Best Place To Get A Private Student Loan – You are here: Home / US Student Loan Center / Student Loan Consolidation / Private Student Loans / 11 Private Student Loans With No Consignor

Education can be expensive and most of us need financial assistance. In fact, student loan debt is on the rise in the United States.

Best Place To Get A Private Student Loan

In addition to federal student aid, there are private lenders that can make it easier for borrowers to get financial aid.

Private Student Loans

Some private student loan providers do not require a co-signer at all and have different loan repayment options.

Let’s take a look at the different options available and see what it takes to qualify for unsecured student loans.

A cosigner is an authorized person responsible for receiving student loans and making sure payments are made in full and on time.

A co-signer is usually a parent, but other relatives can also lend their credit history and steady income to your application, making approval easier. Many students lack the credit history and proof of income needed to take out large student loans.

Infographic: How To Apply For Student Loans

When you share the responsibilities of a loan, your ability to make timely repayments not only affects you, but also your co-signer. If you miss payments or leave your loan in default, it will also negatively affect your cosigner’s credit score.

Until the loan is repaid, the borrower is responsible for the loan, unless the borrower requests the release of the consignor after meeting certain conditions.

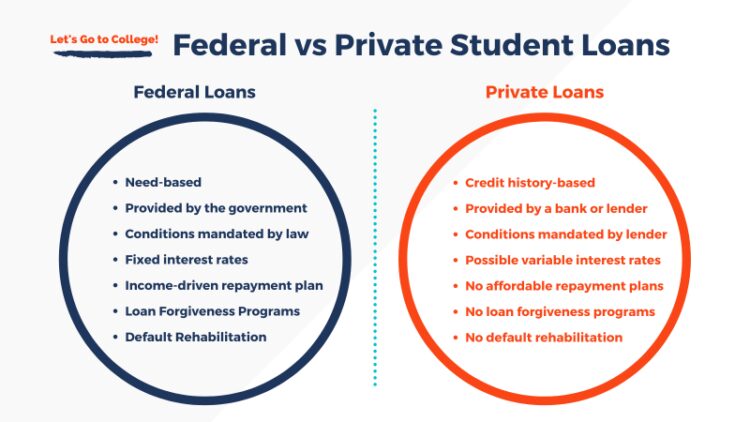

Federal student loans are determined based on financial need and other factors, so even if you have little or no credit history, you can get approved without a cosigner. However, private student loans usually require a cosigner if you don’t qualify for approval yourself.

It’s best to exhaust your federal student loan options before turning to private student loans to supplement the funds you need for your education.

What Is A Private Student Loan

Up to 96% of private student loans are co-signed because most students struggle to qualify.

Students need at least two years of credit history, earn at least $24,000 a year and have a low debt-to-income ratio to qualify for unsigned credit loans with some lenders. Students with no credit or eligible students who have a minimum credit score but do not have a two-year credit history can also apply for certain loans without a cosigner.

$24,000 is the minimum salary required to qualify for an unsecured loan. Many lenders require an income of $30,000 or more.

Finding a relative or friend willing to cosign a loan for you has its advantages:

Dealing With Collections For Private Student Loan Default

It also has “zero fees” which means no loan application fees, origination fees or late fees. This is good news for all borrowers.

About Bank Discover: Bank Discover was the first to introduce a cash rewards credit card in 1986. Today, Discover has become one of the most recognized brands in the US financial services industry.

Citizens Bank allows student loans without a cosigner, but loans with cosigners can receive a lower interest rate for repayment. After a certain period, the bank can release the creditor from the loan agreement.

However, borrowers must make on-time principal and interest payments for 36 consecutive months to qualify for the co-signer waiver.

Do Private Student Loans Accrue Interest While In School?

About Citizens Bank: Citizens Bank is the 12th largest retail bank in the United States and provides financial services to more than five million customers.

(Pro tip: Not sure if federal or private student loans are right for you? Don’t worry and download the best student loan resource library for everything you need to know about getting student loans. Learn more.)

The bank also has a program where the lender can cancel the loan agreement when the borrower makes 12 consecutive payments.

About Sallie Mae: For 40 years, Sallie Mae has helped 30 million Americans in need of student loans earn a college degree by saving, planning and repaying.

Napkin Finance Explains Federal Student Loans And Private Student Loans

University Funding offers up to $10,000 in student loans with no cosigners per academic year. Then, one month into the semester, students begin a repayment schedule that involves making monthly payments of $40 toward their loans.

