Average 30 Year Fixed Mortgage Rate History – Interest rates hit record highs in March after the Central Bank raised interest rates for the first time since 2018 on hopes of a pick-up in inflation.

The average 30-year fixed-rate mortgage — the U.S.’s most common mortgage type — has risen 24% in the past four weeks, data from Freddie Mac show. Taylor Marr, deputy chief economist at Redfin, said that was the longest four-week increase in mortgage rates in history.

Average 30 Year Fixed Mortgage Rate History

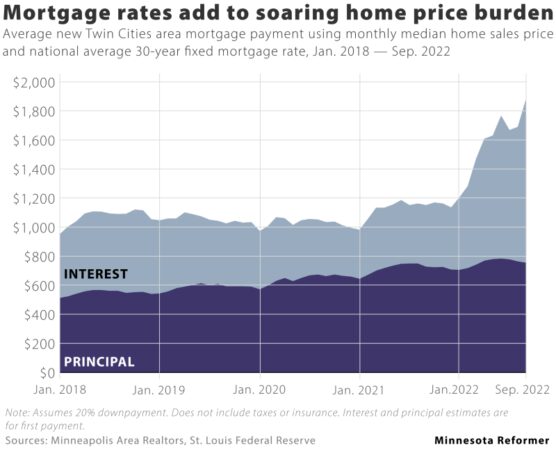

Homebuyers are now paying an average of 4.67% on their 30-year fixed rate mortgage — up from just 3.22% in January. Marr said the steep rise in U.S. mortgage rates in recent months has pushed the average monthly payment for U.S. homebuyers above $500.

Said No To A 15 Year Mortgage…? Think Again

Wall Street says the Federal Reserve will raise interest rates seven times this year — raising the cost of borrowing for everything from autos to student loans — on a move to raise mortgage rates to help homebuyers. let them go.

A rise in mortgage rates could help dampen the already hot US housing market as higher rates could cause some borrowers to default on their loans due to tighter bank lending requirements.

“We’re hearing from our staff in the area that some of the first-time home buyers may be feeling the price increase and the first-time buyers are going down. I think we’re getting buyers out of the market right now. Let’s look at the price.”

In a Bankrate.com survey released Wednesday, 64% of non-homeowners also say affordability is a factor holding them back from buying a home.

U.s. Mortgage Applications Ease Slightly; Average Rate Highest In More Than 20 Years

However, in the fourth quarter of 2021, Redfin found that 80% of homes were purchased by investors who typically bought cash and were therefore not paying attention to rising interest rates. This means that, despite the recent rise in mortgage rates, housing prices may continue to rise in the short term.

The median home price has remained impressive over the past few years, rising from $215,000 at the start of the pandemic to more than $280,000 this month.

In January alone, home prices rose 19.2% year-over-year, which was below the annual rate of price growth before the 2008 U.S. housing downturn.

One of the main reasons behind the rapid rise in housing prices is low housing stock. According to the Realtors Association’s 2021 report, 5.5 million to 6.8 million new homes were built in the U.S. over the past 20 years.

With Rising Mortgage Rates, Is Now The Right Time To Buy A Home?

Single-family home inventory is near its lowest level in decades, Marr said, and “as of March 27, active listings are down 22% from last year.”

While U.S. builders are focusing on rapid construction to help meet demand, Marr believes new construction is adding enough inventory to keep prices down in the short term.

“One in three single-family homes are under construction, but construction is still about 31 percent below the long-term average per family,” Marr said. “So housing starts still don’t have a big problem in terms of inventory shortages.”

Never miss a story: Get a personalized email to follow your favorite topics and the authors and magazines that matter to you. Also, the average 30-year mortgage reached a 21-year high, up more than a tenth. Monday After a slight decline on Friday, Monday’s rise put the average 6 basis points higher than last week.

Us 30 Year Mortgage Rate Soars To Highest Since 2000

The most recent 30-year rate is 7.76%. Rates vary among lenders, so it’s always a good idea to shop around for the best lenders and compare rates regularly, no matter what type of market you’re in.

The national average for the lowest rate offered by more than 200 of the nation’s lenders is a loan-to-value (LTV) ratio of 80%, applicants with a FICO credit score of 700-760, and no credit score they have.

Last Thursday, Freddie Mac released its weekly mortgage average, showing a 21-year high above the 30-year average. Freddie Mac’s average rose 13 basis points last week to 7.09%, the highest level since April. 2002.

Freddie Mac’s average is different from the average we publish because it is a weekly index that compares prices over the past five days, and may include credit discount points. Instead of the average value of the daily rate, it is also a specific rate.

