Best Personal Loan To Pay Off Credit Card Debt – If you’re approved for a low-interest loan, you can pay off your credit card with a personal loan. However, before taking out a loan, consider the pros and cons, as well as other payment options.

While you may have many options when it comes to paying off credit card debt, some people take out personal loans, sometimes called personal loans, to pay off their credit cards.

Best Personal Loan To Pay Off Credit Card Debt

It doesn’t always make sense to borrow from one lender to pay off another, but consolidating debt can lower your monthly payments and interest rates. to your current credit card. Paying off debt is easier if you have a fixed payment schedule. However, deciding whether or not to try this depends on your personal circumstances, credit and preferences.

Personal Loans For A 600 Credit Score

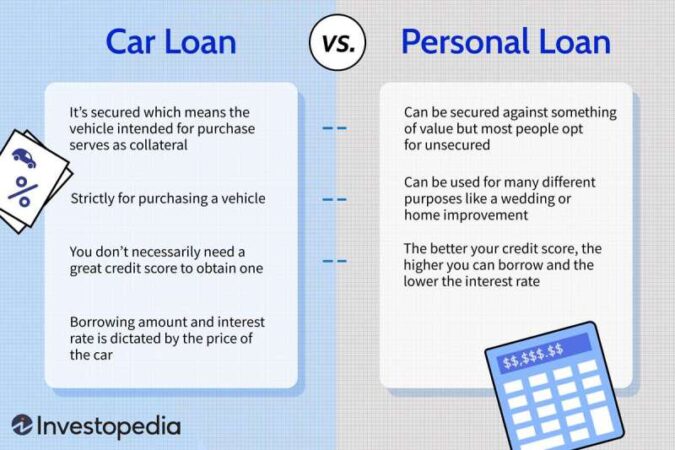

Although one is not necessarily better than the other, there are some important differences between a personal loan and a credit card.

Personal loans and credit cards affect your credit score differently. However, making payments on time helps your credit, and late payments can hurt it. The score in your current balance compared to your original balance for a mortgage loan. But what may be more important is your spending habits or the number of credit cards you currently use.

In other words, more credit card debt (relative to their credit limit) than your personal debt is worse for your credit.

Applying for a personal loan and using the money to pay off your credit card debt can be a great strategy to help you get out of debt. However, you want to consider the pros and cons and how these strategies compare to other options.

Should I Use A Personal Loan To Pay Off Credit Card Debt?

A personal loan calculator can help you figure out your monthly payments and how much you will pay, including interest, over the life of the loan, so you can decide what A personal loan is the right choice for you.

The information provided is for educational purposes only and should not be considered as financial advice. cannot guarantee the accuracy of the results provided. Your lender may charge other fees that are not included in this calculation. These results are estimates based on the information you provide, and you should consult your financial advisor regarding your specific needs.

Focusing on paying off credit card debt is a top priority for many people, because credit cards have high interest rates. But if a personal loan is not right for you, or if you want to compare your options, here are four options:

There may be other options, and the best option will depend on your financial situation and preferences. Consider some free options that won’t affect your credit, such as getting pre-approved for a personal loan and calling a credit bureau to see which options are right for you. you

Best Credit Card Loans To Pay Off Your Debt (dec. 2023)

If you think a personal loan might make sense, you can get a loan from a number of service providers through CreditMatch™. When you check your offers, the sales check will not affect your credit score, so you can quickly compare and see which lender offers you the best loan. .

Apply for a personal loan with confidence and find an offer that fits your credit situation and your FICO score

The SmartMoney™ Debit Card is issued by International Federal Savings Bank (CFSB) under license from Mastercard International. CFSB, a financial service provided by the FDIC. The program manager, not the bank.

Editorial Policy: The information in this survey is for educational purposes only and is not legal advice. You should consult your attorney or seek specific legal advice. Understand that rules change over time. The post reflects the rules at the time of writing. While maintaining your privacy, the information collected will not reflect current policies.

Should You Get A Personal Loan To Pay Off Credit Card Debt? — Tally

The opinions expressed herein are solely those of the authors, and are not the opinions of any bank, credit card issuer, or other company, and have not been reviewed, endorsed, or approved. from an organization. All information, including prices and fees, is correct as of the date of publication and will be updated as provided by our partners. Some of the information on this page may not be available on our website.

