Average Interest Rate For 30 Year Mortgage – We independently evaluate all recommended products and services. We may receive compensation if you click on the provided links. Learn more.

Interest rates on 30-year mortgages fell on Tuesday, with rates remaining roughly unchanged from a week earlier. But this figure is more than an eighth of a percent higher than the 22-year high recorded last Thursday. Interest rates on other types of loans, however, were different.

Average Interest Rate For 30 Year Mortgage

The most recent 30-year fixed average is 7.70%. Because interest rates vary widely among lenders, it’s always smart to shop around for the best mortgage option for you and compare rates regularly, no matter what type of loan you’re in.

Solved Suppose You Obtain A 30 Year Mortgage Loan On Which

The national average for the lowest interest rates offered by over 200 of the nation’s top lenders with a loan-to-value (LTV) ratio of 80%, applicants with FICO credit scores of 700-760, and mortgage scores.

Interest rates on new 30-year mortgages fell 7 basis points on Tuesday to an average of 7.70%. This is close to last Tuesday’s reading and 14 points lower than last weekend’s high. Up 7.84%, Thursday’s 30-year average was the highest since 2001.

When Freddie Mac released its weekly mortgage averages on August 24, it revealed that the 30-year rate had reached a 22-year high. Freddie Mac’s average for the week was 7.23%, the highest reading since June 2001. Since then, the average has fallen to 7.12%.

Average of the combined interest rate of the previous five days and may include loans at a discount. On the contrary, his average indicators show

Arizona Mortgage Rates Are Still At Historic Lows, But How Long Will They Last?

The 15-year note yield moved in the opposite direction on Tuesday, but was up just one basis point. The current average is 7.15% and is slightly below the 21-year high in August of 7.17%.

Once again, the 30-year jumbo average was flat on Tuesday, holding its fifth-day high of 6.90%. Daily averages for 2009 are not available, but it is fair to assume that August’s 30-year high of 7.02% was also the most expensive level reached in 20 years.

Several new market indicators rose on Tuesday, including big gains for FHA 15-year, 15-year and jumbo 5/6 ARM loans, and only a slight increase in the average non-5/6 ARM.

Although the average refinancing rate was flat or nearly unchanged on Tuesday, the 30-year average refinancing rate fell by 15 basis points. This narrows the gap between the new 30-year market rate and the repo rate from 42 basis points on Monday to 34 basis points.

The Most Important Factors Affecting Mortgage Rates

The 15-year refi and jumbo 30-year averages were flat on Tuesday, but the biggest price increases were for the jumbo 15-year and jumbo 5/6 ARM loans, which each rose an eighth of a percentage point.

The prices you see here generally do not directly compare to the prices of ads you have advertised online, as these prices are selected as the most attractive, while these prices are averages. Introductory criteria may include preset points or be selected based on a hypothetical borrower with very high credit or less than normal credit. The mortgage rate you end up securing is based on factors like your credit score, income, and more, so it could be higher or lower than the average you see here.

The lowest mortgage interest rates vary depending on the state in which the building is located. Home loan rates can be affected by state-level differences in credit scores, the type and size of the average mortgage, as well as differences in risk management practices among individual lenders.

Mortgage interest rates are determined by a complex combination of macroeconomic and economic factors, such as the level and direction of the bond market, including the 10-year Treasury yield. the current monetary and credit policy of the Central Bank, especially in relation to mortgage financing guaranteed by the state, competition between mortgage lenders and loan types. Because changes can be caused by any number of these at the same time, it is difficult to generally attribute changes to any one factor.

Interest Rates: Different Types And What They Mean To Borrowers

Macroeconomic factors have kept the mortgage market relatively sluggish through 2021. In particular, the Federal Reserve is buying billions of dollars in bonds in response to economic pressures from the pandemic. This bond buying policy has a significant impact on mortgage rates.

But starting in November 2021, the Fed began tapering its bond purchases, reducing them sharply each month until it reaches zero in March 2022.

The federal funds rate, which is set every six to eight weeks by the Fed’s interest rate and policy committee, the Federal Open Market Committee (FOMC), can also affect mortgage rates. However, it does not directly control mortgage interest rates, and in fact, mutual fund interest rates and mortgage rates can move in opposite directions.

At its last meeting, which ended on July 26, the central bank raised the interest rate by 25 basis points to 5.25% to 5.50%. Federal Reserve Chairman Jerome Powell said that while inflation is still above 2 percent of the Fed’s interest rate, the Federal Reserve Board could either raise rates again or hold off on them, depending on economic conditions, at its Sept. 20 meeting.

Mortgage Rates Wavering Near 21 Year Peak

The averages listed above are based on the lowest interest rates offered by over 200 of the nation’s top lenders, based on an 80% loan-to-value (LTV) ratio and an applicant with a FICO credit score in the 700-760 range. The quoted rates represent what customers can expect when they receive actual offers from authorized lenders, which may differ from advertised introductory rates.

