Average Interest Rate On 30 Year Mortgage – We independently evaluate all recommended products and services. If you click on the links we provide, we may receive compensation. Learn more.

Rates on 30-year mortgages fell on Tuesday, leaving rates roughly flat from levels a week ago. But the headline average is more than an eighth of a percentage point lower than the 22-year peak it hit last Thursday. Meanwhile, rates for other types of loans were mixed.

Average Interest Rate On 30 Year Mortgage

The most recent 30-year fixed rate average is 7.70%. Because rates vary widely between lenders, it’s always smart to shop around for your best mortgage option and regularly compare rates, regardless of the type of loan you’re in the market for.

Mortgage Interest Rates Have Begun To Level Off

The national average for the lowest rates offered by more than 200 of the nation’s leading lenders, with a loan-to-value (LTV) ratio of 80%, an applicant with a FICO credit score of 700-760 and no mortgage score.

New 30-year mortgage rates fell 7 basis points Tuesday, bringing the average to 7.70%. That’s close to the reading since last Tuesday and is 14 basis points cheaper than last week’s record high. Rising to 7.84%, Thursday’s 30-year average was the highest level recorded since 2001.

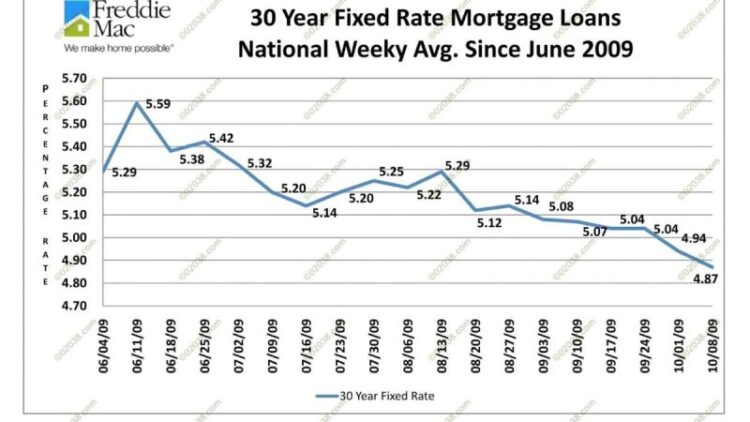

When Freddie Mac released its weekly mortgage averages on Aug. 24, it found that 30-year yields had hit a 22-year high. Freddie Mac’s average that week was 7.23%, the highest target since June 2001. The average has since fallen to 7.12%.

Average that combines rates from the previous five days and may include low-cost loans for discount points. On the contrary, the average shows

Year Mortgage Rates Dip

Yields on 15-year bonds moved in the opposite direction on Tuesday, but only gained one basis point. Down at 7.15%, the current average is just shy of August’s 21-year peak of 7.17%.

Once again, the 30-year moving average was flat on Tuesday, rising for the fifth day in a row to 6.90%. Daily jumbo averages are not available prior to 2009, but it is reasonable to assume that August’s 30-year high of 7.02% was also the most expensive level reached in at least 20 years.

A handful of new buying averages rose Tuesday, including significant gains for FHA 15-year, 15-year and jumbo 5/6 ARM mortgages, with only a small increase in non-jumbo 5/6 ARMI.

Although half of Tuesday’s refinancing average was flat or nearly flat, the 30-year refinancing average fell a remarkable 15 basis points. This narrowed the gap between the 30-year new purchase rates and refinancing rates to 34 basis points versus 42 basis points on Monday. .

Mortgage Rate News

The 15-year and 30-year averages were flat on Tuesday, while the biggest gains were seen for 15-year loans and jumbo 5/6 ARMs, each rising about an eighth of a percentage point.

The prices you see here are generally not directly comparable to the prices of the ads you see advertised online, as these prices have been chosen as the most attractive, while these prices are average. Bullying fees can involve prepaying points, or they can be chosen based on a hypothetical loan with an unusually high credit score or taking out a smaller loan than usual. The mortgage rate you ultimately secure will be based on factors such as your credit score, income and more, so it could be higher or lower than the average you see here.

The lowest mortgage rates available vary depending on the state where the originators are located. Mortgage interest rates can be affected by state variations in credit scores, average mortgage loan type and size, in addition to the different risk management strategies of individual lenders.

Mortgage interest rates are determined by a complex interplay of macroeconomic and industry factors, such as the level and direction of the bond market, including 10-year Treasury yields; the Federal Reserve’s current monetary policy, particularly with respect to government-backed mortgage financing; and competition between mortgage institutions and loan types. Because fluctuations can be caused by any number of these at the same time, it is generally difficult to attribute the change to a single factor.

Average Long Term Mortgage Rates Fall; 30 Year Loan At 5.1%

Macroeconomic factors will keep the mortgage market relatively subdued for most of 2021. In particular, the Federal Reserve had been buying billions of dollars in bonds in response to economic pressures from the pandemic. This bond buying policy is a major influence on mortgage rates.

