Best Place To Get Prequalified For A Mortgage – In many regions, home sales have slowed to a more modest rate. But even if you’re not facing a potential bidding war, getting pre-approved for a mortgage before you start house hunting is a smart choice. A mortgage pre-approval can simplify home buying by giving you an estimate of how much you can borrow and an estimate of your monthly mortgage payment. Additionally, having a pre-approval letter in hand gives sellers confidence that your mortgage application will be approved and the home sale will be completed. Is there a difference between mortgage pre-approval and pre-qualification? Although the terms sound similar, there are some significant differences between the two. A mortgage prequalification assesses your borrowing power based on a high-level overview of your financial circumstances. On the other hand, a mortgage is pre-approved, before signing. The lender conducts an in-depth review of your financial circumstances, including an income and credit check, and then assesses your borrowing power based on the results. A pre-approval does not guarantee that your loan application will be approved, but it does indicate that the lender is likely to approve you for the estimated mortgage amount specified in the pre-approval letter. How long does it take to get pre-approved for a mortgage? Depending on your level of preparation and how much income and document verification the lender requires, mortgage pre-approval can take 1-10 business days. However, the actual term is highly dependent on the lender. For example, an FFB mortgage lender can pre-approve you within 15 minutes of receiving your application and required documents through an online portal. 5 Ways to Speed Up Your Pre-Approval Even though the current housing market has calmed down, time savers – like Federal Bank’s First Online Mortgage Lender Portal – put you in a position to act quickly when you find your dream home . Here are some more tips to speed up pre-approval for a home loan so you can make a confident offer when the time is right. 1. Do your research. Save time – and frustration – by setting realistic expectations about how much you need to borrow. A mortgage calculator can help you get a basic idea of how much credit you can afford right now. It will also show if you need to save more for a down payment or increase your household income before committing to a mortgage. 2. Check the health of your money. Once you submit your pre-approval application, your finances will be under the microscope, so make sure they’re in good shape. Get a free credit report to determine any issues with your credit score and financial history that could affect pre-approval. You may need to address issues with your debt-to-income ratio or credit report before applying for pre-approval. 3. Choose the right lender. Which lender you choose can affect how quickly your pre-approval application is processed. Work with a lender that makes it easy to submit a pre-approval application. For example, FFB Mortgage Lenders’ online portal lets you complete an application from your mobile phone or computer in about 15 minutes, so there’s no need to visit a physical branch or navigate an automated phone system. 4. Be prepared. When applying for mortgage pre-approval, one of the biggest time savers is having the required documents to submit, preferably in electronic form. Depending on your circumstances, the lender may ask for clarification on specific financial XYZ. But you’ll usually be asked to provide documents about your income, assets, debt and down payment. 5. Don’t be a hindrance. If you want to move quickly through the pre-approval process, be available to sign and return the necessary documents. The sooner you submit the forms and address any questions or clarifications, the sooner your lender will be able to respond. Less stress on your home buying journey Even if you’re not competing with dozens of other home buyers, it’s a good idea to move quickly with an offer and contract when you find the right home. Getting pre-approved for a home loan can take anywhere from minutes to weeks depending on the lender. Fortunately, the five tips above can help speed things up. For more information on buying a home, download the “Essential Checklist for First-Time Home Buyers” to learn the most stress-free ways to “Can we afford a home?” “Welcome home.”

We are honored to be your partner in the home buying process. And like any good relationship, it helps to know who you’re working with. A home is one of the most important purchases we can make in our lifetime. At FFB, we are designed to provide exceptional customer service from your first phone call to your closing day and beyond. For decades, First Federal Bank has helped families find the right loan to fit their needs.

Best Place To Get Prequalified For A Mortgage

Mortgages How do you get pre-approved for a mortgage? Read Mortgage How does a mortgage application affect my credit score? Reed Loans Student Loan Debt Reduction Puts Home Ownership Within Reach Most Reed real estate buyers have heard that they need to be pre-qualified or pre-approved for a mortgage if they want to buy a property. These are the two main steps in the mortgage application process.

What Do I Need For Mortgage Pre Approval? 7 Documents

Some people use the terms interchangeably, but there are important differences that every home buyer should understand. Prequalification is only the first step. This gives you an idea of how big a loan you qualify for. Pre-approval is the second step, actually a conditional commitment to give you a mortgage.

