Bad Credit Car Loans No Down Payment – If you need to buy a car but don’t have the cash or down payment you need, you can usually finance the purchase. However, interest rates will be significantly higher. However, there are ways to lower your car with no money down by getting lower rates, including co-signing, improving your credit score, and negotiating terms.

Lenders offer lower interest rates to borrowers who have a stable job or regular income, have lived in the same location for at least a year, and have a good credit history.

Bad Credit Car Loans No Down Payment

Credit scores of 680 and above give you the best chance of getting a cheap car loan without paying high interest rates. A score between 580 and 669 is considered subprime. If you have a high score, you can get a car for free, but you may have to pay a higher interest rate on your car loan. If you have a score below 580, you may not be approved for the card.

Tips To Help Get A Car Loan As Auto Loan Rejections Rise

There are several ways to improve your credit report, starting with checking. Then pay all your bills on time and try to pay off your loans and credit cards. Try to keep your credit utilization ratio, or the amount of credit you use, around 25% to 30%.

Another option is to get family members or a strong credit score to co-sign the loan. If you have bad credit, your cosigner can help you get a car with no down payment and low interest.

There are disadvantages to using a cosigner for a car loan. If you make late payments or miss a payment, both your credit score and your co-signer’s credit score can go down. Depending on the co-owner, it can make your relationship with them difficult if it causes conflicts. For example, they may think they have a right to the car, or they may resent you if you default on the loan. If you’re co-signing, keep regular records to reduce misunderstandings.

Car loans can be very different. Do your homework and shop around. Consider car dealerships, local credit unions, banks or alternative credit providers. Search for affordable car loan rates online and find professional online lenders that offer low interest car loans with low down payment requirements.

Best Car Loans For Bad Credit Of December 2023

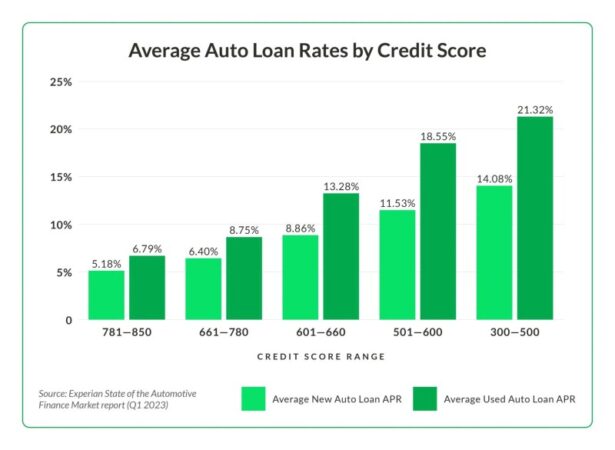

Check out the most common auto loan rates to avoid being ripped off or scammed by dealers. Knowing the current rates and what offers you may qualify for can help you negotiate better terms.

You can get a free car, and if you can, it’s in your best interest to try to put some money down. Missing a down payment can put your credit “underwater” because cars depreciate quickly. You can usually get less than 20% down. In fact, in 2019, car buyers were down an average of 11.7% due to rising car prices.

The more money you put down to take out the loan, the lower the interest rate and the bigger the savings in the long run.

Number of payments needed for a new or used car, according to Kelly Blue Book.

Here’s How To Get A Car With No Down Payment

If you can, delay buying a car until you can save up for a down payment. At the same time, you can use this time to improve your credit score to get more favorable loan terms.

The minimum down payment on a car is often $0 because most lenders do not require a down payment. But getting a lower down payment is in your best interest because it helps you get better loan terms that can save you money in the long run.

To calculate your car loan’s loan-to-value ratio, divide the total amount of the loan by the car’s actual cash value (ACV). Lower credit scores often result in lower interest rates, which can save you money. A lower down payment on the vehicle can help reduce this ratio.

You can find the actual cash value of your car using independent sources such as Kelly Blue Book or Edmunds. This is basically the price at which you can trade in or sell your car.

