- Best Way To Pay Student Loan Debt

- How A Student Loan Repayment Plan Can Help You

- A Better Way To Forgive Student Loans? Match At Risk Borrowers’ Monthly Payments

- How To Eliminate Student Loan Debt

- Student Loan Debt Forgiveness Might Not Be The Best Investment In Students

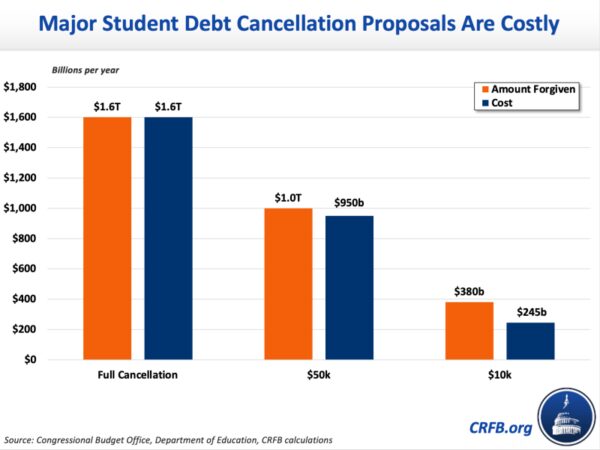

- What Does Student Debt Cancellation Mean For Federal Finances?

- My Debt Story: How I Paid Off $125,181 Of Student Loan Debt

- Student Loans Vs Resps: How To Plan

Best Way To Pay Student Loan Debt – Our goal at Credible Operations, Inc., NMLS #1681276, hereafter referred to as “Credible,” is to give you the tools and confidence you need to improve your finances. Although we promote products from lender partners who reimburse us for our services, all opinions are our own.

If you’re wondering how to pay off $300,000 in student loan debt, here are 4 repayment methods you can use. (Shutterstock)

Best Way To Pay Student Loan Debt

Leaving college with six figures in student loans can be overwhelming, but it is possible to pay off that debt. With the right repayment strategy in place, you won’t have to struggle with student loan debt for life.

How A Student Loan Repayment Plan Can Help You

Refinancing is an option that will help you pay off your debt. By visiting Credible, you can learn more about student loan financing and compare rates from several private student loan lenders.

When you take out a loan, your principal, interest and repayment terms will affect how much you end up getting. For example, if you have a higher interest rate or a longer repayment term, you’ll end up paying more interest over the life of the loan.

Student loan debt can be complicated because many borrowers take out multiple loans to pay for their education. And you can have a combination of several government and private loans at different interest rates.

Here’s a breakdown of what you can expect to pay for $300,000 in total student loan debt plus all of your loans on a 10-year repayment plan:

A Better Way To Forgive Student Loans? Match At Risk Borrowers’ Monthly Payments

In this case, with $362,000 in student loan debt at these different interest rates, your total costs would be $497,224. Paying off these loans as soon as possible will help keep interest costs down.

When you take out student loans, interest costs can add up quickly. If you’re looking for ways to pay off more than $300,000 in student loan debt, here are four strategies you can implement.

The debt lump method focuses on paying off the debt with the highest interest rate first. The goal is to reduce the amount of interest you end up paying.

Using the previous student loan example, you would start by putting the extra money you have toward the $138,000 in debt. That debt is the largest, but you will pay extra because it has the highest interest.

How Do I Make Extra Principal Payments On My Loans?

You will continue to pay the minimum payment for the other three loans. When the loan is paid off, you will put that money towards the loan with the highest interest rate, which is the $66,000 loan.

The debt pile approach aims to pay off your smallest debt first. So, using the example above, you would start by putting the extra money you have toward a $57,500 student loan and making the minimum payment on the balance.

When the loan is paid off, you’ll put that money toward the $66,000 loan. The idea is to create a snowball effect and you’ll see faster progress when you pay off the smallest debt first. But you may end up paying more interest with this method.

Consider paying off your debt with a lower interest rate. You can easily compare qualification rates from multiple lenders using Credible.

Debt Avalanche Vs. Debt Snowball: What’s The Difference?

Some federal loan borrowers may be eligible for student loan forgiveness. Once your loan is forgiven, you no longer have to pay the balance. Several types of loan forgiveness are available:

One of the challenges that comes with paying off a student loan is having multiple loans at different interest rates. One way to get around this is to refinance your loan to a loan with a lower interest rate.

But remember that if you refinance a federal loan into a personal loan, you’ll lose access to certain borrower protections, including income-driven repayment (IDR) programs and loan forgiveness. And if you have bad credit, you may have to apply to the employer.

All federal student loans start with a standard 10-year repayment period, unless you enroll in another repayment plan. An IDR plan, for example, allows you to extend your repayment term and receive more manageable monthly payments.