The pros and cons of this offer are determined by our editorial team based on independent research. Banks, lenders and credit card companies are not responsible for the content posted on this website and do not endorse or guarantee the reviews.

Advertising: Promotion of this site is provided by third party companies (“our partners”) to paying customers. These prices will affect how, where and in what order the products appear on this site. The site does not represent any financial service, company or product.

* For more information, see the terms and conditions of the offer on the recipient’s or partner’s website. After clicking Apply, you will be redirected to the supplier’s or partner’s website where you can review the terms and conditions of the offer before applying. We conclude, not all legal terms – before applying you must understand all the terms of the proposal from the publisher or partner themselves. While Customer Service makes reasonable efforts to display the most accurate information, any information provided is provided without warranty.

Rolling Over Credit Card Debt Is No Game

Websites are designed to support modern, up-to-date browsers. Internet Explorer is not supported. If you use a browser that is not currently supported, your experience will be poor, you may encounter problems, and you may be exposed to security risks. It is recommended that you upgrade to the latest browser version.

© 2023 All rights reserved. . and trademarks used herein and their respective suppliers are trademarks or registered trademarks. The use of other trade names, copyrights, or trademarks is for identification and reference purposes only and is not associated with the owner or distributor of their products or services. trademark. Other products and company names mentioned herein are the property of their respective owners. License and Disclosure. New feature! – You do not need to provide your income information when requesting through Myinfo with Singpass.

The interest rates and fees shown are the lowest published rates and may differ from those offered to you. The interest rate and processing fee offered to you will be released at the time of application and will be determined at the company’s discretion based on your personal credit and income profile.

Borrowing is fast. Don’t believe us? Watch the video and see for yourself.

Pros And Cons Of Using A Personal Loan To Pay Off Credit Card Debt

3.88% less than the customized interest rate. + 1% commission (EIR 7.56% p.a.)! Note that the maximum EIR can reach a maximum of 20.01%. Depending on your loan, rent and personal history.

AIR – Applied Interest Rate. This is the interest rate that is used to calculate the interest you pay on your loan. The interest on the loan is calculated as the principal term of the loan (simple interest) by multiplying the loan amount by the annual interest rate for the total loan amount.

EIR is a good interest rate. This is the interest rate that shows the actual cost of the loan as shown in the reduced interest rate (such as a home loan) and is useful for comparing different loans to obtain the best price.

Online Special! Apply for a personal loan today with promo code “POSBPL” and get 2% unlimited cashback on your approved loan! The loan amount is S$10,000 or more and the minimum loan period is 24 months.

What Happens If You Pay Off A Personal Loan Early?

Personal Loan 2% Unlimited Cashback Promotion Terms and conditions apply. Promotion ends on December 31, 2023. Cashback will be calculated within 120 days from the date of approval of the personal loan application.

/POSB Personal Loans require (i) cash and/or credit card to pay off the loan, and (ii) /POSB savings (including mutual funds, trusts, MSAs, SAYEs, and POSBs) to repay loans; for (See frequently asked questions tab for more details).

If you do not have a cash/credit card account, you will need the following information:

Please note that applications that do not include the required information or contain incomplete information will be delayed in processing.

Apply For A Personal Loan From Dbs At Low Interest Rates

If you do not have an existing account / POSB savings account, you can select your preferred account here and apply online.

After approval of / POSB Personal Loan via your cash and / or credit card, you will receive another SMS confirming approval of / POSB Personal Loan. Check your credit card for loan approval.

Cash is a standby line of credit account and is used for credit checks / POSB personal loans.

For Singapore citizens or Singapore permanent residents who have borrowed $3,000 or more, you can choose to repay the loan in 6, 12, 24, 36, or 48 months.

Best Ways To Pay Off Credit Card Debt

Taking personal loan to pay off debt, best personal loan to pay off debt, getting a personal loan to pay off credit card debt, use personal loan to pay off credit card debt, personal loan to pay credit card debt, personal loan to pay off credit card debt good idea, personal loan to pay off student debt, personal loan pay off credit card debt, pay off credit card debt with personal loan, business loan to pay off personal debt, personal loan pay off debt, personal loan to pay off tax debt