Best Place To Get A Mortgage Loan – When it comes to buying a new home, financial problems are the fear of many people in Singapore. Whether your next home is an HDB, a private property or a condo, it’s worth emphasizing this investment when you look at your finances – especially if you’re a first-time home buyer.

Getting a mortgage loan means giving you peace of mind. Through DollarBack Mortgage, you can enjoy a hassle-free process to find new home loan payments and refinance mortgages all in one place.

Best Place To Get A Mortgage Loan

Financially speaking – even with enough money to finance your home purchase, it may not be in your best interest if you are thinking long term. As one of life’s biggest investments, you’ll want to consider your options carefully so that your first purchase is more affordable. Using a home equity loan can help you secure the home of your dreams while saving your money for other important real estate expenses.

How Locking The Interest Rate On A Mortgage Works

Also, depending on the mortgage loan you get in Singapore, you can take advantage of lower interest rates.

If you would like to apply, please be assured that our proposal will provide a consultation process to allow homeowners like you to understand how mortgage loans work, payment methods and more. Then you can make an informed decision and choose the best mortgage loan that suits your needs.

Additionally, you can use Dollar Loan Financing to enjoy lower legal fees and many other benefits with our Singapore law firms. Please speak to our team for more information – we’re eager to show you the best mortgage loans!

It will depend on many factors such as minimum monthly income, minimum age of the customer, loan amount and residence status. Eligibility requirements may vary between different banks in Singapore. Our mortgage experts will help you narrow down your options for finding a new home or mortgage loan for you.

Hdb Loan In 2023

Yes, there is. The costs that go with a bank mortgage loan are usually attorneys’ fees, property appraisal fees and – if there is a time limit – late payment penalties. We cover more in our new guide to mortgages in Singapore. Between rising prices, high demand for housing, and limited supply, finding a good mortgage in Singapore can be a challenge.

Designed as a financial platform to help customers find the financial products they need, we thought now would be a good time to make a recommendation.

The first step to finding the best mortgage rate is to do your research and compare offers from different financial institutions. Rates can vary between banks and other lenders, so taking the time to look at each of the different options can save you a lot of money. a long time

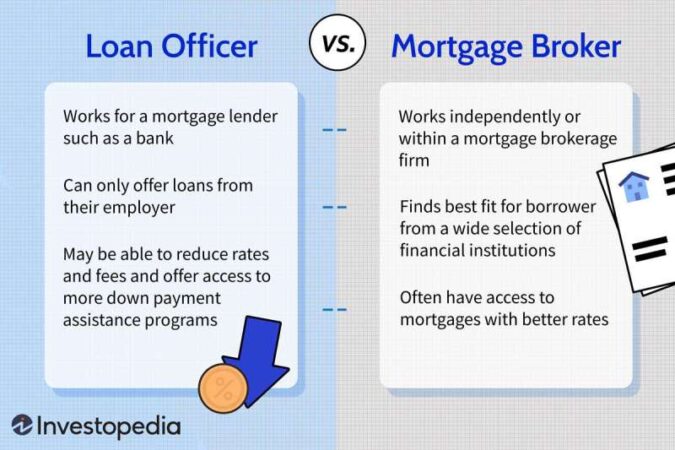

If you are concerned about the number of lenders and financial institutions, contact a trusted mortgage broker. A mortgage broker is often involved in various economic factors, and can help you find the best rate.

Best Tips To Improve Your Chances Of Mortgage Approval

We recommend scheduling a call with one of our experts. Thanks to long-term relationships with our partners, we have special prices and packages that are not available to the public.

Your credit score plays an important role in determining your mortgage rate. Banks and lenders look at borrowers with great credit as having low credit, which will result in better rates.

So, do what you can to improve your credit score; Pay your bills on time, stay within your available credit limits, and avoid overdrafts. If necessary, delay the home search until you are financially secure.

Saving for a down payment is one of the best ways to ensure the best mortgage payment. A higher down payment lowers the loan-to-value (LTV) ratio, which lowers the lender’s risk, giving them a better rate of return. Also, after saving money on paying on time, you need to pay more for a small loan.