How To Eliminate Student Loan Debt

However, by extending the repayment period, you may pay higher interest. The repayment period you get for a personal loan will depend on your lender.

Paying off six-figure student loan debt can feel like a daunting task, but you can find a way to do it. By repaying the money in a shorter period of time and making additional payments, you can repay the loan faster and reduce the amount of interest paid. If you have federal student loans, you should see if you qualify for loan forgiveness. In the Student Loan Program, we follow a strict policy of editorial ethics. This post may contain references to our partners’ products within the guidelines of this policy. Let’s read

If you’re tired of endless student loan payments, you’ll love this guide on the many ways to pay off your student loans faster and lower your student loan balance.

We’ve compiled a list of our 107 best ideas for paying off your student loans. Sure, the usual tips like “pay extra” or “use autopay” can help, but there’s a lot more you can do to speed up the process.

Student Loan Debt Forgiveness Might Not Be The Best Investment In Students

There’s something for everyone on this list, and we’re sure that using just a few of these tricks can save you thousands on student loans and years of paying off student debt.

Check out our category-by-category strategies below and see how you can start paying off your student loans fast today.

You can sign up for automatic payment with your credit provider and get a 0.25% discount on your interest rate and effectively a lower interest rate.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23983301/1417997644.jpg?strip=all)

Did you know that the interest on your student loans increases every day? Yes. It’s not just you. This can make it difficult to move forward and even more difficult to lose balance.

Navigating Student Loans: How To Manage Your Debt And Plan For The Future

One payment method that helps is weekly payments. Simply cut your monthly payments in half and make two payments a month instead of one to service your student loan.

You can lower your interest rate through student loan financing. Check out our various lenders and cashback bonuses.

Keep in mind that you offer valuable benefits like Income Driven Repayment (IDR) and student loan forgiveness. You also need good credit. If done right, student loan financing can save you thousands of dollars.

The debt collapse method means that you prioritize paying off the debt with the highest interest. You pay the minimum down payment on all your other loans and throw any extra money at your highest interest loan (for example, the Grad PLUS loan).

Debt Moratoria: Evidence From Student Loan Forbearance

You can reduce interest by stopping procrastination and starting to pay off debts and principal before they pile up.

You can write off up to $2,500 in student loan interest. The amount you can write off and eligibility will depend on your income, as there is a reduction or a gradual reduction.

You can use Form 1098-E from your credit servicer to find out how much interest you paid.

If you are a Mzazi PLUS borrower and you and your child agree that it is time for them to take out a loan, you can pay in your child’s name.

What Does Student Debt Cancellation Mean For Federal Finances?

Note that some lenders, but not all, allow this. It can help save money on loans and transfer obligations.

The cheapest is the Standard Repayment Plan, which has a term of 10 years, which can save you money in the long run on interest and the total cost of your loan.

Borrowers must recertify to remain in good standing with IDR. If you don’t, your monthly payment may revert to the regular repayment plan.

Patience can be a good option if you really need it, but try to avoid it at all costs.

My Debt Story: How I Paid Off $125,181 Of Student Loan Debt

Putting your loan on hold and defaulting can increase the amount of interest you end up paying.

Borrowers go into default if they don’t make payments within 270 days. Unpaid wages can lead to unpaid wages, bad credit and more.

Continue making payments and if necessary, continue with an income-based repayment plan or transfer your loan to a transfer or repayment instead of defaulting on the loan.

During your free period or payment period, interest accrues on your loan. That interest will be added to your loan and then you pay interest on the new and higher amount.

When Do Student Loan Payments Start? What To Know About Save Program And More While Paying Off Student Loans

If you’re using an income-based repayment plan and you’re married filing jointly, your income, along with your spouse’s, will affect your monthly payment.

Have you ever seen an ad for “Obama’s Student Loan Forgiveness,” “Trump’s Student Loan Forgiveness,” or the promise that a company can cancel your student loans? Proceed with caution.

After you graduate, you’ll get a six-month grace period where you don’t have to pay back your student loan.

If you can afford it, don’t wait. Start paying monthly installments during the free period. This will help you control interest and prevent your balance from growing during the free period.

Student Loans Vs Resps: How To Plan

At Student Loan Planner®, we are dedicated to helping borrowers find the best plan for their unique situation and helping them pay off their student loans. We found that 90% of our customers

Best way to pay off student loan debt fast, best loan to pay off debt, loan to pay debt, solution to student loan debt, best personal loan to pay off debt, best way to pay down student loan debt, best way to pay off student loan debt, pay student loan debt, how to pay off student loan debt, personal loan to pay off student debt, how to pay student debt, best student loan debt consolidation