Best Auto Loan Rates For Excellent Credit – Its content is for informational and educational purposes only and should not be considered professional financial advice. Consult a financial or tax advisor if you need such advice. Links are often to products, services, or fees from third-party websites. Although we do our best to keep this information current, the images on this website may differ from the actual images. We may have financial relationships with some of the companies mentioned on this website. Among other things, we may receive free products, services, and/or compensation for installing sponsored products or services. While we strive to write fair and honest reviews and articles, all opinions and views expressed are solely those of the author.

ECG Pte Ltd () is not an investment or financial advisor but an independent issuer and comparison service. Its articles, links and other information are provided to you free of charge, as a resource and for informational purposes only. They are not intended to provide investment or financial advice. does not guarantee the accuracy or relevance of any information to your situation. The example is hypothetical, and we encourage you to seek specific advice from qualified professionals regarding your specific investment or financial problems. Our estimates are based on past market performance and past performance is not a guarantee of future performance.

Best Auto Loan Rates For Excellent Credit

We believe that everyone can make financial decisions with confidence. And while our website does not represent every company or product on the market, we pride ourselves on the guidance we provide, the information we provide and the tools we create. to be objective, independent, simple – and free.

Best Car Title Loans For Bad Credit And No Credit Check Texas 2023

So how do you make money? Our friends punish us. This may apply to the products we review or write about (and where those products may be found online), but it does not apply to our opinions or recommendations regarding thousands of hours of research. We cannot pay our partners to ensure positive reviews of their products or services. Understanding How Loans Work – How To Get The Best Rate For You! 1. What is credit?

A car loan is a loan used to buy a car. There are different types of car loans, but the most common type is the easy loan. With a simple loan, interest is calculated based on the principal or amount owed. The interest rate is fixed, meaning it does not change during the loan period. Loan payments are fixed, meaning they are usually repaid within two to seven years.

The biggest advantage of a car loan is that you can buy a car without making any payments. This is a good option for those who don’t have the money to buy a car. It can be a good choice for those looking for cash on a used car. Used cars often have a lower depreciation rate than new cars.

Another benefit of a car loan is that it helps you build your credit. If you make your payments on time and in full, you will build a good payment history. This good payment history can help you qualify for better rates in the future.

Auto Loan Hackr…best Auto Loan Rates?

If you are considering taking out a loan, there are a few things to keep in mind. First, you need to shop around for the best interest rate. Interest rates can vary from lender to lender, so it’s important to compare interest rates before you decide on a loan. Second, you need to understand all the terms and conditions of the loan before you sign anything. Finally, you should always make sure you can afford the monthly payments before making a payment.

Car buyers need loans through various channels. The main thing is to have a good relationship with the donor. Another way is to get a good credit score, a down payment, or a mortgage.

Car buyers can get a loan through a number of ways. The most common way is to have a good relationship with the provider. This means that the customer has a history of making payments on time and is considered a low-interest lender. Other ways for a buyer to get a car loan include having a good credit score, significant down payments, or a credit offer.

A good credit score is important in getting a car loan because it shows the lender that the customer is financially responsible and that the loan is not too bad. A high payment indicates to the lender that the customer is securing the loan and reducing the risk. Finally, providing a loan to the borrower gives the lender a refund if the loan is not approved, reducing risk.

Best Private Party Auto Loans And Rates (2023)

Finally, there are several ways a car buyer can qualify for a car loan. The main factor is the customer’s relationship with the lender, but other factors such as credit scores, payments and lenders can also play a role.

When you buy a new car, it’s important to consider the interest rate on your loan. The interest rate depends on your monthly payment and the amount you will pay over the life of the loan. It’s important to understand how car loan payments work so you can get the best rate possible.

The interest rate on a loan is the cost of the loan to the lender. Interest is expressed as a percentage of the loan amount and is paid over the life of the loan. The higher the interest rate, the more interest you will pay over the life of the loan.

The interest rate on a car loan is determined by many factors, such as the lender, your credit history, the length of the loan and the amount of money paid. About 4%.

Best Personal Loans For Good Credit (670 739 Credit Score)

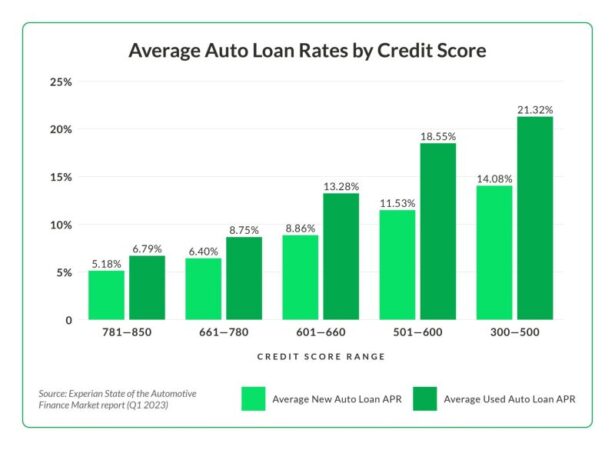

If you have good credit, you may qualify for a lower interest rate. If you have bad credit, you can borrow money, but you will pay a higher interest rate.

The term of the loan also affects the interest rate. The longer the loan, the higher the interest rate. The shorter the loan, the lower the interest rate.

It also affects the interest rate. The larger the deposit, the lower the interest rate.

To get the best interest rate on a car loan, it’s important to compare the rates of different lenders. It is also important to have a good credit history and steady payments.

Instant Approval Auto Loans For Bad Credit (dec. 2023)

It is common to want to know how long it takes to get an approved car loan. The answer can vary based on many factors, but let’s start with the basics.

When you apply for a car loan, the lender wants to know basic information about you and your finances. This includes things like your work history, income and credit. Lenders want to know the value of the car you are looking to buy.

Once the lender has this information, they will process a loan. That’s where your credit score comes in. The higher your credit score, the better your chances of getting approved for a car loan.

If you have a good credit score, you can be approved for a car loan within 24 hours. However, if your credit score is low, it may take a few days or weeks to get approved.

Best Credit Unions For Car Loans

Once you’re approved for a car loan, the lender will send you the money. Then you can use that money to buy the car you want.

It is important to remember that not all lenders are the same. Some lenders may approve your loan earlier than others. It’s a good idea to shop around and compare different providers before deciding which one to use.

Now that you know how long it takes to get a car loan, let’s talk about how you can qualify for the best rate.

The interest rate you get on your home loan depends on many factors, including your credit score. If you have a good credit score, you will be offered a lower rate than someone with a bad credit score.

Best Bad Credit Auto Loans (the 2020 Edition)

You can find the lowest interest rate by shopping around and comparing different lenders. It’s a good idea to get three different lenders before deciding which one to use.

Finally, you can try to negotiate with the lender for a smaller amount.

Auto loan rates for excellent credit, current auto loan rates for excellent credit, lowest auto loan rates for excellent credit, auto loan rates excellent credit, used car auto loan rates excellent credit, auto loan interest rates for excellent credit, used auto loan rates excellent credit, best car loan rates for excellent credit, best new auto loan rates for excellent credit, excellent credit score auto loan rates, best personal loan rates for excellent credit, best auto loan rates with excellent credit