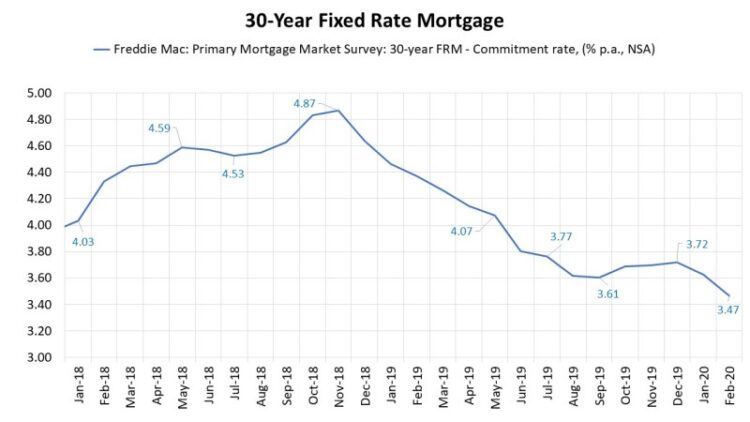

Average Mortgage Rate Over The Last 30 Years – Mortgage rates rose sharply in March after the Central Bank raised interest rates for the first time since 2018 on hopes of easing inflation.

The mortgage rate on a 30-year fixed-rate mortgage—the most common type of mortgage in the U.S.—increased 24 percent in the past four weeks, according to Freddie Mac. Taylor Marr, deputy chief economist at Redfin, said that was the longest four-week increase in mortgage rates in history.

Average Mortgage Rate Over The Last 30 Years

Home buyers now pay an average of 4.67% on a 30-year mortgage – up from just 3.22% in January. The rapid increase in U.S. mortgage rates in recent months has pushed the average monthly payment for U.S. consumers to more than $500, Marr.

Mortgage Rates Over 5+ Decades. Rates Near 6% Would Be Considered Low In 70s, 80s, 90s And 2000s @lenkiefer

With Wall Street predicting that the Federal Reserve will raise interest rates seven times this year — increasing the cost of borrowing for everything from autos to student loans — homebuyers may be in for a rate hike going forward. .

Rising mortgage rates could help slow the U.S. housing market because higher rates will cause some borrowers to lose their credit due to high interest rates.

“We’re hearing from our staff that some of the first-time homebuyers may be feeling the pressure of rising prices and are the first to move down. I think we’ve probably already seen some of the homebuyers being pushed out. “market. That’s the idea,” Marr.

64% of the homeless also said affordability is a barrier to buying a home, according to a Bankrate.com survey released Wednesday.

U.s. Mortgage Rates March 2022 Surge To 4.42%, Highest Since January 2019

However, in the fourth quarter of 2021, Redfin found that a record 80% of homes were purchased by investors who prefer to buy cash and therefore are not concerned about currency depreciation. This means that, even with a quick jump in mortgage rates, housing prices may continue to rise in the short term.

The median home price has fallen over the past few years, from $250,000 when the crisis began to $280,000 this month.

In January alone, home prices rose 19.2% year-over-year, a number that exceeded the annual price increase for US homes in 2008.

One of the main reasons for the rapid increase in housing prices is the low history. A 2021 report by the Chamber of Commerce estimates that the U.S. has between 5.5 million and 6.8 million new homes built in the past 20 years.

What’s Happening In The World Economy: Unforgiving Mortgage Rates

Marr said single-family homes are at their lowest level in decades, and “as of March 27, active listings are down 22% from last year.”

While U.S. builders have been ramping up construction to help meet demand, Marr believes new construction won’t be enough to keep prices low in the near term.

“One in three single-family homes are now new construction, but they’re still building 31 percent less than the long-term average for each home,” Marr said. “So housing starts don’t pose a big problem in terms of supply shortages right now.”

Never miss a story: Follow your favorite articles and authors to get personalized emails and newsletters that matter to you. By Spencer Lee Close Posts About Spencer twitter Spencer_NYC link spencer-lee-journo June 17, 2021, 5:02 am EDT 2 minutes Read

Could 6% To 7% 30 Year Mortgage Rates Be The

, hitting its lowest level since mid-February, but comments from the Federal Reserve Board on Wednesday immediately sent prices higher and could signal that that has changed.

The 30-year yield fell to 2.93% in the week ending June 17, according to Freddie Mac’s primary mortgage market survey, three basis points from 2.96% the previous week. The last time the average was lower was four months ago, then

At the time it expires on February 18. In the same week last year, the 30-year Treasury note was 3.13%.

But Wednesday’s update after the Fed’s committee meeting immediately pushed up Treasury yields and related bond prices.