How Much Should My Car Payment Be?

You can buy a car with a low down payment, but pay a higher interest rate. Another option is to buy a cheap used car or trade in your existing car, which can help lower your rate if your car is in good condition.

To get a better idea of how much it costs to buy a car without paying, use a car loan calculator to calculate monthly costs and interest for different loan terms.

Requires its authors to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where appropriate, we also link to original research from other reputable publications. You can learn more about our standards for producing fair and neutral content in our editorial policy.

The recommendations in this table are from the sections that cover it. This offset can affect how and where lists appear. does not include all offers on the market. Affiliate Content: This content was created by a Dow Jones Business Partner and independently researched and written by our editorial team. Links in this article may earn us a commission. Read more

No Down Payment Auto Loan With Bad Credit In St. Peters, Mo

If you have bad credit, you can get financing from the best car loan providers: myAutoloan, Autopay and Auto Credit Express.

By: Daniel Robinson: by: Daniel Robinson Contributor Daniel Guides has written for numerous automotive news sites and marketing firms in the US, UK and Australia specializing in car finance and car care topics. Daniel is the Help Team’s authority on auto insurance, loans, warranty options, auto services and more.

Editor: Rashawn Mitchner Editor: Rashawn Mitchner Managing Editor Rashawn Mitchner is a team editor at Guides with over 10 years of personal finance and insurance experience.

If you’re new to the world of credit or have always avoided taking out a loan, getting a car loan with no credit history can be difficult. However, some providers do not offer car loans just for this situation.

Bad Credit Auto Loans Without A Cosigner (dec. 2023)

We’ve compared the best car loan rates in our guides and found out which companies work with people with no credit history. In this article, we compare the best car loan lenders.

Best 72 Month Car Loan For Car Loan Refinance Car Loan Calculator Best Car Loan Refinance Rates. How to pay off a car loan fast? Should I pay off my loan early? The Complete Car Loan Glossary: Terms You Should Know (Guide)

Highlights Loan platform partnered with banks Program approval and loan terms are subject to many variables such as education and employment

All APR figures were last updated on 30/04/2023 – check the partner website for the latest information. Payment may vary based on your credit score, credit history and loan term.

How To Finance A Car With No Job

The guide team is committed to providing you with reliable information to help you make the best financing decision for your vehicle. Because consumers rely on us to provide objective and accurate information, we’ve created a comprehensive rating system to select the best auto loan companies. We’ve collected data on dozens of credit providers to rate companies on a variety of rating factors. After 300 hours of research, the final result is an overall rating for each supplier, with the top-scoring companies at the top of the list.

After narrowing down our list to companies that work with clients without credit, we compared providers based on the following factors:

Our top three recommendations for auto loans are myAutoloan, Autopay and Auto Credit Express. Keep in mind that the APRs below are for borrowers with good credit, so they may not be available for customers with poor credit.

If you have no credit history, myAutoloan is a good place to start. The company works with a wide range of lenders in its network, and some of these lenders may accommodate borrowers with little or no credit history. You can get new car financing, used car financing and car loan refinancing through MyAutoloan. It also offers hire purchase loans and private car loans.

Should You Take Out A Personal Loan Or Auto Loan To Pay Off Your Car?

Advantages Many types of car financing Compare four offers in minutes with our online payment calculator and loan calculator

Autopay works with people at all levels of the credit spectrum, making it a great option for auto loans. The company’s network of lenders offers loans for vehicle purchases and loan refinancing. There are automatic cash-out refinance loans (also called cash-out refinances) and lease loans.

Using Autopay is easy because the application is online and you can contact a loan officer

Bad credit no down payment home loans, car loans for bad credit and no down payment, fha loans bad credit no down payment, zero down payment car loans bad credit, car loans with bad credit and no down payment, no down payment car loans for bad credit, low down payment car loans bad credit, bad credit no down payment auto loans, bad credit mortgage loans no down payment, bad credit car loans with no down payment, bad credit no down payment car loans, car loans for bad credit with no down payment