Average Mortgage Interest Rate Last 30 Years – Spencer Lee CloseText About Spencer on twitter Spencer_NYC Join Spencer-lee Magazine on May 20, 2021 at 2:23 pm. EDT 1 Minute Read

It rose for the first time in three weeks after Federal Reserve officials said a change in monetary policy was likely later this year.

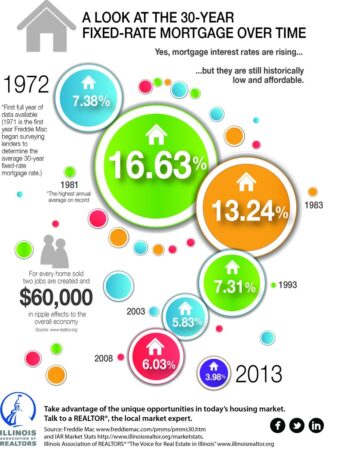

Average Mortgage Interest Rate Last 30 Years

After a 30-year period of settling below 3 percent a month, interest rates reached 3 percent for the week through May 20, said Freddie Mac’s Primary Mortgage Market Survey. This figure is up from 2.94 percent last week, but still lower than 3.24 percent a year ago.

What’s Happening In The World Economy: Unforgiving Mortgage Rates

Every time there is a financial crisis, the Federal Reserve intends to lower interest rates until the US economy recovers. At its April meeting, the Fed’s Open Market Committee reiterated this point by voting unanimously to keep short-term interest rates near zero and continue its bond-buying program.

However, some officials at the meeting said that they could be close to reforming the state’s loan purchase system.

“As the economy continues to slow, Fed rates over the next few days will provide important information about the central bank’s stance and likely will not change interest rates,” he said.

Reduce the speed of acquisition. According to data from the Lenders Association, the mortgage lending ratio reached 63.3 percent last week, the highest since March.

Interest Rates Remain At Historic Lows… But For How Long?

Despite the good weather, there is still a shortage of houses for sale. The housing shortage is exacerbated by a lack of jobs and expensive building materials, making it difficult for homebuyers to find affordable housing,” said Sam Hatter, Freddie Mac’s chief financial officer.

Also, the yield on the 15-year fixed mortgage was the highest for the week, reaching 2.29% compared to 2.26% last week. A year ago the rate was 2.7%.

The average 5-year standard mortgage rate was unchanged at 2.59% for the week, compared to 3.17% for the same period last year. Mortgage rates rose after the Federal Reserve in March. It raised interest rates for the first time since 2018 in hopes of taming inflation.

The 30-year fixed-rate mortgage is the most popular type of mortgage in the U.S., rising a staggering 24% in the past four weeks, according to Freddie Mac. That’s the fastest four-week increase in earnings, said Taylor Marr, deputy chief economist at Redfin.

Year Mortgage Rates Dip

Homebuyers are now paying an average of 4.67% on a 30-year fixed rate — up from just 3.22% in January. Marr said the rapid increase in US home prices in the past few months has resulted in a $500 increase in the average monthly salary for an American home buyer.

Wall Street estimates that the Federal Reserve will raise interest rates seven times this year – raising the cost of borrowing for everything from cars to student loans – giving homebuyers a chance to raise interest rates in the future.

Rising mortgage rates may help cool the hot US housing market, as higher interest rates cause some borrowers to lose interest on their bank loans.

“We’re hearing from our agents that inflation may affect first-time home buyers more than first-time buyers. I think we may have already seen some buyers selling. Now in the market,” said Mar.

Mortgage Rates Jump Above 6% For First Time Since 2008

According to a Bankrate.com survey released Wednesday, nearly 64 percent of homeowners also say housing affordability is holding them back from buying a home.

However, in the fourth quarter of 2021, Redfin found that 80% of homes were purchased by investors, who are mostly cash buyers so interest rates are not affected. This means that despite rising housing prices, housing prices will continue to rise in the near future.

The median home price has fallen over the past few years, rising from $215,000 at the beginning of the epidemic to $280,000 this month.

In January alone, home prices rose 19.2 percent annually, more than double the rate seen in the year before the US housing bubble burst in 2008.

