolve the issue.

Businesses must follow proper whistleblowing reporting procedures. This includes sending the notice to the correct address and using the correct format. Failure to follow the correct procedures can lead to legal issues and delays in payments.

Student Loans Can Be Erased

When sending a dishonor notice, it is important to consider the debtor’s perspective. Many borrowers may not know that a payment is due or may have a valid reason for not paying on time. It is important to talk to the borrower and try to resolve the issue before taking legal action.

Businesses should consider alternative payment options when reporting fraudulent reports. This includes offering payment plans or negotiating an agreement. These options can be more effective than legal action in dealing with debt.

Businesses should avoid common mistakes when sending whistleblowing notifications. This includes sending notices in a timely manner, providing adequate information, following appropriate procedures, considering the borrower’s perspective and considering alternative payment options. By avoiding these mistakes, businesses can increase their chances of collecting bad debts and avoiding legal problems.

Common Mistakes to Avoid When Filing a Bad Debt Notice – Bad Debt and Dishonored Notice Collection Strategies

Leiden & Leiden

When a company faces financial problems and seeks Chapter 11 bankruptcy protection, one of the most important lifelines it can rely on is debtor-in-possession (DIP) financing. DIP financing allows the borrower to obtain additional financing to continue operations and restructure its financial affairs. It provides the necessary liquidity to face the complexities of bankruptcy and become a stronger and more viable business entity. In this section, we will review the different types of DIP financing options available and highlight the benefits and considerations associated with each.

Many borrowers turn to traditional banks for DIP financing, using their existing relationships to secure loans. These loans are secured by the borrower’s property and are subject to strict repayment terms.

For example, ABC Manufacturing, a struggling textile company, can obtain a DIP loan from its longtime banking partner XYZ Bank. The loan can be secured by ABC Manufacturing’s inventory, machinery, or real property, providing necessary funds to continue operations during the bankruptcy process.

Asset-based lending (ABL) is another popular form of DIP financing, especially for companies with valuable assets such as inventory, receivables or real estate. ABL lenders appraise the value of these assets and provide a revolving loan based on a percentage of their appraised value.

Bankruptcy & Discharging Student Loans

For example, fashion challenger DEF Retail could obtain an ABL facility from a specialist lender. The lender may extend revolving credit based on a percentage of DEF Retail’s eligible receivables and inventory. This enables DEF Retail to access necessary funds to support its operations and restructuring efforts.

Debtor-owned factoring, also known as DIP factoring, offers an alternative financing solution for companies with large receivables. In this arrangement, the borrower sells its receivables to the factoring company at a discount, providing an immediate cash injection.

For example, struggling GHI Construction could enter into a DIP factoring agreement with JKL Factors. JKL Factors purchases GHI Construction’s receivables at a discount and provides GHI Construction with the necessary working capital

Discharged student loans, can private student loans be discharged, can student loans be discharged in bankruptcy, when can student loans be discharged, can student loans be discharged through bankruptcy, how can student loans be discharged, can student loans be discharged, student loans discharged in bankruptcy, can private student loans be discharged in bankruptcy, can student loans be discharged under chapter 7, getting student loans discharged, can private student loans be discharged in chapter 7