Average Interest Rate For First Time Home Buyers – Since 2003, Dan Green has been a leading mortgage lender and respected authority in the industry. Her unwavering commitment to educating and educating first-time homebuyers has established her as a trusted voice among peers, colleagues and the media. Dan was founded to make the American dream of home ownership come true for all who want it. Learn more about Dan Green.

We strive to help make your dream of owning a home come true. We follow editorial guidelines of truth and transparency and may feature third-party recommendations. Read about how we make money.

Average Interest Rate For First Time Home Buyers

Your trusted guide to home ownership. Since 2003, our team has provided knowledge and fact-based advice to millions of American homebuyers. Our content remains authentic. This means that it is fact-based, impartial and free from external influences. Find out more about our editorial guidelines.

Trends In Residential Real Estate Lending Standards And Implications For Financial Stability

It is a publishing house affiliated with a mortgage company. We may receive compensation when you click on certain links on our website or apply for a mortgage loan with a partner or partners listed in our comparison tables. Our partners reward us in different ways, so we draw the tables to avoid reader manipulation. We may also receive compensation for advertising displayed on the Site. The limitations of our software, whether we provide mortgage loans in your area and lending factors may affect the offers and comparison tables found on various parts of this website. We do not include offers on every mortgage product available. I hope this will happen someday.

Your trust is important to us. This article has been checked for accuracy as of November 7, 2023. We ensure that all the information we share meets the latest mortgage standards. More information about our commitment to readers can be found in our Editorial Guidelines.

It was created with the mission of making homeownership more accessible and inclusive for all Americans. We’re committed to strengthening our communities with a simpler, faster and better home buying experience.

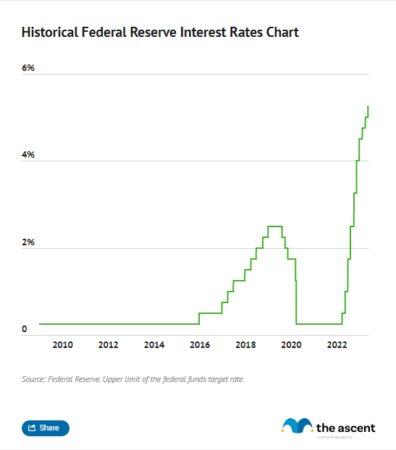

Mortgage rates, home prices, and the housing market as a whole are always changing. Financial factors, such as the Federal Reserve, influence mortgage rates. Sometimes it may be external factors, such as a global pandemic. If you’re a first-time home buyer, it can take a long time to get all the information you need and feel ready to start the home buying process.

Mortgage Rates Chart

These mortgage facts and home buyer statistics will help you learn more about buying a home and avoid mistakes when making your first purchase.

There are different types of mortgage loans available to home buyers, depending on the type of loan they are interested in, the size of the property, finances and location. A mortgage is a large loan that involves large sums of money, so there is a lot to know.

“From January 1992 through December 2020, the average difference between the interest rate on a 30-year fixed-rate mortgage and the interest rate on a 15-year fixed-rate mortgage was 0.546 percentage points.” (Freddie Mac, 2021)

“Over the last 25 years, mortgage rates have halved, but house prices have tripled. Homeowners pay less per month to stay in the home, but pay more for the down payment. The good news is that you can make a small payment up front. “The typical first home buyer makes a 7% down payment.”

Cost Of Living: New Average Mortgage Rates Fall Below 6%

*Estimated monthly mortgage payment is based on average new home sales price data from the U.S. Census Bureau.

Buying your first home is an exciting milestone in life that offers new experiences, opportunities and lessons. Check out these home buying facts to better understand what to expect from the home buying process.

“When you buy a home for the first time, you always feel like the seller is in control because they are less emotional. They know that if you don’t buy the house, someone else will.”

With the right education, careful planning, and a home buying team, anyone can become a homeowner. Homebuyers choose home ownership for many reasons, including financial investment and security, comfort and privacy, and the flexibility of owning a property.

Rate Rises Hits Some Aussie Mortgage Holders Harder Than Others

“The biggest motivators for first-time buyers are the 5Ds: diamonds, diapers, certificates, dogs and the daily grind. “Renters want to own their own home after they get married, have a baby, graduate from college, get a pet or start a new job.”

Conventional mortgages are the most common and typically require a credit score of at least 620. Of course, the minimum credit score varies depending on the lender and type of mortgage.

Many lenders offer FHA and VA loans to buyers with a credit score of 580 or higher. Although technically there are no credit score requirements for FHA loans, most lenders want a score of 580 or higher to approve a loan.