“The pre-qualification process is based on the data submitted by clients,” said Todd Kadrabek, a residential broker affiliated with Beverly-Hanks Realtors in downtown Asheville, NC. “Pre-approval is verified customer data – for example, a credit check.”

Preparing for prequalification involves providing the bank or lender with an overall financial picture, including debts, income and assets. The lender looks at everything and gives an estimate of how much the borrower can expect to receive. Prequalification can be done over the phone or online and is usually free of charge.

Pre-qualification is fast, it usually only takes one to three days to receive a pre-qualification letter. Keep in mind that loan prequalification does not include credit report analysis or an in-depth look at a borrower’s ability to purchase a home.

Home Loan Process

The initial pre-qualification step allows for discussion of any mortgage-related goals or needs. The lender will explain the different mortgage options and recommend the type that is most suitable.

Mortgage discrimination is illegal. If you believe you have been discriminated against based on your race, religion, sex, marital status, use of public assistance, national origin, disability or age, you can take action. One such step is to file a report with the Consumer Financial Protection Bureau or the US Department of Housing and Urban Development (HUD).

Again, the pre-qualified amount is not a given as it is only based on the information provided. It is only the amount that the borrower can expect to receive. A pre-qualified buyer does not carry as much weight as a pre-approved buyer who has been better vetted.

However, pre-qualification can come in handy when it comes time to make an offer. “A prequalification letter with an offer is almost required in our market,” Kadrabek said. “Sellers are smart and don’t want to sign a contract with a buyer who can’t live up to the contract. This is one of the first questions we ask a potential buyer: Have you met with a lender and set up your prequalification? ? Status ? If not, we advise borrowers of options. If so, we request and keep a copy of the prequalification letter on file.”

Strategies For Securing Approval On Your Mortgage Loan

Getting pre-approved is the next step and there is a lot involved. “Pre-qualification is a good indicator of creditworthiness and borrower ability, but pre-approval is a more specific term,” Kadrabek said.

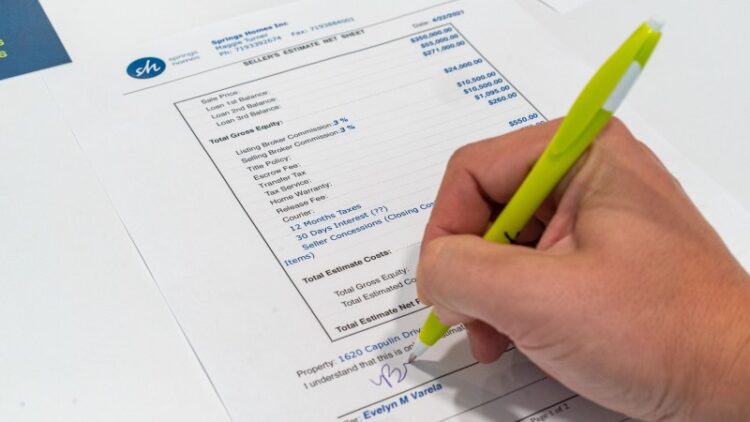

The borrower must complete a formal mortgage application to be pre-approved, as well as provide all necessary documentation for the lender to conduct an extensive credit and financial background check. The lender will then offer pre-approval up to a certain amount.

Going through the pre-approval process also gives a better idea of the interest rate that should be charged. Some lenders allow borrowers to consider the interest rate for pre-approval or pay an application fee, which can be several hundred dollars.

Lenders will give a conditional written commitment to a certain loan amount, allowing borrowers to find homes at or below that price level. This puts lenders at an advantage when dealing with a seller because they are one step closer to getting an actual mortgage.

Steps To Buying

The advantage of completing both steps—prequalification and preapproval—before looking for a home is that it gives the borrower an idea of how much to spend. This prevents wasting time looking at overpriced properties. Getting pre-approved for a mortgage also speeds up the actual buying process and lets the seller know the offer is serious in a competitive market.

The lender provides the borrower with a copy of the purchase agreement and other required documents as part of the full underwriting process after the home has been selected and offered. The lender hires a third-party certified or licensed contractor to appraise the home to determine its value.

Your income and

How to get prequalified for mortgage, how to get prequalified for a mortgage, get prequalified for mortgage, how to get prequalified for mortgage loan, get prequalified for mortgage online, best way to get prequalified for a mortgage, how long to get prequalified for mortgage, best place to get prequalified for a home loan, get prequalified for a mortgage, where to get prequalified for a mortgage, best place to get prequalified for a mortgage, get prequalified for mortgage loan