Average Interest Rate For Small Business Loan – It is important to consider the cost of financing your business through loans. That said, it can be difficult to find and compare the various costs and fees associated with all the loans available to your MSP. Here we summarize information available from major banks and alternative lenders (P2P / Crowdfunding platforms) to detail the difference between the costs associated with business loans in Singapore.

The average interest rate for a business loan can range from 4% to 20%, depending on the term and nature of the loan. Long-term and specific loans carry lower interest rates than short-term and general business loans because they offer long-term returns and low risk. Fees associated with business loans range from 1 to 5% of the total amount of the loan.

Average Interest Rate For Small Business Loan

Banks are the largest source of business loans. They also have extensive experience in lending to small businesses. Banks generally offer business loans with longer repayment terms, lower interest rates and lower fees. However, they also have slower payouts, lower maximum loan amounts and stricter eligibility requirements than alternative lenders. Business loans from banks are ideal for established SMEs that meet eligibility requirements and want to avoid fees and high interest payments.

Small Business Accounting 101: 12 Steps For Basics And Setup (2023)

On average, banks charge around 4-10% interest on business loans. They are cheaper than other loans because banks are selective in the application process. They often require businesses to have a minimum operating history of 2-3 years and minimum revenues of S$500,000-S$1 million. Banks therefore lend to the most financially sound and least risky SMEs and can therefore offer the lowest interest rates. Compared to banks, P2P / Crowdfunding usually charges higher interest rates (9-20%) because they do not lend exclusively to experienced and financially sound companies. SMEs that qualify for bank financing can save money on interest rates by using a business loan from a bank compared to a P2P/crowdfunding platform.

For business loans, banks usually charge an application fee and, in some cases, an early repayment fee. The application fee is usually S$500-S$1,000 or 1-2% of the approved loan amount. The fees tend to be slightly lower than P2P / Crowdfunding platforms (2-5%), although the ranges do not vary significantly, so it is important to compare on a case-by-case basis.

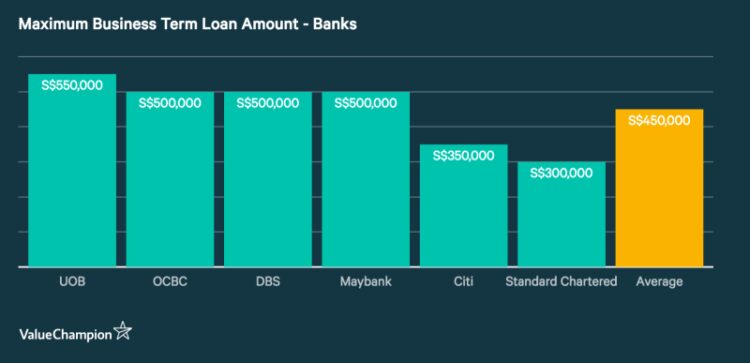

Banks offer business loans ranging from S$300,000 to S$550,000 for 3-5 years. These loans have fixed repayment schedules and therefore offer less flexibility and customization than P2P/crowdfunding loans. SMEs that need more than S$550,000 should consider applying for a P2P/Crowdfunding business loan.

P2P / Crowdfunding allows SMEs to access funding raised by a group of individual investors. This process bypasses bank eligibility requirements and provides access to financing to SMEs that may not otherwise qualify for a bank loan. These loans also tend to pay out much faster than banks (some in 1 to 3 business days). When considering the best source of finance, P2P/Crowdfunding business loans are a great choice for SMEs that need large and customizable loans or don’t qualify for bank loans.

Pandemic Small Business Loans

P2P/Crowdfunding platforms charge higher interest rates (9-20%) than banks (4-10%). Because P2P/Crowdfunding platforms have lower eligibility criteria, they increase risk and charge higher interest rates. For SMEs that do not qualify for bank loans, high interest rates can be an unfortunate reality of financing their company through P2P/crowdfunding business loans.

P2P / Crowdfunding platforms charge a success fee, which is important to consider when applying for funding. These platforms typically charge a success fee of 2-5% of the loan amount. Some platforms also charge application or early repayment fees. These fees are better than bank loan fees, but they are not very different and should be considered on a case-by-case basis.

