1st Time Home Buyer Down Payment Assistance Programs – The goal of our First Home Buyer Program is to help buyers become financially independent and become members of our community. We believe that when we help each person around us to become the person they want to be, we help the entire community.

Our first-time home buying programs focus on teaching buyers everything they need to know to become successful homeowners. The best options offer one-on-one counseling, group training, and/or online training to qualified individuals. A great opportunity to use Neighbor Works America’s Realizing the American Dream program as a pre-purchase group training with E-Home America for online education. When the participant completes the training either face-to-face or online, the individual advises whether to proceed with the home purchase, proceed with the mortgage preparation, or decide not to purchase their home. Through HUD-certified housing counselors working with members, to ensure that participants have a consistent resource to manage the intervention process that results in a positive outcome of “driving participation” in homeownership, Greater Opportunities provides home inspections when a client purchases a home with grant money, which benefits beneficiaries’ health, – helps to reduce the impact on health and safety. The best repair options look for health and safety issues during a home buyer’s first home inspection, but they don’t replace an inspection. Accreditation of buildings by a professional.

1st Time Home Buyer Down Payment Assistance Programs

Low- and moderate-income families looking to buy their first home in Chenango or Broome County received help learning about the real estate process and financing options. When you need roadside assistance in Maryland, First Home Mortgage is here to help. The tools and resources you need to make sure your journey through the loan process goes smoothly. There are many types of plans that you can use for many reasons and our experienced team will help you choose the best one!

First Time Buyers: How Much Do You Need For A Down Payment?

Buying a home for the first time can be overwhelming and confusing. That’s why the My Home Mortgage team is here to help! There are several down payment programs available to Maryland residents that can help cover costs that can get you closer to home ownership. Contact us today to get pre-qualified and start your journey to your dream home!

When it comes to buying a home for the first time, there are many steps and processes involved. Fortunately, there are many financial aid programs and financial aid available for Marylanders. From government assistance to special local programs to help first-time homebuyers, the My Home Mortgage team can help you search and find the best program for your needs. Call us today for more information.

Although some first-time homebuyer programs are specific to the county or city in which you want to buy, there are several statewide programs that homebuyers in Maryland can take advantage of. Read on for more information or contact us today!

When you think of a great place to live, Maryland is probably the place that comes to mind. Coastal life and city life go hand in hand here, making it a solid choice for anyone looking for their forever home. Check out the many great things Maryland has to offer and contact First Home Mortgage for the help you need to buy your dream home!

Find Down Payment Assistance Programs In Alexandria Va

Maryland has many options for first-time and repeat home buyers. These programs can hook you up to below-market rates, lower your mortgage insurance, and provide you with down payment and closing assistance. Down payments are based on program type, such as FHA, traditional homes, rural homes, and VA assisted living programs. Our team will guide you through all your options to help you find the perfect fit. Note that for these programs, first-time buyers are defined as those who have not owned a home in the past three years. Check out some of the available programs below and contact us to see if you qualify!

This program is designed for first-time buyers and offers lower interest rates than the market. You need a minimum credit score of 640. Discounted mortgage insurance may also be available.

This program provides financial aid in Maryland. You can get up to 3% of the loan principal as down payment and closing costs. This amount is free and is returned every time the house is sold.

If the purchase price is under $170,000, this program is for you. You can get $5,000 to help pay for your down payment and closing costs.

Best First Time Homebuyer Programs For 2024

Are you tired of college loans and wish there was a way to get rid of them? You can get up to $40,000 in college loans paid off and forgiven when you buy a home through this program. Call us to find certificates.

Another government subsidy program that is not limited to first-time home buyers is the MMP Flex 3% grant. If you have a credit score of 640 or higher, you can apply for a 3% down payment loan or closing costs. Similar to the Flex 4% grant, the grant does not have to be repaid.

If you have a credit score of 640 or higher, you can get a 30-year loan with 0% interest. Additionally, you can apply for a 3% home payment or closing cost loan.

If you are looking to buy your first home or have previously bought a home, you can qualify for the MMP Flex 5000 program if you have a minimum credit score of 640. You can get it if you qualify. $5,000 credit toward down payment and/or closing costs.

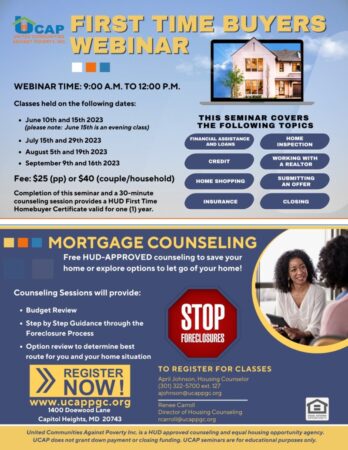

First Time Homebuyer Seminar

MMP Flex Direct offers a competitive interest rate to homebuyers with a credit score of at least 640. Like some other financing programs in the state, you don’t have to be a first-time home buyer to qualify.

If any of these programs catch your eye, let us know! We’ll help guide you through the process and get you to your dream home!

Please note that these programs are subject to change. Please call us to find out if there are other programs or changes that may be of benefit to you. Also, check the specific county programs below for additional assistance.

If you’re buying a home outside the city, you can get 100% financing at below-market interest rates. Country houses tend to be owned and winter-oriented, but you might be surprised by what’s called “country.”

Homeowner Assistance Programs

If you’re looking to buy a home as a first-time home buyer in a city or town, did you know that you can qualify for many financial assistance and closing cost assistance programs? We at My Home Mortgage Group know that buying your first home can be daunting and expensive. That’s why we give you all the resources to ensure a smooth and easy process that fits your budget. Here are some cities and counties that offer first-time home loans:

Call My Home Mortgage Group for more information on special programs available. We’ve been helping people buy their first home for over 25 years and know how to get your dream home at an affordable price on time.

With a few steps to consider when looking for a home loan, there’s no room for guessing games if you want to get the best out of your business. That’s where the team of experts at First Home Mortgage Maryland is here to help. With our experience in the loan and mortgage business, we can ensure that you get the help below when you need it. Contact us today. We are happy to help you and answer any questions you may have!

Tammy was very patient and helpful during the application process. As a first time home buyer I didn’t know a lot that put me off but I was able to prove it and now I am a home owner thanks to Tammy!

Down Payment Assistance Programs And Grants For First Time Buyers

Tammy Lewis made my home buying experience so much easier. I didn’t feel any stress or pressure. Tammy was with me every step of the way and made sure I understood everything with detailed lessons. My grades were low and Tammy advised me to improve my studies. Make the loan process hassle-free. We recommend Tammy Lewis and First Home Mortgage to anyone who knows they are looking to buy their first home.

Rob made sure my first home buying experience was smooth and painless. Be professional and get things done on time. Couldn’t ask for more!

Rob was always willing to go through many pages of information with me.

1st time buyer down payment assistance, home buyer down payment assistance programs, first time home buyer down payment assistance, florida first time home buyer down payment assistance, first time home buyer down payment assistance nc, 1st time home buyer down payment assistance, first time home buyer down payment assistance illinois, down payment assistance programs, home buyer down payment assistance, colorado first time home buyer down payment assistance, first time buyer down payment assistance programs, 1st time home buyer assistance programs