The simple answer is to save as much as possible and contribute to your savings with a down payment. The exact mortgage loan amount depends on the mortgage loan and the lender’s approval requirements.

The Great Mortgage Rates Debate: Are Rates Set To Spike Or Fall?

USDA and VA loans do not require a down payment, but lenders may have approval requirements. You can also save for a larger down payment to lower your interest rate. Otherwise, you can secure a loan of 3-5% down payment and get down payment assistance.

You should also consider closing costs, relocation costs, and other purchasing costs that may arise after you purchase your home. It’s also a good idea to save extra money for emergencies or home repairs and maintenance.

Your choice of mortgage will depend on your location, type of home, financial situation and history. Common loan types and requirements include:

Similar to mortgage insurance, each mortgage and lender has different approval requirements. Talk to your lender to determine which mortgage loan is best for you.

Average 15 And 30 Year Fixed Rate Mortgages

There are five types of mortgages available to Americans, with conventional mortgages being the most popular. There is no exact number of mortgage loans in the United States, but 64% of Americans are homeowners and the total amount of mortgage loans is $10.4 trillion.

Buying a home is an exciting adventure that can benefit your financial and emotional well-being. You will also need additional education about the home buying process and the current real estate industry. Before you start looking for a home, read the mortgage terms and get pre-approved.

Become a better buyer. Sign up today and never miss out on exclusive information, new market trends and events for first-time buyers.

© 2021-2023 All rights reserved. Growella Inc d/b/a. Powered by Novus Home Mortgage (NMLS 423065), a division of Exonia Bank. www.nmlsconsumeraccess.org is located at 230 Findlay Street, Cincinnati, Ohio 45202. Novus Home Mortgage, a division of Exonia Bank, is located at 20225 Water Tower Blvd. , Suite 400, Brookfield, WI 53045. We are not affiliated with the U.S. Department of Housing and Urban Development, the U.S. Department of Veterans Affairs, the U.S. Department of Agriculture, or any other government agency. This information has not been reviewed by any U.S. government agency and this site is not affiliated with any government agency. Equal home lenders. Applicants are subject to credit and underwriting approval. Not all applicants will be approved for funding. Submitting an application does not constitute consent to financing or a guaranteed interest rate. Restrictions may apply.

Fixed Vs. Floating Rate: Which Is Better For Your Home Loan?

The mortgage rates shown on this page are based on assumptions about you, your home and the state in which you want to buy. The rates shown are current as of today, but please note that mortgage rates may change without notice, depending on activity in the mortgage bond market.

The mortgage rates shown on this page are based on assumptions about you, your home and the state in which you want to buy. The interest rates displayed are currently correct. However, please note that mortgage rates may change without notice depending on activity in the mortgage bond market.

Our assumptions about mortgage rates may differ from those of other mortgage lenders in our comparison tables. Your actual mortgage interest rate, APR, points and monthly payments are unlikely to match the table above unless they match the details below.

You are a first-time buyer of a single-family home to be used as your primary residence in a state other than New York, Hawaii, or Alaska. Your credit score is 660 or higher. You take advantage of a 30-year fixed-rate mortgage with a 20% down payment. Your household income in your area is moderate.

Mortgage Rates Spike At The End Of September

The information provided is for informational purposes only and should not be confused with a mortgage repayment obligation or mortgage loan approval.

, The mortgage rates (APR) shown above for } are based on information published on lenders’ websites and obtained from }. For example, according to the website, for a 30-year fixed-rate conventional mortgage, the quoted interest rate requires the home buyer to pay 0 points at closing. Mortgage rates assume that home buyers will pay more than the down payment to purchase a single-family home. Mortgage rates also assume that the home buyer has a credit score of 10 or higher. The monthly home mortgage repayment under the terms above is based on 360 months, excluding taxes and insurance. } This information is for estimation purposes only and is not guaranteed to be accurate. Mortgage interest rates, APRs, loan sizes and fees may vary.

Advertising Disclosure: We may receive compensation from companies and data providers that operate this website, which may influence which products are displayed and in what order. Referral rewards are ‘high’

Average home interest rate, interest for first time home buyers, average home loan interest rate for first time buyers, average loan for first time home buyers, interest rate for new home buyers, average mortgage interest rate for first time buyers, interest rate for first time home buyers, what is the interest rate for first time home buyers, average interest rate for new home buyers, what's the average interest rate for first time home buyers, average first time home buyer interest rate, average interest for first time home buyers