About Funding University: Funding University started its activities in 2015. This year, the company hopes to expand to 11 countries and serve 1,000 students.

CommonBond offers graduate student loans that do not require a cosigner. This is a huge advantage for anyone attending medical school. Those who live in apartments only have to pay $100 a month.

About CommonBond: CommonBond has the benefits of simpler options, lower rates and a great experience. Founded in 2012, they have since funded more than $3 billion in student loans.

Private Student Loan Interest Rates Skyrocket For 5 And 10 Year Loans

These private student loans have no down payment fees or origination fees and are better protected than most lenders. This includes a 9-month grace period and the option to waive payments for a full year.

About Earnest: Earnest uses a system called “merit-based lending” that goes beyond traditional credit scores to get the full financial profile of its applicants.

Bank Tejarat offers private student loans without a consignor. With this type of financial aid, the borrower can also remove one of the signatories of the loan agreement.

About Commerce Bank: Commerce Bank is the largest bank in the United States by assets with $25.3 billion. The bank began operations immediately after the Civil War, which ended in 1865.

When To Apply For Private Student Loans

Connext sources financing from non-traditional lenders, credit unions and local banks, making their interest rates very competitive compared to the big players. After a simple application, the borrower will be assigned an agent who will arrange and process the loan after payment.

About Connext: Connext is a private student loan company powered by ReliaMax. It has competitive fixed and variable rate loans, no origination fees, and a variety of repayment options that make it easy for borrowers to get and repay a loan.

College Ave has flexible student loan programs that make it easier for graduate and undergraduate borrowers.

You can choose a payment plan from four options. You can also choose the loan term and specifically the number of repayment years.

Private Student Loan Market Share Ppt Powerpoint Presentation Ideas Example File Cpb

About College Ave: College Ave offers simple, clear and private student loan processes. Their products are available through Firstrust Bank, Member FDIC or M.Y. Safra Bank, FSB, FDIC member.

The best benefit for LendKey student borrowers is the ability to save money. After paying 10% of your loan, you can qualify for a 1% reduction in your interest rate.

About LendKey: LendKey enables borrowers to get student loans from a network of community lenders who put community before profit. After completing the application process, you will receive an instant decision and can adjust your loan accordingly.

Ascent Independent has the best student loans for juniors, seniors and graduate students. Student loans are adjustable and you can choose between a fixed or variable interest rate.

Enterval Private Student Loan Report

If you want to continue your education but need a lot of student aid, don’t give up! You can choose the private student loans that are right for you, even without a cosigner. It also helps you build a credit history score in the long run.

(Pro tip: Not sure if private student loans or federal student loans are best for you? Don’t worry and download the Best Student Loans Resource Library to learn everything you need to know about getting student loans. More here know.)

Have you ever had the experience of getting a private student loan without a co-signer? How is that? Share your thoughts in the comments below to help other student loan borrowers! Although higher education is a priority for many people, rising costs put it out of financial reach. If you don’t have the savings to cover the cost of college, check out your loan options.

The US Supreme Court blocked the implementation of the student loan forgiveness plan in June 2023, ruling that US President Joe Biden exceeded his authority in implementing the plan. The Biden administration responded by launching a new program called Savings in Education Values (SAVE). This plan allows eligible borrowers to lower their monthly payments, shorten the maximum loan repayment period and avoid some interest.

Should I Cosign My Child’s Private Student Loan?

Applications for the SAVE scheme will open on 22 August 2023. People already on the REPAYE scheme will automatically be placed on the SAVE scheme.

Private college loans can come from a variety of sources, including banks, credit unions, and other financial institutions. You can apply for a personal loan at any time and use the money for any expenses you want, including tuition, room and board, books, computers, transportation, and living expenses.

Unlike some federal loans, private loans are not based on the borrower’s financial need. You may be asked to complete a credit check to prove your creditworthiness. If you have little or no credit or bad credit, you may need a lender.

Private loans may have higher loan limits than federal loans. Repayment period of student loans from private lenders

Get Educated About The Pros And Cons Of Private Student Loans

Private student loan refinance, refinancing private student loan, best place to apply for private student loan, best place to get a private loan, best place to take out a private student loan, private student loan comparison, best private student loan refinance, private student loan consolidate, best place to get student loan, best place to get a private student loan, best place to get a student loan, best private student loan options