Balance Sheet Income Statement Cash Flow Relationship – In this video series financial statements are presented in the context of building a financial model. The aim is not only to explain what they are, but to show how they relate to others. These links are essential to the mechanical process of building a three-statement model, and for this reason we recommend that you review this series even if you have been exposed to the previous three basic financial statements. This series is divided into the following chapters:

The accounting equation is the single most important concept in accounting, and is critical to developing a deeper understanding of financial statements.

Balance Sheet Income Statement Cash Flow Relationship

This video explains how the accounting equation applies when building financial models. It also provides an overview of double-entry accounting, which is the most common system used by businesses to record financial information. The video concludes by noting that the balance sheet is just a more formal presentation of the accounting equation.

Difference: Fund Flow, Balance Sheet, And Income Statement

This video introduces the budget by asking you to imagine the resources you need to run a business, and then look at how to secure these resources. To rearrange these variables you can see how they all fall into one of three categories: Assets, Liabilities and Capital. The video then emphasizes that the balance sheet details a company’s financial position at any given time, while the income statement and cash flow statement detail past economic activity between periods.

The instructions conclude by highlighting the relationship between the balance sheet and other financial statements that are important to consider when building financial models.

This video introduces the income statement starting with the most concise presentation and expanding on the number of line items. Following this presentation, the accounting equation is revisited to help show how the balance sheet and income statement relate to each other (green triangle in the following image – the most prominent relationship highlighted is that increase in shareholders’ equity with net income).

Next, the purpose of the income statement is defined and two important accounting concepts are introduced: the Matching Principle and Depreciation. The video concludes by highlighting the relationship between the income statement and the cash flow statement, and highlights the difference between the accrual basis of accounting and the cash basis of accounting.

Introduction To Financial Statements

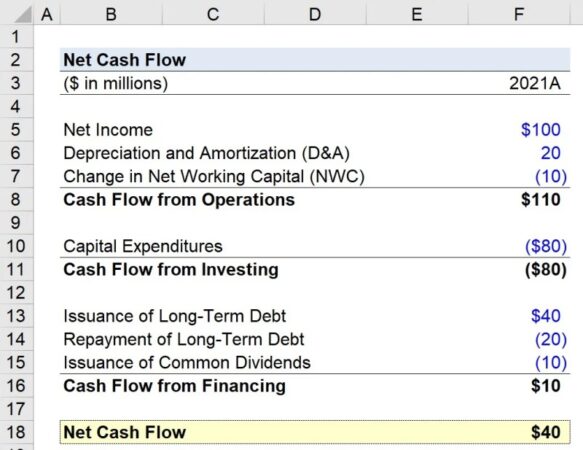

This video introduces the cash flow statement, perhaps the simplest of the three main financial statements. While income and balance sheet reflect the accrual basis of accounting, the cash flow statement begins with net income and changes the economic activity of the business from an accrual basis to a cash basis. To show the difference, the video goes through the purchase of a large piece of equipment based on accrual and cash that provides visuals to help solidify these concepts. The video also details the three different types of cash inflows and outflows: cash flow from operating activities, cash flow from investing activities, and cash flow from financing operating activities. The video concludes by explaining the importance of measuring cash and why GAAP profitability measures alone are not enough to determine a company’s financial condition.

With the presentation of the three financial statements complete, the video then explains how the three financial statements work together to maintain the accounting equation. The first relationship highlighted is that the cash balance calculated on the cash flow statement links to the cash on the balance sheet (see the arrow on the left of the picture below). In this way, the cash flow statement adjusts the asset side of your balance sheet in each successive accounting period. As a reminder, the video then shows that net income adds to the equity account (retained earnings) in each accounting period (see the arrow to the right of the image below).

With this in mind, remember that the balance sheet is only a formal presentation of the accounting equation. If the cash flow statement adjusts the left side of the equation, or assets, the company’s cash flow in that period, and if the income statement adjusts the right side of the equation, or shareholders’ equity, of the net income, then the statement of cash flows, which start with net income, are adjusted so that the accounting equation is true. And this is how the accounting equation is balanced in financial models, and therefore how the budget is balanced in financial models.