Understanding The Rise In Mortgage Rates

The 30-year average rose 9 basis points on Monday, rising to 7.76%. Last Thursday (and July 6), the average reached 7.70% – the highest level since April 2002 – making the average the latest high in 21 years.

The 15-year mortgage rate dropped to a similar score yesterday, making the 15-year key over the past two days. Currently at 7.11%, the average has more than doubled from last week’s high of 7.12%, the highest reading since 2002.

The 30-year jumbo benchmark was positive on Monday. Sitting at 6.90%, the 30-year jumbo yield is at its highest level on record since 2009. Although the average daily jumbo yield was unprecedented before 2009, it’s worth considering that the 30-year yield is 21 ans. tall

Other benchmarks that gained double digits on Monday were the FHA and VA 30-year average, as well as the FHA and Jumbo 15-year fixed rates.

Home Mortgage Rates Skyrocket 24% In The Fastest Four Week Increase In History

The currency moved to a new buying price on Monday, even as the 30-year average of the currency increased by 12 basis points. Meanwhile, the 15-year average added 2 basis points and the jumbo 30-year REFI held up again. It is spread between 30 years of purchase and financing extended to 32 basis points.

After a historic cut in August 2021 — which sent the 30-year rate down to 2.89% — interest rates have risen sharply in the past two years. Notable increases were seen in June 2022, October 2022, May 2023, and this spring pushed the 30-year rate to the highest level on record since April 2002.

The prices you see here usually don’t exactly compare to the model ratings you see advertised online, because those prices were chosen as the most attractive, while these ratings are averages. The sample rate may include prepayment scores, or may be selected based on hypothetical borrowers with higher credit scores or lower credit utilization than normal. Your credit score will depend on factors such as your credit score, income, etc., so it may be higher or lower than the rate you see here.

The minimum loan amount available varies by state. Loan rates can be affected by state-level changes in credit scores, average loan amounts and sizes, in addition to different lending practices.

Housing Market Takes Another Body Blow With Sharp Interest Rate Rise

Credit rates are determined by a complex interplay of economic and industrial factors, such as the direction of the credit market, including 10-year yields; the current monetary policy of the Central Bank, especially in relation to the loan issued by the government that supports the government; and competition between lenders and loan types. Because variables can be affected by any number of factors at once, it is usually difficult to isolate variables from each factor.

Macroeconomic factors are causing the credit market to crash in 2021. In particular, the Federal Reserve has bought billions of dollars in debt to respond to the financial crisis of the pandemic. This policy of purchasing collateral has a significant impact on the credit rating.

But starting in November 2021, the Fed began reducing its bond purchases, reducing it every month until it reaches zero in March 2022.

The federal funds rate, which is set every six to eight weeks by the Federal Reserve’s policy committee – the Federal Reserve Committee (FOMC) – can also affect lending rates. However, it does not affect the cost of credit, and in fact, the rate of inflation and credit can move in opposite directions.

Historical 30 Year Fixed Rate Mortgage Trends With Charts

At its latest meeting, which ended on July 26, the Fed raised interest rates by 25 basis points to an expected range of 5.25% to 5.50%. Federal Reserve Chairman Jerome Powell said that since inflation remains above the Fed’s 2% target rate, the Federal Reserve Committee will either raise or hold rates when it meets on September 20, depending on the state of the economy.

The national average above is calculated based on the lowest rates provided by over 200 national lenders, a loan-to-value (LTV) of 80% and a FICO credit score in the 700-760 range. . Looking at applicants and scores. . The resulting rate indicates what customers should expect to receive when they receive a quote from a lender based on their qualifications, which may differ from the advertised rate.

On our state best rates map, the lowest rates offered by lenders surveyed in that state are listed, based on criteria like 80% LTV and credit scores between 700-760.

Writers need to use primary sources to support their work. It includes white papers, government news, original reports and discussions by industry experts. We also offer original research from other well-known publishers

Buying A Home? Rising Mortgage Rates Are One Consider…

Rocket mortgage 30 year fixed rate, 30 year fixed mortgage rate comparison, average 30 year fixed mortgage rate chart, today's average 30 year fixed mortgage rate, average 30 fixed mortgage rate, average 30 year fixed mortgage rate today, 30 year fixed rate mortgage refinance, average 30 year fixed mortgage interest rate, average rate for 30 year fixed mortgage, current average mortgage rate 30 year fixed, average 30 year fixed mortgage rate, national average 30 year fixed rate mortgage