Average Interest Rate On Savings Account For Last 20 Years – Saving money can be difficult. It helps to have a little incentive like a higher interest rate to increase your savings. Fortunately, many banks and credit unions offer this.

The average interest rate on a savings account has been steadily increasing over the past few years. Here’s a closer look at the average savings account interest rate today and why banks are changing rates.

Average Interest Rate On Savings Account For Last 20 Years

Prices are still rising this year. So far in 2023, the average savings account rate across all financial institutions is 0.46%, according to the FDIC.

Deposit Betas: Up, Up, And Away?

That means if you put $10,000 into a savings account, you’ll have an extra $46 a year later.

Although it may not seem like much, it’s important to remember that savings accounts pay much more now than they did in years past. For example, at this time last year, the average savings account rate was just 0.24%. However, many banks offer higher rates than the national average. Some of the best rates can be found in high-yield savings accounts, which currently offer 5% APY and higher.

Banks set deposit rates, including savings accounts, based on a combination of market rates and competitive performance, according to Ben Swinney, senior vice president and treasurer of Security Bank of Texas. For example, he said, the main market rate that affects the rates banks pay on deposits is the federal funds rate. “The federal funds rate is the interest rate at which depository institutions like banks and credit unions lend reserve balances to each other overnight,” Swinney said. He further said that the rate will be set by the Federal Open Market Committee (FOMC), USA. The Federal Reserve meets eight times a year.

“Determining deposit account rates is a combination of art and science,” said Gene Grant II, CEO and founder of Levelfield Financial Services. He explained that in a rising interest rate environment, a bank typically does not raise savings account rates in proportion to the Fed’s rate hikes. “That’s because the bank knows that deposits are typically ‘sticky’ and that only a small percentage of customers switch banks for deposits,” Grant said. “The bank calculates to estimate the increase in the volume of deposits, which will bring the least cost to the bank for an acceptable amount of outflow of deposits.”

How Interest Works On Savings Accounts

Individual banks may choose to raise or lower their savings account rates depending on the amount of deposits required to fund their loan portfolio. When banks demand more deposits, they may raise interest rates to attract more customers. “A bank that grows and lends more will tend to raise deposit rates so they can afford to lend, while banks that shrink their balance sheets will pay lower rates,” Grant said.

When setting savings account rates, banks also consider the spread between interest paid on deposits and interest earned on loans. To maintain profitability, they must strike a balance between offering competitive rates to attract deposits and keeping lending rates high enough to generate profits. So, sometimes banks may adjust their savings account rates to improve their profit margins.

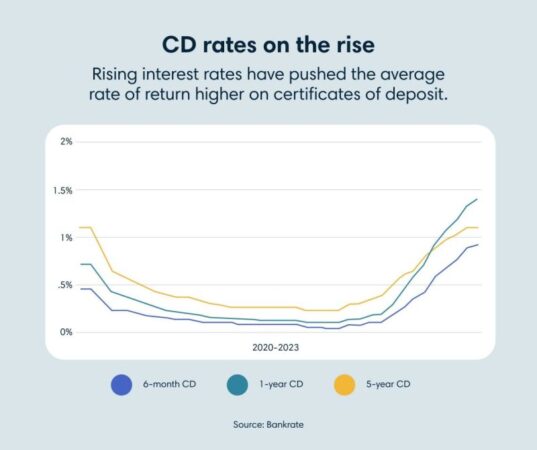

Savings account rates have been relatively flat over the past decade. After the financial crisis and Great Recession of 2007-2008, the Fed lowered the federal funds rate to 0% to make borrowing more attractive and stimulate economic activity.

Rates were at their lowest between 2013 and 2017, when the average savings account rate was 0.6%. Rates began to rise in 2018 as the economy, disrupted by the Covid-19 pandemic and a sharp (but short) recession, continued to improve. By 2021, the average savings account rate will drop to 0.05%.

Move Over, Apple, Step Launches 5% Savings Account

That changed in March 2022, when the Fed began raising rates in response to rising inflation—a side effect of the Fed’s actions. Since then, the Fed has raised rates 11 times and has signaled that it may do so again. As a result, savings account rates have risen sharply. Today, the average savings account rate is 0.46%.