Mortgage Rates In Madison Wi: Mortgage Rate Trends Mar 2019

One of the main reasons behind the rapid increase in housing prices is the low cost of living. According to the American Association of Realtors’ 2021 report, the United States has seen a decline in housing construction over the past 20 years, from 5.5 million to 6.8 million.

Single-family homes are about where they’ve been for years, Mr. Marr said, adding that “as of March 27, listings are down 22 percent for the year.”

Although American home builders have recently increased construction to support demand, Mr. Marr believes that new construction will not create supply at affordable prices in the short term.

“One in three single-family homes are now being built, but they’re still being built at about 31 percent less than the average,” Marr said. “So because of the lack of supply now, starting houses will not be a big problem.”

Mortgage Rates Make Biggest Jump In Over 20 Years

Don’t miss a story: Follow your favorite topics and authors and get a personalized email with the journalism that’s most relevant to you. EDT 2 Minute Reading

It was the lowest since mid-February, but Wednesday’s Fed meeting raised rates immediately and may signal a reversal in the trend.

The 30-year average fell to 2.93 percent in the week ended June 17, down three points from 2.96 percent the previous week, according to a Freddie Mac prime mortgage market research report. The last average was four months ago, when

Last time on February 18th, this week, the 30-year fixed mortgage rate was 3.13%.

Mortgage Rate Predictions For 2022: How High Will Rates Go?

But the move after Wednesday’s Fed meeting sent Treasury yields and related home prices down.

It was created during the crisis to support the economy during the Covid-19 crisis. Recent economic activity has led the central bank to forecast a rate hike in 2023. Federal interest rates are now close to zero.

The announcement came after President Jerome Powell has repeatedly said for months that the Federal Reserve has no plans to raise interest rates despite signs of economic warming from rising inflation and many working Americans.

“What is more important than any hypothesis is that every time it is released, the system is very effective,” Powell said. “When you get to the point where you can lift it, it shows that the recovery is strong and doesn’t want to push prices closer to zero.”

Us 30 Year Mortgage Rate Hits Highest Since 2008, Mba Says

According to Zillow economist Matthew Spykman, Wednesday’s increase is a sign that “it will increase over the next few days.”

“The Federal Reserve stressed that the inflation figures are temporary and there is no need to make any changes in monetary policy until the economy has grown significantly and lowered interest rates for several months. In the past few weeks the past, it seems that it definitely needs to be adjusted. Interest rates will increase again,” he said.

The average weekly interest rate surveyed by Freddie Mac has been below 3% since mid-April. The average rate recorded so far in 2021 is 3.18% in the period up to April 1.

“With tight inventory, the lack of demand has not affected prices, which means the housing market will continue to be strong this summer,” said Freddie Mac Chief Economist Sam Hatter.

Mortgage Rates Hit 7.5% For The First Time Since 2000 As House Sales Tumble To Multi Decade Low

While the 30-year yield fell this week, the fixed 15-year yield fell to 2.24% from 2.23%. in 2020 they changed to +2.58%.

The average rate for a 5-year standard mortgage, or ARM, fell to a three-week low, falling to 2.52 percent from 2.55 percent. A year ago, the average 5-year ARM was 3.09% We monitor all approved products and services. We may receive compensation if you click on links we provide. details.

The 30-year mortgage rate fell slightly on Tuesday, continuing a downward trend that sent mortgage rates down to a record 22-year low earlier this month. Averages for other fixed-income securities also fell on Tuesday, with several other averages holding steady.

The average for the last 30 years is 7.77%. Because rates vary from lender to lender, no matter what type of loan you’re looking for, it’s a good idea to shop around for rates and compare interest rates.

The Main Reason Mortgage Rates Are So High

The lowest score in the world from the world’s top 200 lenders, a loan-to-value (LTV) ratio of 80%, an applicant FICO score of 700-760, and no credit facilities.

The new 30-year mortgage rate fell five basis points to 7.77 percent on Tuesday.

Average 30 years mortgage rate, average 30 year fixed mortgage interest rate, national average interest rate 30 year mortgage, average mortgage rate over last 30 years, average mortgage interest rate 30 year, 30 years mortgage interest rate, today mortgage interest rate 30 years fixed, average mortgage rate last 30 years, average savings interest rate for last 30 years, average mortgage rate over the last 30 years, average interest rate on 30 year mortgage, current average 30 year mortgage interest rate