- Bad Credit Manufactured Home Loans Guaranteed Approval

- Top 10 No Credit Check Loans From Direct Lenders With Guaranteed Approval And Hassle Free, Same Day Decision 2023

- California First Time Home Buyer Programs Of 2023

- In Principle Approval (ipa) Denied? Here Are 6 Reasons Why

- Best Manufactured Home Loans For Bad Credit (dec. 2023)

- Best Personal Loans For Low Income Earners In Singapore

Bad Credit Manufactured Home Loans Guaranteed Approval – If you’re looking for a loan for a manufactured home, you’ll have fewer options than you would with a traditional home loan. But it is entirely possible. Here you can see some of your options.

Editorial Note: Intuit Credit Karma receives compensation from third-party advertisers, but this does not influence the opinions of our editors. Our third-party advertisers do not review, approve or endorse our editorial content. Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge at the time of publication.

Bad Credit Manufactured Home Loans Guaranteed Approval

We think it’s important that you understand how we make money. It is actually quite simple. The financial product offerings you see on our platform come from companies we pay. The money we make helps us provide access to free credit reports and scores and create other great educational tools and materials.

Companies Use Government Backed Loans To Buy Mobile Home Parks And Raise Rents

Compensation may affect how and where products appear on our platform (and in what order). However, because we typically make money when you find and receive an offer you like, we try to show you offers that we think are right for you. That’s why we offer features like approval probabilities and savings estimates.

Of course, the offers on our platform do not represent every financial product, but our goal is to show you as many great options as possible.

If you are considering purchasing a manufactured home, the loan process will likely be different than if you were purchasing a traditional home, townhouse, or condo.

A manufactured home – sometimes called a mobile home – is a single-family home that is built in a factory and meets certain standards set by the U.S. Department of Housing and Urban Development.

Top 10 No Credit Check Loans From Direct Lenders With Guaranteed Approval And Hassle Free, Same Day Decision 2023

Because the structure is not always attached to the property on which it sits, mobile or manufactured homes are not considered suitable for most types of mortgages by many lenders.

We take a closer look at why financing this type of property can be challenging and what financing options may be available to you.

If your home is not permanently attached to the land on which it stands, lenders consider it “personal property” rather than “real property.” In this case, you cannot take out a conventional loan.

If you’re looking for a lower-cost option, the Federal Housing Administration (FHA) approves lenders under its Title 1 program to finance manufactured homes and land.

California First Time Home Buyer Programs Of 2023

The FHA requires fixed interest rates for these loans and stipulates a loan term of typically 20 years. Here are some more details to consider:

There are several government-backed loan options for manufactured homes, each with their own criteria. Some may require that your home be secured with a foundation. Others require homes to have a certain square footage.

You need to research and explore your options to find the right loan for your specific situation. You can also pre-qualify for a loan to get an idea of how much you can afford.

In addition to the FHA Title I program, the FHA offers a Title II program for manufactured homes.

Best Va Loan Lenders Of December 2023

If you qualify for the FHA Title II program, you may be able to get better rates and terms. However, your home must be attached to the property you own. To qualify for these FHA programs, your garage must be used as a primary residence and built after June 15, 1976.

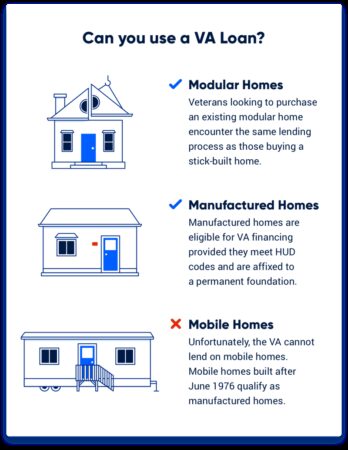

A loan from the U.S. Department of Veterans Affairs may be an option if you serve in the military, are a veteran, or meet other eligibility requirements.

A VA loan for a manufactured home must be attached to a permanent foundation with at least 400 square feet of interior space for a single width and 700 square feet for a double width.

Additionally, it must be considered real property under your state’s laws and meet all local zoning requirements.

Financing Manufactured Homes To Boost Housing Supply In Rural America

The benefits of financing a manufactured home with a VA loan include no down payment required if your home’s selling price is not higher than its appraised value. Additionally, you are not required to purchase private mortgage insurance (PMI). However, keep in mind that you will have to pay a VA financing fee and closing costs.