It is important to understand that a savings account is best used for emergency funds and short-term storage purposes. Earning more interest can help your savings grow faster, and choosing high-yield accounts at institutions insured by the FDIC or NCUA ensures your money is safe.

That said, your savings account should be part of a good financial plan. In addition to other safe harbor investments like CDs and Treasury bills, you should invest your money in high-risk (and high-reward) market investments like stocks, bonds, and mutual funds to grow your wealth and achieve long-term growth. savings goals such as retirement.

Editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties. Have you ever heard the expression “cash is king”? We know it’s important to save money for the rainy season (usually at least 3-6 months), but where is the best place to save that money and still make a good profit?

Bask Bank Review 2023

Savings accounts aren’t just a safe place to store your hard-earned money, in fact, as our population becomes more financially savvy, savings accounts offer higher interest rates, are much lower risk, and provide a way to grow your money. .

That’s why I think a person should work hard to connect with them before looking elsewhere to invest their money.

Check out our guide to the best high interest savings accounts for the self-employed, especially if you’re struggling to meet the salary criteria for high interest rates!

If your savings account offered an interest rate of 5% per annum, would you rush to buy a 4% MCF?

Calculate Minimum Average Daily Balance (madb)

The Treasury bill is due in early 2023 as interest rates rise. I have a friend who was under a lot of stress with an application for MKV that offered around 3-4%. Most importantly, if he actually kept the money in his UOB One account, he would have earned a higher interest rate!

When it comes to your money, it’s important to do a thorough analysis before making important financial decisions, rather than rushing based on trends.

This table assumes that the Effective Interest Rate (EIR) is calculated on the maximum deposit amount and that all other conditions are met for the account to reach the maximum level. Your individual circumstances will be different, so it is recommended that you create an EIR for yourself based on your financial situation.

While having the highest EIR is often a strong factor in deciding which savings account to choose, factors such as the ability to deposit wages into a bank account, any investment/insurance requirements, and the total savings amount should also be considered. This will ultimately affect the final percentage you earn.

Interest Rate Chasing In Your Savings Account

The Chinese have a saying “钱生钱”, which translates to “money creates more money”. We all want to maximize the interest rates on our savings accounts so that we can continue to add to our wealth in a safe and low-risk environment.

Beware of banks’ marketing language. Most of them use words like “up to 7.5% interest” to get your attention, but usually this means a fraction of the entire deposit.

What you need to look at is the effective interest rate (EIR) you are paying on your principal.

:max_bytes(150000):strip_icc()/GettyImages-1357931426-15c90488fc89450aa5ac2bf6d48d23ae.jpg?strip=all)

If you have $90,000 and you meet all the criteria for the maximum level, that doesn’t mean you’ll earn 7.80% interest on $90,000. Instead, it applies to each blog of interest.

Go The Extra Mile With Regular Saving Accounts

Interest earned = [$30,000 x 3.85%] + [$30,000 x 3.90%] + [$15,000 x 4.85%] + [$15,000 x 7.80%] = $4,222.50

In the UOB example above, you can see that the interest rates vary depending on the total deposit amount.

To determine which bracket you fall into, look for accounts with different levels of total deposits and calculate the corresponding EIR for comparison.

Most savings accounts have qualifying activities that must be completed in order to receive higher interest rates. These can be:

Why Is The Wealthfront Cash Account Apy So High?

You may be sold a high interest rate on a particular savings account, but if you don’t meet the salary requirements, the effective interest rate may drop dramatically.

All investments involve risk, and even a relatively “stable” index like the S&P 500, with its average annual return of 8-10%, is not out of stock and falling. Averaging 8% over the year does not mean you are guaranteed to get that amount, in fact there may be years when the market goes down and returns can be negative.

In contrast, savings account interest is almost guaranteed (short of the Singapore banking crisis).

Average savings interest rate last 10 years, average interest rate last 20 years, average savings account interest rate last 10 years, average interest rate high yield savings account, interest rate for savings account, savings account interest rate, average interest rate for online savings account, interest rate on savings account, average interest rate of savings account, average bank interest rate over last 20 years, average savings interest rate for last 30 years, average savings account interest rate