The video series concludes with a handwritten quiz. Multiple choice and fill-in-the-blank quizzes can only achieve so much. These formats are useful because they provide the ability to display results immediately, which is essential to the learning process. But in between, research shows that filling in the blank is more effective because it requires retrieving the answer from memory rather than making it easy from a list of options. It follows that this advantage takes a step beyond writing answers.

Cash Flow Statement: What It Is And Examples

More Financial Modeling Courses and Curriculum Details Purchase Model Leverage Cash Flow Model Discounting Financial Statement Integration Learn Excel for Financial Models

Download links sent straight to your inbox! Enter your email address below and we will email you the information you requested.

You only need to enter your email address the first time. All future downloads will be sent to the same email address.

If you want to send this to another email address, click here, then click the link again. The relationship between the balance sheet and income is that the profits of the business reflected in the income statement belong to and belong to the owners. shown by the movement of equity between the opening and closing balance sheets of the business.

Comparing And Analyzing Financial Statements

Suppose the business starts and the owner injects cash of 600 in the commercial bank account. The opening balance sheet is shown below, the business has cash assets of 600, and owner’s equity in the business is 600.

The business is now trading for an accounting period. Buy goods costing 500 for cash and sell them on credit to customers for 800.

On the balance sheet, the cash asset has decreased by the amount paid to the supplier by 500, and the ending cash balance is 600 – 500 = 100. Accounts receivable has increased by 800, which is what customers owe, and closed accounts is the right 0 + 800 = 800.

Because the net assets are now 900, in order to maintain the accounting equation, and make the balance sheet, the equity must also be 900.

Financial Statement Analysis: How It’s Done, By Statement Type

If we now add another column to show the movement on the budgets, we have the following.

Two of the movements can be explained. The movement on cash, the amount paid to the supplier, is -500. The transfer of accounts receivable is 800, the amount invoiced and pending from customers. In any case, to make the balance sheet there must be a movement on equity 300, which must be explained.

The explanation for the movement in equity lies in the relationship between the balance sheet and the income statement. If we now look at the income statement for the period, we see the following.

The income statement shows that the business sold goods that cost 500 for 800 and made a profit of 300. The profit belongs to the owners and increases the owners’ equity by 300. This increase is the same as the movement in equity between the opening and closing balances, as shown in the diagram below.

Accounting And Bookkeeping Course: Cashflow And Your Balance Sheet

So the relationship between the balance sheet and the income statement is that the profit for the period that comes from the income statement shows the movement of equity which is the difference between the opening equity and the closing equity in the business budgets.

Chartered Accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for over 25 years and has built financial models for all types of industries. He was a Chief Financial Officer or manager of small and medium-sized enterprises and managed his small businesses. He was a manager and auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. The balance sheet and cash flow statement are two of the three financial statements that companies publish to report on their financial performance. Investors, market analysts and creditors use financial statements to assess a company’s financial health and earning potential. While the balance sheet shows the amount of a company’s ownership and liabilities, the cash flow statement records the cash activities for the period.

A balance sheet lists a company’s assets, liabilities and equity at a point in time, usually at the end of a period, such as the end of a quarter or year. A balance sheet shows how much a company owns in the form of assets, how much it owes in the form of liabilities, and the amount of money invested by shareholders listed under shareholders’ equity (also called owners’ equity).

Show the balance sheet

Chapter 3 Project Management

Make cash flow statement from balance sheet, balance sheet income statement and cash flow, cash flow statement from income statement and balance sheet, cash flow balance sheet income statement relationship, balance sheet income statement cash flow template excel, relationship between income statement and balance sheet and cash flow, balance sheet vs income statement vs cash flow, balance sheet to cash flow statement, preparing cash flow statement from balance sheet, create cash flow statement from balance sheet and income statement, cash flow statement balance sheet, balance sheet income statement relationship