Best Way To Consolidate Private Student Loans – Student loan consolidation can save you time and money. Find out how to combine them and what are the advantages and disadvantages of each method.

Clicking the button will take you to the website of one of our student loan companies. We receive a fixed advertising fee for providing this service.

Best Way To Consolidate Private Student Loans

In total, they borrowed $1.5 trillion to get their degrees, and it wasn’t easy to pay back. About 1 in 10 people default on their student loans, and while the average repayment period varies depending on the amount owed, it’s safe to say it’s likely to take at least 10 years and could take as long as 30 years.

Is Student Loan Refinancing Right For You? [infographic]

Class of 2019 members who took out student loans owe an average of $31,172 and their payments are less than $400 a month. This is a big and unpopular graduation gift, so it’s important to know how to minimize the damage.

If the money you borrowed was all government loans, you may find easier repayment options to apply for a direct consolidation loan.

If some or all of your student loans are from private lenders, you’ll need to use a refinancing program to achieve the same results.

Consolidation is a way to make your student loan payments more manageable and possibly smaller. You consolidate all of your student loans, take out one large consolidation loan and use it to pay off the rest. You have one payment per person each month.

Paying For School And Avoiding Scams

A typical student loan borrower receives money from federal loan programs each semester in school. It’s usually from multiple lenders, so it’s not unusual to have 8-10 different lenders owing by the time you graduate. If you’re still borrowing for high school, add another 4-6 lenders to the mix.

Each of these student loans has its own due date, interest rate, and payment amount. Following this kind of schedule is complicated, and that’s one of the reasons so many people don’t do it. This is also why student loan consolidation is such an attractive solution.

State loans can be consolidated in the Direct Loan Consolidation program. You consolidate all of your federal student loans into one fixed-rate loan. This rate is determined by taking the average interest rate on all government loans and rounding the rate to the nearest eighth of a percent.

Although this option will not reduce the interest you pay on government loans, it will leave all payment and forgiveness options open. Some lenders allow you to reduce your interest rate by paying outright or qualify for a discount by paying in installments over a long period of time.

How To Calculate Student Loan Interest

Student loan refinancing is similar to a direct loan consolidation program in that you consolidate all of your loans into one loan and make monthly payments, but there are some important differences to consider first.

Refinancing, sometimes called private student loans, is primarily for private loans and can only be done through private banks, credit unions or online lenders. If you have borrowed from government programs and private programs and want to consolidate the whole group, this can only be done through a private provider.

The main difference between refinancing and direct loan consolidation is that with refinancing, you negotiate a fixed or variable interest rate that should be lower than what you were paying for each loan. Lenders consider your credit score and whether you have a co-signer to check your interest rate.

However, if federal loans are part of your financial transfer, you will lose the repayment options and forgiveness programs they offer, including deferment and forbearance. These last two things can be important if you are facing financial problems in repaying your loans.

Unknown Story Storyboard By Baa8ce9c

The average college graduate has around $8,000 in credit card debt. Let us help you with your credit card so you can budget for your student loan payments.

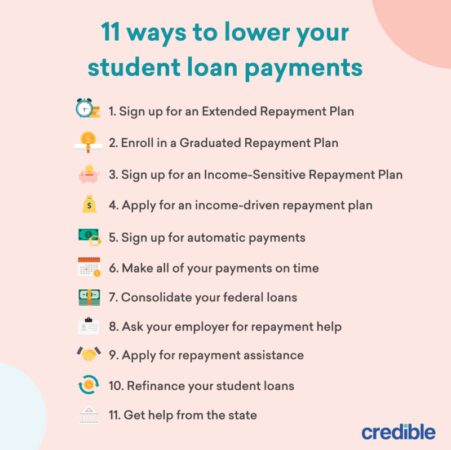

There are many good reasons for combining with a direct loan consolidation program, not the least of which is that it will keep you alive for one of the income based schemes such as REPAYE to earn, PAYE (pay as you earn), IBR. (income-based repayment) and ICR (income-based repayment).