P2P / Crowdfunding platforms offer maximum loan amounts for a fixed period compared to banks. MoolahSense offers loans over $5 million. However, these platforms usually offer a lower maximum loan duration (1-3 years) than banks (3-5 years). Small and medium-sized businesses that require significant amounts of credit and expect to repay the large loans in 1-3 years may be eligible for a bulk loan.

Stephen Lee is a senior research analyst specializing in insurance. He holds a BA in International Studies from the University of Washington and practices risk management and underwriting professional liability and specialty insurance at Victor Insurance. In addition, Stephen is a former Peace Corps Volunteer in Myanmar (serving 2018-2020) where he continues to provide business development consulting services to staffing companies in Asia Pacific.

The Impact Of Covid 19 On Small Business Outcomes And Expectations

Advertiser Disclosure: An Independent Source of Information and Tools for Consumers. Our site may not contain all companies and financial products available on the market. However, the guides and tools we create are based on objective and independent analysis, so they can help anyone make financial decisions with confidence. Some of the offers on this site are from compensation companies. This disclaimer may affect how and where offers are displayed on the Site (including, for example, the order in which they are displayed). However, this does not affect our recommendations or advice, which are based on thousands of hours of research. We cannot pay our partners for favorable reviews of their products or services

We strive to have the most up-to-date information on our site, but customers should contact the relevant financial institution if they have any questions, including eligibility to purchase financial products. It shall not be construed as engaging in the distribution or sale of any financial product or as assuming any risk or liability in connection with any financial product. This site does not review or include all available companies or products. A business loan term refers to a fixed period of time during which the borrower must repay the loan amount, including all interest and fees. The duration of the loan is agreed between the lender and the borrower at the time of loan approval and is one of the key factors in determining the total cost of the loan.

1. Loan terms: Business loan terms can vary from a few months to several years depending on the type of loan and the lender’s requirements. Short-term loans usually have a repayment period of 6-18 months, medium-term loans can be extended up to 5 years. On the other hand, long-term loans can have a repayment period of 10 years or more.

2. Interest rate: The duration of the loan has a direct impact on the interest rate offered by the lender. In general, longer loan terms are associated with higher interest rates because lenders take more risk by extending the repayment period. Shorter loan terms, on the other hand, often come with lower interest rates but require higher monthly payments.

Simple Interest Vs. Compound Interest

3. Monthly payments: The duration of the loan determines the amount of the borrower’s monthly payments. Since the loan amount is spread over a longer period of time, a longer repayment period can lead to lower monthly payments. But it also means paying more in interest over the life of the loan. Conversely, shorter credit terms require higher monthly payments but lower total interest costs.

4. Flexibility: The duration of the loan also affects the flexibility of the borrower. Short-term loans offer quick access to cash and allow businesses to address urgent needs such as inventory purchases or cash flow gaps. On the other hand, longer credit terms give businesses more flexibility and allow for greater investment or expansion over time.

5. Repayment options: Depending on the balloon and loan terms, borrowers may have the option to repay the loan in equal monthly installments or with a balloon payment at the end of the term. Balloon payments are beneficial for businesses that expect large cash flows at the end of the period from seasonal increases in sales or planned investments.

6. Early repayment: Some lenders may allow borrowers to repay the loan early without any penalty. This is beneficial for businesses that have an increase in cash flow or want to save on interest costs by paying off loans earlier than planned. However, it is important to review your loan agreement to understand any early repayment fees or restrictions.

Discount Rate Defined: How It’s Used By The Fed And In Cash Flow Analysis

In conclusion, the duration of a business loan is a critical aspect of lending that affects the total cost of the loan, monthly payments and flexibility for businesses. It is important that borrowers carefully consider their needs and financial situation when choosing a loan term and read the terms of any loan agreement before proceeding.

The term of a business loan refers to the time the borrower has to repay the loan. It plays a vital role in determining the amount of the payment. Here are some key points

Average bank loan interest rate for small business, average loan interest rate, average interest rate on small business loan, average va loan interest rate, average personal loan interest rate, average business loan interest rate, average auto loan interest rate, average small loan interest rate, average student loan interest rate, average sba loan interest rate, average boat loan interest rate, average home loan interest rate