2nd Time Home Buyer No Down Payment – When buying a home, every home buyer should be aware of some key conditions. The two most important terms are LTV and down payment. Understanding the relationship between these two conditions can help you make more informed home buying decisions. LTV stands for loan-to-value ratio, which is the ratio of the loan amount to the appraised value of the home. A down payment is the amount you pay upfront when you buy a home.

LTV and down payment are closely related, as the amount of down payment you pay will affect the LTV of your loan. The higher the down payment, the lower the LTV and vice versa. For example, if your home’s appraised value is $200,000 and you make a $40,000 down payment, the loan amount will be $160,000. This means your LTV is 80%.

2nd Time Home Buyer No Down Payment

1. Lenders are generally allowed to maximize the LTV ratio. For example, if a lender has a maximum LTV of 90%, that means they will lend up to 90% of the home’s appraisal. This means you need to pay at least 10%.

Strategies For Financing Your Home Purchase More Easily

2. The higher the LTV, the more risk the lender is taking. This is because if you default on your loan, the higher the LTV, the harder it will be for the lender to recoup their losses. This is why lenders may charge higher interest rates or require mortgage insurance for high LTV loans.

3. A higher down payment can help you save money in the long run. This is because a lower LTV usually means lower interest rates and lower monthly mortgage payments. Plus, if your LTV is low, you can avoid paying mortgage insurance, which can save you thousands of dollars over the life of the loan.

Understanding the relationship between LTV and down payment is important for all home buyers. By making a larger down payment, you can lower your LTV, which can save you money in the long run. Keep these tips in mind when buying a home and you’ll be well on your way to making a smart financial decision

When it comes to buying a home, there are two important terms that every home buyer should know: LTV and Down Payment LTV stands for loan-to-value ratio, which is the amount of mortgage debt divided by the value of the property. On the other hand, a down payment is the amount that a home buyer has to pay to purchase a home. The LTV to payout ratio is important because it determines the lender’s level of risk and how much equity the homebuyer has in the property. In this section, we will explore the importance of LTV and down payment when buying a home from different perspectives.

Kentucky First Time Home Buyer

1. Lenders: Lenders use LTV to determine the risk level of a mortgage loan. The higher the LTV, the riskier the loan is for the lender. For example, a home buyer with 20% down with an 80% LTV is considered less risky than a 5% down home buyer with a 95% LTV. Lenders may require private mortgage insurance (PMI) for borrowers with high LTVs to protect themselves if the borrower defaults on the loan.

2. Homebuyer: From a homebuyer’s perspective, the down payment and LTV can affect the monthly mortgage payment and the total cost of the loan. A higher down payment means a lower LTV, which can lead to lower interest rates and lower monthly mortgage payments. For example, if a home buyer puts a 20% down payment on a $300,000 home, a mortgage with an 80% LTV would be $240,000. For a 30-year mortgage with a fixed rate of 3.5%, the monthly mortgage payment would be about $1,077. However, if the home buyer only makes a 5% down payment, the mortgage would be $285,000 with an LTV of 95%. At the same interest rate and loan term, the monthly mortgage would be around $1,283

3. Home Equity: Down payment and LTV determine how much equity a home buyer has in the property. Equity is the difference between the value of the property and the mortgage balance. A larger down payment means a larger ownership stake in the property. For example, if a home buyer puts a 20% down payment on a $300,000 home, the initial equity would be $60,000. As the home buyer pays off the mortgage and the value of the property increases, the equity portion will also increase.

Understanding the relationship between LTV and down payment is important for homebuyers. A higher down payment means a lower LTV, which can mean lower interest rates, lower monthly mortgage payments and more equity in the property. While a lower down payment can make housing more affordable for some, it can lead to a higher LTV, which can increase your overall loan cost and monthly mortgage payment.

Keyword:affordable Mortgage Payment

The Importance of LTV and Down Payment When Buying a Home – LTV and Down Payment: The Relationship Every Home Buyer Should Know

Calculating your loan to value (LTV) and down payment is an important part of the buying process. Understanding the relationship between these two factors can help you better plan your budget and make informed decisions. LTV refers to the amount you are borrowing based on the total value of the property. The higher the LTV, the riskier the loan is for the lender. This is why lenders usually require a minimum down payment to reduce risk and protect their investment. A down payment is the amount you pay upfront when you buy a property and is usually expressed as a percentage of the total purchase price.