But starting in November 2021, the Fed began tapering its bond purchases, making significant reductions each month until it reached net zero in March 2022.

The Federal Funds rate, which is set every six to eight weeks by the Fed’s interest rate and policy committee – the Federal Open Market Committee (FOMC) – can also affect mortgage rates. However, it does not directly drive mortgage interest rates, and in fact the rate on hedge funds and mortgage interest rates can move in opposite directions.

At its last meeting, which ended July 26, the Fed raised interest rates by a widely expected 25 basis points, lifting the Fed Funds rate to a range of 5.25% to 5.50%. Fed Chairman Jerome Powell said that because inflation is still above the Fed’s 2% target, the policy committee could raise rates again or cut them when it meets on Sept. 20, depending on economic conditions.

Average Mortgage Interest Rates: Mortgage Rates By Credit Score, Year, And Loan Type

The national averages cited above were calculated based on the lowest rate offered by more than 200 of the nation’s leading lenders, assuming a loan-to-value (LTV) ratio of 80% and an applicant with a FICO credit score of 700- 760 verses. . The resulting rates are representative of what customers should expect to see when they receive actual offers from lenders based on their ratings, which may differ from advertised rates.

For our best state rate cards, the lowest rate currently offered by a researched lender in that state is listed, assuming the same parameters are an 80% LTV and a credit score between 700-760.

Requires authors to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also refer to original research from other reputable publishers where necessary. You can learn more about the standards we follow to produce accurate and unbiased content in our Editorial Policy. Mortgage rates rose at a record pace in March after the Federal Reserve raised its benchmark interest rate for the first time since 2018 in hopes of cooling rising inflation.

The average interest rate on a 30-year mortgage – the most common type of mortgage in the US – has risen 24% in just the past four weeks, Freddie Mac data show. That’s the fastest four-week rise in mortgage rates on record, said Redfin economist Taylor Marr.

Average 30 Year Mortgage Interest Rate Rises Almost A Full Percentage Point In A Year

Homebuyers are now paying an average of 4.67% on their 30-year fixed rate mortgage – up from just 3.22% in January. The rapid rise in U.S. mortgage rates in recent months has pushed up the typical monthly payment for a U.S. homebuyer by more than $500, Marr said.

And with Wall Street predicting the Federal Reserve will raise interest rates up to seven times this year — raising the cost of borrowing for everything from cars to student loans — homebuyers will see more increases in mortgage rates going forward.

A rise in the cost of home loans could help cool the U.S. housing market as higher interest rates cause some lenders to lose their eligibility for mortgages due to tighter bank debt-to-income requirements.

“We’ve heard from our agents in the area that some of the first home buyers may be more sensitive to the increase in rates and are some of the first to remove. I definitely think we’ve already seen some buyers who have a price out.” of the market at this point,” Marr said.

Us 30 Year Mortgage Rate Tumbles By Most In More Than A Year

A full 64% of homeowners also said affordability is already a factor holding them back from buying a home, according to a Bankrate.com survey released Wednesday.

But in the fourth quarter of 2021, Redfin found that a record 80% of homes are being purchased by investors, who are typically cash buyers and therefore less sensitive to rising interest rates. This means that even with the recent rise in mortgage rates, home prices are likely to continue to rise in the short term.

Median home prices have fallen in recent years, rising from about $215,000 at the start of the pandemic to more than $280,000 this month.

In January alone, home prices rose 19.2% year over year, a figure that dwarfs any annual price increase prior to the 2008 US housing bubble.

Mortgage Loan Applications Fall Sharply

One of the main reasons for the rapid increase in house prices is the historically low inventory. According to a 2021 report by the National Association of Realtors, the United States has between 5.5 million and 6.8 million homes that have not been built in the last two decades.

Marr said single-family home inventory is near the lowest level in decades and “as of March 27, active listings are down 22% year over year.”

While U.S. homebuilders have ramped up construction recently to help keep up with demand, Marr believes new construction won’t be able to push inventory enough to lower prices in the near term.

“One in three single-family homes are now new construction, but they are still built about 31% below their long-term average per family,” Marr said. “So housing starts are not that great, even relative to the lack of inventory.”

How Interest Rates Can Impact Your Monthly Housing Payments

Never miss a story: Follow your favorite topics and authors to get one

Today's 30 year mortgage interest rate, current average 30 year mortgage interest rate, average mortgage interest rate 30 year, average interest rate for 30 year mortgage, average interest rate on mortgage, lowest interest rate on 30 year mortgage, average 30 year fixed mortgage interest rate, national average interest rate 30 year mortgage, average interest rate on a 30 year fixed mortgage, 30 year mortgage interest rate, current interest rate on 30 year mortgage, average annual interest rate 30 year mortgage