Today’s Lowest Mortgage Rate? 10 Year Terms At 6.625%

It was created during the financial crisis during the Covid-19 pandemic. The current pace of economic reform has also led the central bank to predict a double interest rate hike in 2023. The government rate is now close to zero.

The announcement comes after Chairman Jerome Powell has said repeatedly over the past several months that the Fed has no plans to raise rates despite signs of economic warming seen in rising inflation and rising US employment, although the number of jobs has grown slowly. compared to what was said.

“More important than any announcement is that whenever a waiver comes, the law will remain in effect. Meeting the requirements for a raise will show that the bond is large enough that it no longer needs to be at a level close to zero,” Powell said.

Wednesday’s increase indicated, according to Zillow economist Matthew Speakman, that “more growth is likely in the coming days.”

Mortgage Interest Rates Remain Low

“The Central Bank’s insistence that the latest rate hikes are temporary and that any change in monetary policy will not be necessary until the economy shows strong growth has kept prices at a standstill for months. And in recent weeks, it looked like it would take change.. instead of this position going to higher levels”, he said.

The average weekly mortgage rate shown in the Freddie Mac survey has remained at 3% or less since mid-April. The highest rate recorded so far in 2021 was 3.18% in the period ending April 1.

“With tight supply, weak demand will continue to weigh on prices, meaning this summer will continue to be a seller’s market,” said Sam Khater, chief economist at Freddie Mac.

Although the 30-year rate fell for the week, the average 15-year fixed rate rose to 2.24% from 2.23%. In the first week of 2020, the rate was 2.58%.

Mortgage Rates Are On The Rise

The average 5-year mortgage rate, or ARM, came in three points lower on the week, falling to 2.52% from 2.55%. Last year, the average 5-year ARM reached 3.09% By Glenn McCullom CloseText About Glenn mailto glenn.mccullom@arizent.com July 23, 2020, 11:36 am. EDT 1 Min Read

According to Freddie Mac, mortgage rates rose for the first time in six weeks, falling back below 3%, as the spread over the 10-year yield widened again.

Sam Khater, chief economist at Freddie Mac, said in a statement: “While demand for housing continues to grow, this month’s slowdown in economic activity has led to a 10-year recession.” “In the short term, this means that demand will continue because of the low cost of credit.”

Between July 16 and July 22, the 10-year yield fell to 0.597% from 0.619%. This means that the spread has increased by five points during that time.

Rising Mortgage Rates Continue To Slow Market Activity

“However, the latest consumer spending data showed a slight increase since mid-June,” Khater said. “The problem is that the economic shutdown will keep unemployment high, which will cause a long-term problem in the labor market.”

The 15-year mortgage rate reached 2.54%, up from last week’s average of 2.48%. Last year at this time, the average 15-year mortgage rate was 3.18%.

The average five-year mortgage rate averaged 3.09% and averaged 0.3 basis points, up slightly from last week’s 3.06%. Last year at this time, the average five-year mortgage rate was 3.47%.

“Investors remain on hold, waiting for more visible signs of economic damage due to increased activity, or signs that the public is struggling to sustain business as usual,” Speakman said in Zillow’s announcement. price tracking on July 22.

Understanding The Rise In Mortgage Rates

“The good news about this second event can disturb the rate from the current sleep and restore it. However, nothing serious happens, this reduction will remain. If the prices remain stable or eventually start to increase for a long time it will be possible. It really depends on the fight against COVID-19.” “Our mission here at Credible Operations, Inc., NMLS Number 1681276, known as “Credible” below, is to provide you with the tools and confidence you need to grow your business. Although we promote products from our lending partners for our services, all opinions are our own.

According to data collected by Credible, home equity loan rates have not changed in any significant period.

These prices were last updated on August 22, 2023. These prices are based on the estimate shown here. Actual prices may vary. Trusted, personal finance marketplace with over 5,000 trusted reviews and an average rating of 4.7 stars (out of a possible 5.0).

What this means: The purchase price for 30-, 20- and 10-year notes was unchanged at 8.125% and 6.275%. Rates on the 15-year term increased by half a percentage point, from 6.375% the previous day to 6.875%. Borrowers looking to increase their interest rates should consider a 10-year term, as 6.625% is the lowest purchase price today. Home buyers who want lower monthly payments should consider a longer term.

Where Might Mortgage Interest Rates Go From Here?

For the best mortgage rates, start with Credible

Average 401k return rate over 30 years, average mortgage rate last 30 years, average mortgage interest rate last 30 years, average 30 years mortgage rate, average mortgage rate last 10 years, mortgage rate over 30 years, mortgage rates over the last 30 years, average mortgage interest rates over the last 30 years, average mortgage rate over last 30 years, average interest rate over last 30 years, average mortgage rate last 20 years, average mortgage rates over the last 30 years