1. Determine the purchase price of the property: Start by finding out what the property is worth. This can be done by looking at the posted price or getting an estimate.

2. Calculate the payout: To calculate the payout, multiply the purchase price by the payout percentage. For example, if the purchase price is $200,000 and the down payment is 20%, the down payment would be $40,000.

Mike Bernhart On Linkedin: Homeownership May Be Closer Than You Think With Premier Lending’s 1%…

3. Determine your loan amount: To determine your loan amount, subtract the down payment from the purchase price. In this example, the loan amount would be $160,000.

4. Calculate the LTV ratio. To calculate the LTV ratio, divide the loan amount by the purchase price and multiply by 100. In this example, the LTV ratio would be 80%.

5. Understand the impact of LTV and down payment. LTV and down payment can affect your mortgage interest rate, monthly payment and overall affordability. A higher down payment can lower your monthly payment and interest rate, but a higher LTV ratio can result in a higher monthly payment and interest rate. It’s important to find a balance that fits your budget and financial goals.

Thus, calculating your LTV and down payment is an important part of the home buying process. By understanding the relationship between these two factors and following the steps outlined above, you can make informed decisions and find a mortgage that fits your budget and financial goals.

Tips For Making Your Dream Of Buying A Home Come True [infographic]

How to Calculate LTV and Down Payment – LTV and Down Payment: Ratios Every Home Buyer Should Know

When it comes to buying a home, there are two main financial factors that every home buyer should be aware of: Loan to Equity Ratio (LTV) and Down Payment. Understanding the relationship between these two factors is important to determining the ideal LTV and down payment for your home purchase.

From the lender’s perspective, a higher down payment means less risk for the lender, which often means lower interest rates for the borrower. However, for many home buyers, especially first time home buyers, paying a large down payment can be a challenge. This is where the LTV ratio comes into play. LTV is the ratio of the loan amount to the value of the property being purchased. The higher the LTV, the higher the risk for the lender and the higher the interest rate for the borrower.

So what is the ideal LTV and down payment for home buyers? Here are some key points to consider:

First Time Home Buying In Maryland: Do You Need $25,000 In Help?

1. The general rule of thumb is that the deposit is a minimum of 20% of the purchase price. Not only will this lower your LTV, but it will also help you avoid paying private mortgage insurance (PMI), which can add thousands of dollars over the life of the loan.

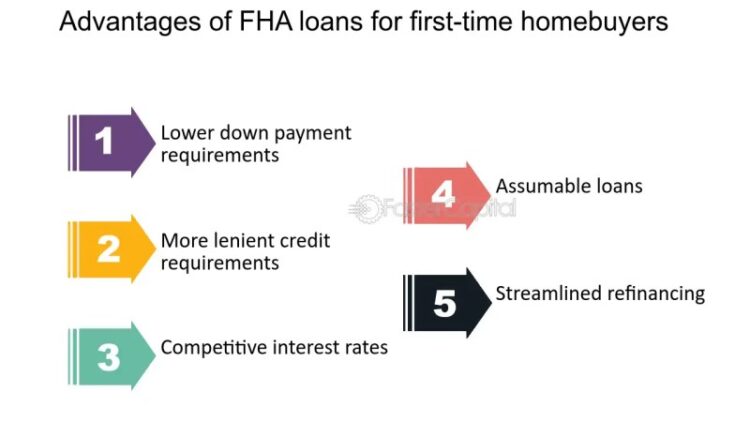

2. However, if you can’t afford a 20% down payment, don’t worry. Many lenders offer loans with low down payment requirements, such as FHA loans that only require 3.5% down. Keep in mind that lower down payments will result in higher LTVs and potentially higher interest rates.

3. Your ideal LTV and down payment is up to you

First time home buyer down payment amount, first time home buyer florida down payment, first time home buyer loans no down payment, 2nd time home buyer down payment, 2nd time home buyer down payment assistance, first time home buyer 0 down payment, first time home buyer ohio no down payment, first time home buyer low down payment, first time home buyer nc no down payment, no down payment first time home buyer, first time home buyer programs no down payment, 1st time home buyer loans no down payment