If you want to build a manufactured home on a lot in a rural area, it’s worth considering a loan guaranteed by the U.S. Department of Agriculture, as long as the home was built on or after January 1, 2006. No deposit is required, you must meet USDA income limits for your area.

The USDA also requires that your manufactured home be at least 400 square feet, sit on a permanent foundation, and meet all state and local regulations. In addition, it must be in its original condition as it was manufactured at the factory.

The credit score you need to finance a manufactured home depends on the lender and the government program you choose.

In Principle Approval (ipa) Denied? Here Are 6 Reasons Why

Although financing a manufactured home can be more difficult, it is certainly possible. Use these questions to guide your loan selection.

About the Author: Anna Baluch is a freelance personal finance writer based in Cleveland, Ohio. You can find her work on sites like The Balance, Freedom Debt Relief, LendingTree, and RateGenius. Anna holds an MBA in Marketing from Roosevelt Un… Read more. If you don’t have answers to your questions, it can be difficult to navigate the garage financing process in Texas. What types of financing are there for mobile homes? How to apply for a mobile home loan? What is a Personal Real Estate Mortgage vs. a Traditional FHA Mortgage? Can you still get garage financing in Texas despite bad credit or not? Which real estate lenders are available to take on RV loans and how can you contact them?

Our experienced team at Top Notch Homes will be happy to help you answer all your questions and find the mobile and manufactured home in Texas your family needs for a new single or semi-detached home. We can even help you apply for financing for manufactured homes on properties we offer in our property catalog and home packages.

We work with several top lenders to help you find the lender you prefer. We want to help you make the most informed RV loan decision and connect you with the lender who can help your family with the best terms, such as:

Best Manufactured Home Loans For Bad Credit (dec. 2023)

Before you apply for prefabricated home financing, carefully review the eligibility requirements of the financing options available for this type of home and consider their advantages and disadvantages. If you have any questions about which option might be right for you, please don’t hesitate to contact us today! We are ready to assist you in contacting your preferred lender for a manufactured home loan application.

The classic “Land & Home” mortgage usually offers the lowest interest rate. A traditional mortgage bundles everything together – the garage, the land, and the improvements to the property. With this type of mortgage, you will typically need a larger down payment. With a conventional mortgage, you’ll need to make a down payment of at least 20%. A typical down payment can cost tens of thousands of dollars, depending on the property and home you are purchasing. Traditionally, a conventional loan is usually best for buyers of a second or even third home because they can use the equity in their old home to purchase a new home.

This is a personal real estate loan most commonly used for mobile home purchases and is NOT permanent. A mobile home that does not have a permanent base is considered personal property and must be financed as such. Click here to learn more about mobile loans in Texas.

This involves financing a prefabricated house on private property where the property serves as security for the loan. Lenders allow the buyer (instead) to use all or part of the equity in the property, thereby reducing the down payment required. This is a viable option if you are financing a garage with land rather than the house itself.

Best Personal Loans For Low Income Earners In Singapore

This is a temporary loan that provides funds to the prefabricated home dealer and/or builders at regular intervals after various construction elements are completed. At the end of the construction process, this loan is repaid with the permanent loan proceeds.

The FHA insures the original lender against loss if the borrower defaults. There are various requirements and restrictions for an FHA manufactured home loan, including home approval, retailer approval, and furnishings. Loan terms for FHA-approved manufactured home loans are typically 20 years for a single-family home and 25 years for a multi-family home. Down payment requirements and interest rates for FHA mobile home loans are much lower than traditional manufactured home financing.

When you pay for a garage and installation with money already in the bank, it is called a “cash deal.” Most mobile homes

Bad credit home equity loans guaranteed approval, bad credit auto loans guaranteed approval, bad credit mortgage loans guaranteed approval, bad credit military loans guaranteed approval, bad credit motorcycle loans guaranteed approval, bad credit car loans guaranteed approval, bad credit mobile home loans guaranteed approval, bad credit personal loans canada guaranteed approval, bad credit student loans guaranteed approval, bad credit installment loans guaranteed approval canada, bad credit startup business loans guaranteed approval, personal loans for bad credit guaranteed approval