Hsbc Home Loan Options And Interest Rates In Singapore

If you have a mortgage, you may want to consider refinancing to get a better rate. Refinancing involves changing your loan to a new one with better terms.

To determine if refinancing is right for you, evaluate your current mortgage, loan balance, and potential savings from refinancing.

Contact us for a free consultation and we’ll help you decide if it’s time to renovate your home.

Don’t be afraid to negotiate with lenders for the best mortgage rates. Banks and financial institutions are interested in your business and may be willing to give you a better rate if you show them your plan to transfer your loan. Be sure to use your research and comparisons to give yourself a strong selling position. Additionally, there is no one better than a mortgage broker so let them consult with lenders for you.

Besmartee’s Mortgage Pos Delivers The Best Borrower And Loan Officer Experience

Securing the best mortgage rates in Singapore can be difficult, but with these five key tips, you’ll be well equipped to get the best value for your property purchase.

If you’re not sure where to start or want a second opinion on a potential decision, don’t hesitate to schedule a call with our experts for expert guidance. Alternatively, you can submit your inquiry here to help us understand your needs, and our loan officer will get back to you quickly with the best options.

Best of all, our service comes to you for free. Let us help you turn your dream home into reality.

Lendingpot makes it easy for you to find financing products. Apply for loans, business loans and mortgage payments on our site to get special rates with our partners. In addition, we aim to bring you information and reviews on the latest financial products.

Mortgage Broker In Nanaimo, Bc

Lena does marketing and branding at The Landing Path. With a deep vision, he believes in using strategic communication with our SME community and wants to make Landing Road a household name. Outside of work, I am a camper and thanks to the great outdoors. Welcome to the world of Singapore mortgage brokers, where your home ownership dreams come true! Whether you’re an experienced investor or a first-time home buyer, understanding the complex world of mortgage lending can be overwhelming. Mortgage brokers fulfill this role by acting as trusted advisors and financial advisors.

Singapore, a capital city, has a rich housing market with many housing options. However, finding the right mortgage can be difficult due to the number of lenders, different interest rates, and complicated loan policies. Now, the knowledge of mortgage lenders is very useful.

Accredited mortgage brokers are experts in matching customers with accredited lenders and creating loan programs based on the needs of each borrower. By providing personalized advice, evaluating your financial situation, and identifying the best mortgage options in the market, they act as an intermediary and facilitate the process.

When you work with a mortgage broker in Singapore, you can gain a deeper understanding of their market conditions, lending laws, and local economic conditions. In order to get the best mortgage terms, they look at your financial situation, including your income, credit history, and needs.

How To Calculate Housing Loan In Singapore

Mortgage brokers negotiate for you, ensuring you get the best credit terms thanks to competitive rates, flexible payment terms, and a wide network of numbers in the loan industry. They help you with the application process, save paperwork, and simplify everything to save time and effort.

The foundation of the relationship between a mortgage broker and a customer is knowledge and trust. Brokers are responsible for representing your interests, giving you unbiased advice and making sure they understand your mortgage needs. Their dedication to the job ensures that you make the best informed choice in line with your financial goals.

Therefore, mortgage brokers are your reliable partners whether you want to buy the house you want, refinance, or invest in the Singapore property market. With their knowledge and passion, they can make smart choices and navigate the mortgage business with confidence.

Get ready to start your journey to your home with the help and guidance of mortgage brokers in Singapore. Find the best mortgage option to meet your needs.

Tips On How To Get The Best Mortgage Rates

ROSHI strives to use a digital solution that is flexible and convenient to facilitate the loan process more than ever. Through their application, borrowers can create and access their own dashboard, access custom loan options and chat directly with loan officers. They introduced email to the platform to speed up support and gave it a machine learning experience to accept or reject applications, offering a choice of approved loans.

Best place to get debt consolidation loan, where is the best place to get a mortgage loan, best place to get a home mortgage loan, what's the best place to get a mortgage loan, best place to get a mortgage loan with bad credit, easiest place to get a mortgage loan, best place to go for mortgage loan, best place to get home equity loan, the best place to get a mortgage loan, best place to get a mortgage loan, best place for mortgage loan, what is the best place to get a mortgage loan