There are two sides to every story and here is one side to consider before joining a direct loan consolidation program:

:fill(white):max_bytes(150000):strip_icc()/Splash-Financial-Logo-4ecb909d186c4a05ac71bca555b408d2.jpeg?strip=all)

If you’ve missed payments because you’re struggling to keep up with multiple loan officers and multiple payment dates, consolidating or refinancing is the way to go. Making one payment each month instead of several makes life easier.

Best Private Student Loans Companies For 2023

You can enter a direct loan consolidation program because it allows you to stay open to cash payment options that result in lower monthly payments.

However, it’s important to know that if your payments are part of qualifying for any forgiveness program, the clock starts again when you combine with For example, if you made three years of eligible payments for public loan forgiveness, you consolidate your loans, you lose three years of eligible payments and the clock starts again.

The biggest problem for most borrowers is can they afford the monthly payment? That’s what consolidation and refinancing are all about: giving you a payment that won’t break your budget every month.

However, if you’re making enough money early on and are serious about paying off your loan, the fastest and most efficient way is to go with a regular repayment schedule and do it over 10 years… or less!

Student Loan Debt Consolidation

Max Fay has been writing about personal finance for five years. His expertise is in student loans, credit cards and mortgages. Max inherited a genetic tendency to be tight with his money and loose with financial advice. While at Florida State University, he was published in every major Florida newspaper. He can be reached at [email protected] .

Tries to help people with financial literacy and arm themselves with management tools. Our information is freely available, but the services on this website are provided by companies who may pay us an advertising fee when you click or register. These companies may influence how and where the services appear on the site, but do not influence our editorial decisions, recommendations or advice. Here is a list of our service providers. If you’re burdened with multiple student loans, you may be able to consolidate them into one fixed-rate loan based on your standard loan rate. from his debt. The goal is to make student loan debt more manageable and maybe even cheaper if done right.

There are two types of student loan consolidation that are often confusing but very different: student loan consolidation (for federal loans) and student loan refinancing or private student loan consolidation.

Federal loan consolidation is when you take multiple federal loans and combine them into one federal loan. This is done through an office of the Department of Education, Federal Student Aid. Your new loan, a direct loan, is free. Instead of making several monthly payments, you will have one monthly payment.

Refinance Student Loans: Sure Fire Ways To Get Approved

Student loan refinancing is done through a private lender. If you have federal and private student loans and want to consolidate them into one monthly payment, refinancing will be your only option. For refinancing, you agree on a fixed or variable interest rate, which must be lower than the individual interest rate for one of your existing loans.

You cannot transfer private loans to the federal government, but you can consolidate private and federal loans through a private lender. If federal loans are included in your renewal, you will lose the payment options and forgiveness programs, such as deferment and forbearance, that are included.

Under certain conditions, the deferment temporarily postpones the repayment of the loan. At present, interest is generally not accrued directly from the support part of the partnership loan. Foreclosure stops or reduces your loan payments for a certain period of time.

There is no credit requirement for federal student loan debt consolidation. But only federal loans can be consolidated this way. It may be a good choice for you if:

Can You Consolidate Private Student Loans?

With private student loan consolidation or refinancing, your financial history will begin to work with the new interest rate you get. Your financial history includes your credit score, income, work history and education.

Generally, you need at least a good credit score to qualify. The interest rate can range from 2% to 13% depending on the lender and whether it is a fixed or variable interest rate.

The private student loan consolidation process is entirely up to the borrower. However, online lenders offer online applications that take 10 minutes or less to complete and provide an answer within minutes.

By using this website, you agree to our use of cookies to collect specific information about your browsing time, to improve website performance, for analytical purposes and for marketing through third parties. For

How To Refinance Student Loans If You Have Bad Credit

Best bank to consolidate private student loans, consolidate federal student loans, can i consolidate federal and private student loans, consolidate private student loans into federal, consolidate my private student loans, how to consolidate private student loans, consolidate private student loans, consolidate federal and private student loans, consolidate private loans, best place to consolidate private student loans, can you consolidate private student loans, consolidate private student loans to federal