For our top card, the lowest rate currently offered by the lender in the survey is based on the same parameters of 80% LTV and a credit score in the 700-760 range.

Requires authors to use primary sources to support their work. These include white papers, government data, firsthand reports and interviews with industry experts. We also cite original research from other reputable publishers where appropriate. You can learn more about our standards for producing accurate and unbiased content in our editorial policy. By Spencer Lee CloseText About Spencer twitter Spencer_NYC linkedin spencer-lee-journo May 13, 2021 5:26 PM EDT 2 min Read

The average 30-year fixed mortgage rate fell for a second week in a row, even as the latest inflation data initially boosted bond yields, raising concerns among industry experts who say a rate hike is not far off. .

Real Estate Real Talk: Mortgage Rates Continue To Climb

For the fourth week in a row, the 30-year fixed mortgage rate remained below 3 percent, falling to 2.94 percent in the week of May 13, from 2.96 percent a week earlier, according to the latest results from Freddie Mac’s primary mortgage market. Research. . A year ago, the 30-year average rate was 3.28%.

But official data released Wednesday showed annual inflation rose at a faster pace in April than in 2008, while core monthly consumer prices, excluding food and gasoline, also rose faster than in decades. Freddie Mac Chief Economist Sam Hater said in a news release that the news could dampen the home heating market and lead to higher mortgage rates.

While the Federal Reserve has said it won’t raise interest rates unless inflation remains at or above 2% for a long time, the inflation news — combined with the latest jobs data — puts the Fed in a “difficult position” going forward. adds new uncertainty. for mortgage interest,” according to Zillow economist Matthew Speakman.

“In theory, a spike in inflation would force the central bank to tighten policy by raising interest rates or slowing bond purchases.” But for now, Fed officials played down the risks associated with Wednesday’s report, saying the big rate hike would be temporary. Any change from this perspective will put more pressure on mortgage rates,” he said.

Federal Funds Rate

Hater said that with interest rates likely to rise, the window is closing for many borrowers who are not taking advantage of current trends.

“Low interest rates allow homeowners to lower their monthly payments by refinancing, and our latest research shows that many borrowers, particularly black and Hispanic borrowers, can benefit from refinancing,” he said.

The 15-year mortgage-backed average and the 5-year Treasury hybrid index also fell during the week. The 15-year yield fell to 2.26 percent from 2.3 percent last week. A year ago, the average was 2.72%.

The average 5-year hybrid variable rate mortgage with the state index fell to 2.59% from 2.7% last week, compared to 3.18% this week in 2020. Mortgage rates rose at a record pace in March, according to the Fed. went up raised its key interest rate for the first time since 2018 in hopes of taming rising inflation.

Mortgage Interest Rates Have Begun To Level Off

According to data from Freddie Mac, the average interest rate on a 30-year mortgage — the most common type of mortgage in the U.S. — has risen 24% in the past four weeks alone. Redfin Deputy Chief Economist Taylor Marr said this was the fastest rate of rise in mortgage rates in four weeks.

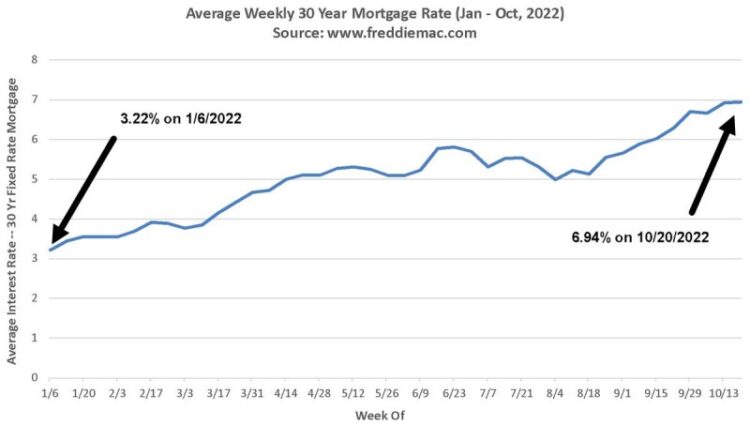

Homebuyers now pay an average of 4.67% on their 30-year fixed-rate mortgage — up from 3.22% in January. The rapid rise in US mortgage rates in recent months has caused the typical monthly payment of an American home buyer to rise

Current average interest rate for 30 year mortgage, average mortgage interest rate, national average interest rate 30 year mortgage, average interest rate for mortgage, current average 30 year mortgage interest rate, average mortgage interest rate last 30 years, average annual interest rate 30 year mortgage, average 30 year fixed mortgage interest rate, today's 30 year mortgage interest rate, average interest rate for a 30 year fixed mortgage, average mortgage interest rate 30 year, average interest rate on 30 year mortgage